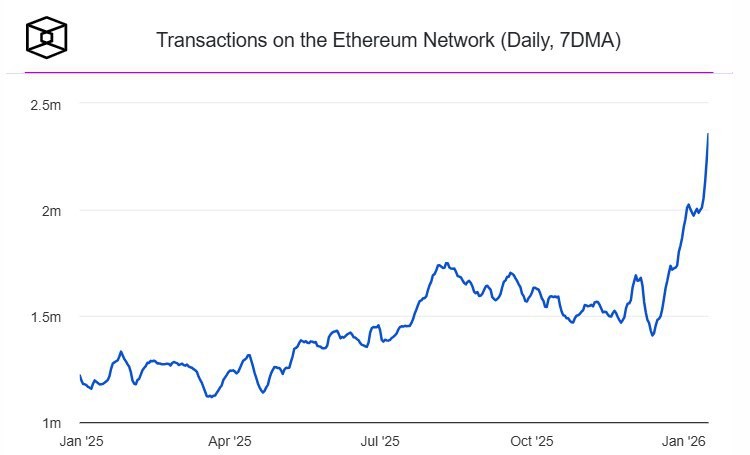

The average number of transactions on the Ethereum network has once again reached an all-time high, while the average gas fee has dropped to a record-low level of around $0.15 per transaction. This combination once seemed almost impossible: historically, rising network activity led to congestion and sharply higher fees. Today, Ethereum is showing the opposite dynamic – the network is processing more operations while doing so more cheaply and more reliably.

A key role in this shift has been played by major changes to Ethereum’s architecture over recent years. The growth of L2 solutions (Arbitrum, Optimism, Base, zkSync, and others), the implementation of upgrades that optimize data storage and transaction processing, and the gradual redistribution of load between the base layer and rollups have dramatically reduced pressure on the main network. For users, the result is simple: more transfers, more DeFi operations, more NFTs and onchain activity – without the familiar $20-50 fees that were considered “normal” during previous hype cycles.

It is particularly notable that this record activity has coincided with a sharp decline in the number of validators looking to exit the network. The staking exit queue has effectively emptied: at present, the number of exit requests stands at zero. This is a rare situation for Ethereum after the transition to Proof-of-Stake, when long unstaking queues were observed at various times, especially amid market volatility.

Since the start of 2026, the trend has been reinforced by the entry of large institutional and corporate players. Companies such as Bitmine and Sharplink have begun actively directing ETH into staking, deploying billions of dollars. For them, Ethereum is no longer purely a speculative asset and is increasingly viewed as an infrastructure-level financial instrument – a kind of digital bond with yield, but without reliance on sovereign debt.

The growing interest in staking is driven by several factors. First, network stability: Ethereum has proven it can scale without sacrificing decentralization or security. Second, predictable returns: with declining inflationary pressure and active fee burning, ETH is increasingly seen as a deflationary asset. Third, greater regulatory clarity in certain jurisdictions makes participation in staking more understandable and legally safer for large institutions.

At the macro level, these developments point to a qualitative shift in how Ethereum is perceived. The network is gradually shedding its image as an “expensive blockchain for whales” and becoming a universal settlement layer for Web3, financial applications, and corporate solutions. Low gas fees reduce barriers to entry for users and developers, while the rising number of transactions confirms that this demand is real rather than theoretical.

At the same time, the shrinking number of participants exiting staking signals growing long-term confidence in the ecosystem. Validators and institutional investors are not merely “parking” capital in anticipation of price appreciation; they are betting on a sustainable network economy for years to come. With a significant portion of ETH locked in staking, circulating supply is reduced, creating an additional structural support factor for price.

As a result, Ethereum enters 2026 in an unusually strong position: record network load combined with minimal fees, active inflows of institutional capital into staking, and an effective halt to validator exits. It is a rare case where technical metrics, economic design, and the behavior of major players all point in the same direction – Ethereum is moving beyond an experimental platform and becoming a mature financial and technological infrastructure.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.