?️

The United States announced a new package of restrictive measures against major Russian oil companies — Rosneft and Lukoil, along with 34 of their subsidiaries.

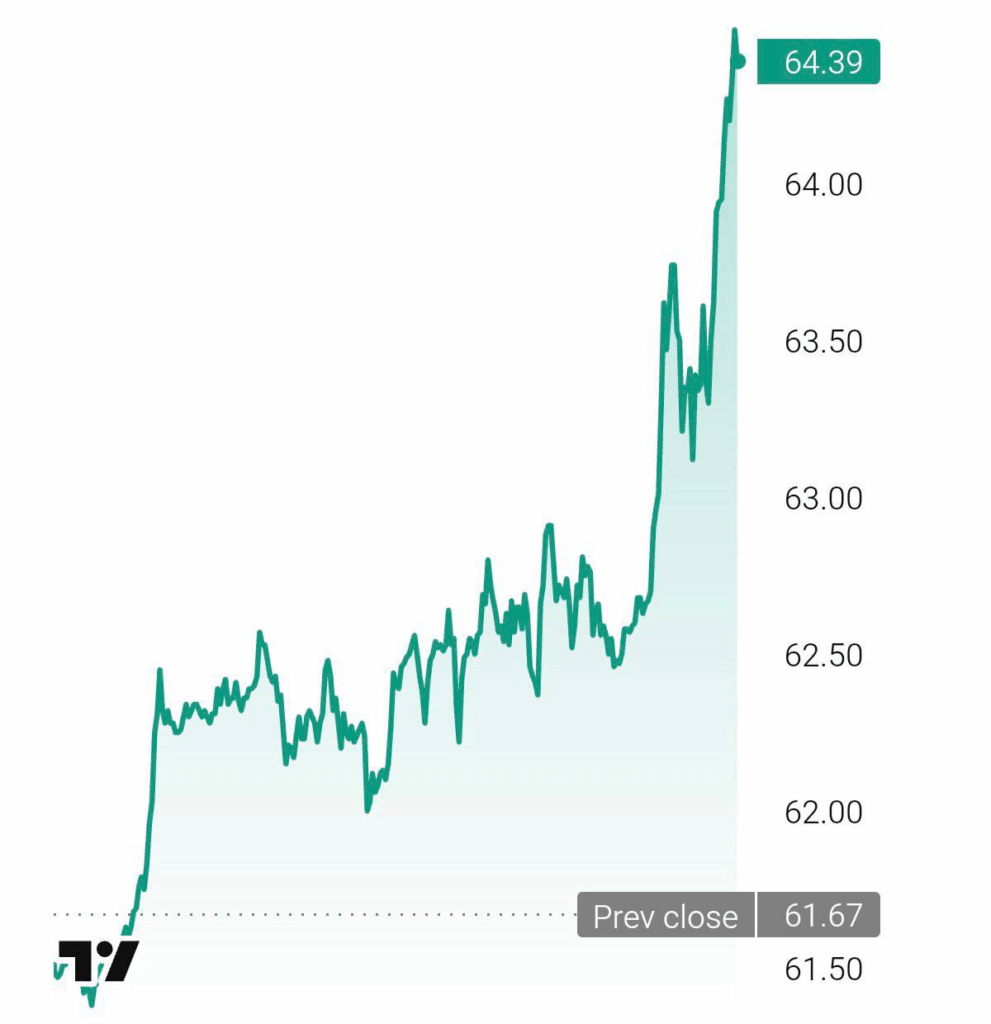

Washington’s decision caused noticeable fluctuations in the markets: shares of both companies plunged, while Brent crude oil rose by more than 4%.

What Happened

The U.S. Department of the Treasury published an updated sanctions list that includes:

- OAO “Oil Company Rosneft”

- OAO “Lukoil”

- 28 Rosneft subsidiaries

- 6 Lukoil subsidiaries registered in Russia

Moreover, the restrictions apply to all entities where these companies hold more than 50% ownership, even if they are not directly listed.

The document was published on the official website of the U.S. Treasury.

The U.S. side issued a special license allowing the winding down of operations with these companies and their affiliates until November 21, 2025. After that date, any financial or trade transactions will be completely prohibited.

Why the U.S. Took This Step

According to U.S. Treasury officials, the new measures are due to “Moscow’s unwillingness to engage in a peaceful process regarding Ukraine.”

Treasury Secretary Scott Bessent stated that this sanctions package is one of the most extensive in the history of U.S. restrictive measures against Russia.

Market Reaction

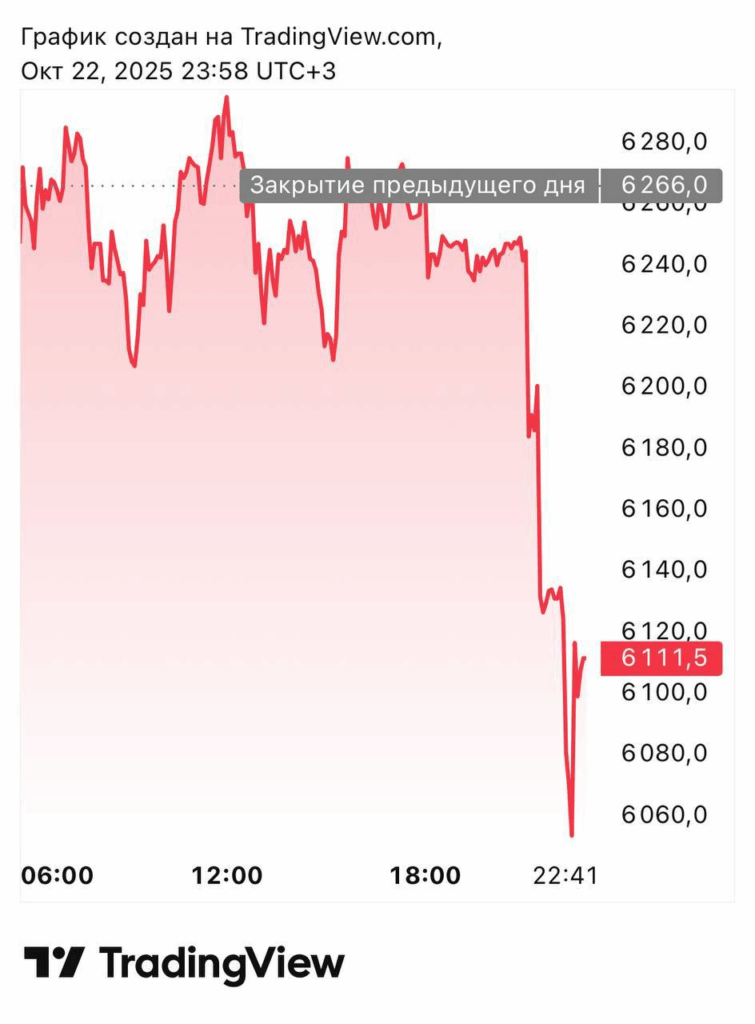

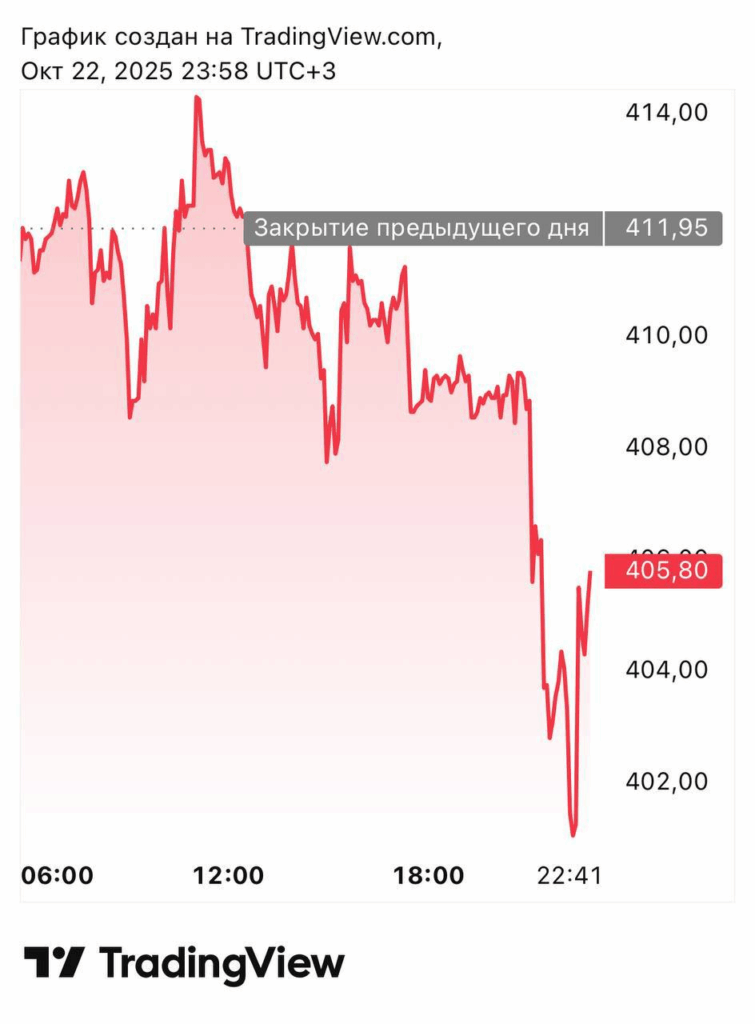

The markets reacted immediately.

On the morning of October 23, shares of both companies on the Moscow Exchange sharply declined:

- Lukoil: -4.18% (down to 5,799 rubles per share)

Rosneft: -4.03% (down to 385.75 rubles)

The Moscow Exchange index as a whole fell by 3.2%, to 2,568 points.

During the following week, the downward trend continued:

- Lukoil shares lost up to 8% in value

- Rosneft — about 6%

At the same time, Brent oil prices rose above $90 per barrel, as investors factored in potential supply risks from the Russian market.

Main Reasons for the Decline

- 1. Ban on Technology and Investment

The new restrictions cut off Rosneft and Lukoil from access to Western technologies used for hydrocarbon extraction in the Arctic and on the continental shelf. This reduces future production potential and project profitability. - 2. Oil Supply Embargo

Europe and the U.S. are effectively cut off from Russian oil deliveries. Attempts by companies to redirect exports to Asia face logistical challenges, heavy discounts, and limited demand. - 3. Financial Isolation

Sanctions block access to Western loans, payment systems, and investment markets. This complicates debt refinancing and increases borrowing costs. - 4. Psychological Effect on Investors

Even within Russia, many market participants prefer to avoid risks by withdrawing capital from oil giant stocks. Panic selling has intensified downward pressure on share prices.

What Analysts Say

Experts note that this is one of the most severe blows to Russia’s oil sector in recent years.

The restrictions cast doubt on the implementation of several large projects, especially in extraction and refining.

However, analysts emphasize that both companies have enough resilience to adapt — provided they diversify exports and strengthen cooperation with Asia, the Middle East, and BRICS countries.

But it will take years and billions of dollars in investment.

Outlook: What’s Next for the Stocks

For now, Lukoil and Rosneft shares will remain under strong pressure.

By the end of the year, analysts expect volatility and a gradual decline amid uncertainty over the sanctions’ consequences.

Growth will only be possible if:

- export routes stabilize,

- domestic extraction technologies are developed,

- or sanctions are eased (which seems unlikely for now).

? Conclusion

U.S. sanctions against Rosneft and Lukoil mark a new stage in the energy confrontation.

Oil prices are rising, but for Russian companies, this won’t offset the losses from isolation.

Investors are moving into “safe assets,” while Russia’s oil sector enters a long period of adaptation — without its usual partners, technologies, or markets.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.