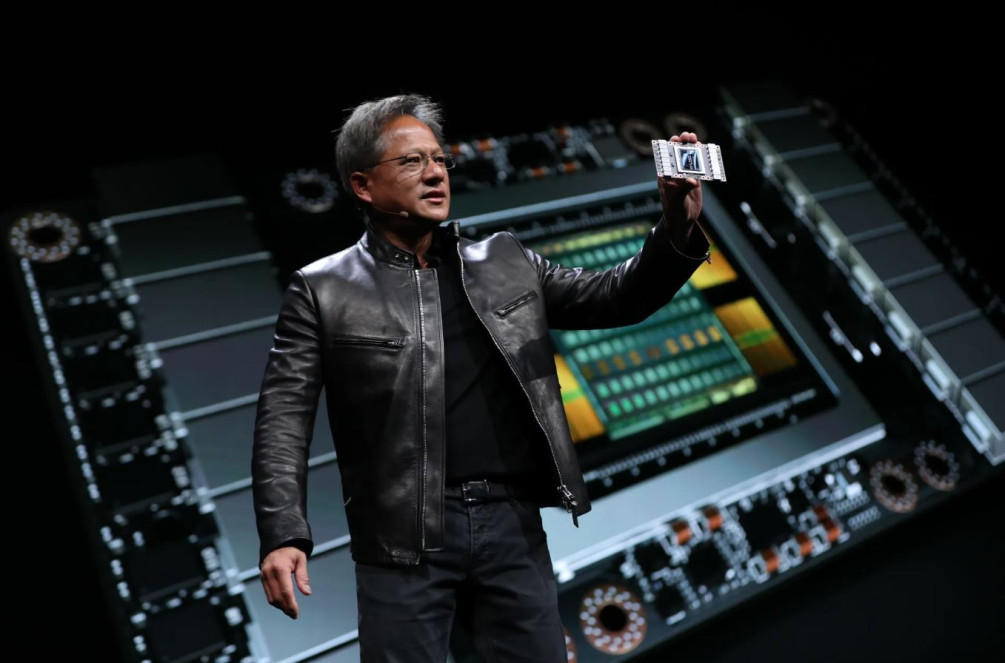

? Nvidia CEO Jensen Huang made a statement that made energy experts nervously adjust their glasses: according to him, in 6–7 years, portable nuclear reactors will become a common part of infrastructure, providing massive power for AI development. In such a scenario, a data center could literally be powered from a suitcase. Miners were clearly excited: an outlet that doesn’t fail at the first surge of load sounds like an unattainable dream gradually taking shape.

Meanwhile, the crypto community is discussing a completely different hot topic — Strategy’s $1.4 billion reserve. Many are confident that Michael Saylor will not sell Bitcoin, but analysts are already considering that the market could enter a bearish phase. Predictions of a drop to $55,000 don’t seem so far-fetched, given the overall volatility and tension of recent weeks.

On the global stage, the US is showing unexpected flexibility in trade negotiations with China. The American administration is ready to abandon new export control measures and is also considering allowing shipments of current Nvidia chips to China. Trump, in his public rhetoric, is gradually backing down, and financial markets see this softness as a good sign: the less confrontation, the calmer the investors.

Against the backdrop of a geopolitical pause, the business elite is pushing technological reforms. Larry Fink of BlackRock and Brian Armstrong of Coinbase are confidently promoting the idea of asset tokenization, estimating the market potential at about $4.1 trillion. In their view, the shift to digital registries will increase transparency, simplify ownership, and make global finance faster and more accessible. The stock market could get a new driver if institutional players support the initiative.

However, not everyone shares the optimism. JPMorgan, Deutsche Bank, and Goldman Sachs doubt that the GENIUS law can increase demand for US government bonds. The market is already showing signs of saturation, and investors prefer to wait for real macroeconomic changes rather than rely on legislative promises.

⚡ On the crypto scene, meanwhile, a novelty has appeared: CZ introduced a new native prediction market, Predict fun, on the BNB Chain. Users are expected to be able to make predictions on events of various scales — from price movements to social trends. This continues to expand the Binance ecosystem and emphasizes the platform’s ambition to take a key position in Web3 entertainment.

A video clip of the speech can be viewed on our Telegram channel.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.