✨ Right now, the global markets are in the middle of a true golden fever marathon: every week we hear about new all-time highs. Gold has become a symbol of a “safe haven” for investors, and its price is rising so fast that even the most cautious analysts are starting to talk about a bubble. But behind this shine lies a much more intriguing story.

There is an interesting theory: physically, there is only about 17 times more gold than silver in the Earth’s crust and accessible reserves (the exact figure should be verified). Yet gold is not 17 times more expensive – it’s about 80 times. A natural question arises: what’s wrong here? Is silver so undervalued by the market, or is gold excessively overvalued?

From an industrial point of view, the picture becomes even more fascinating. Silver is actively used in solar panels, electronics, and medicine. Gold, on the other hand, is mostly seen as a “safe-haven asset” and a symbol of wealth. It is less in demand in mass production, although its unique properties (conductivity, resistance to corrosion) are well known. That means demand for silver in the future could grow much faster than for gold. In that case, we’re not just seeing a price imbalance, but a hidden potential for a re-evaluation of silver’s role in the global economy.

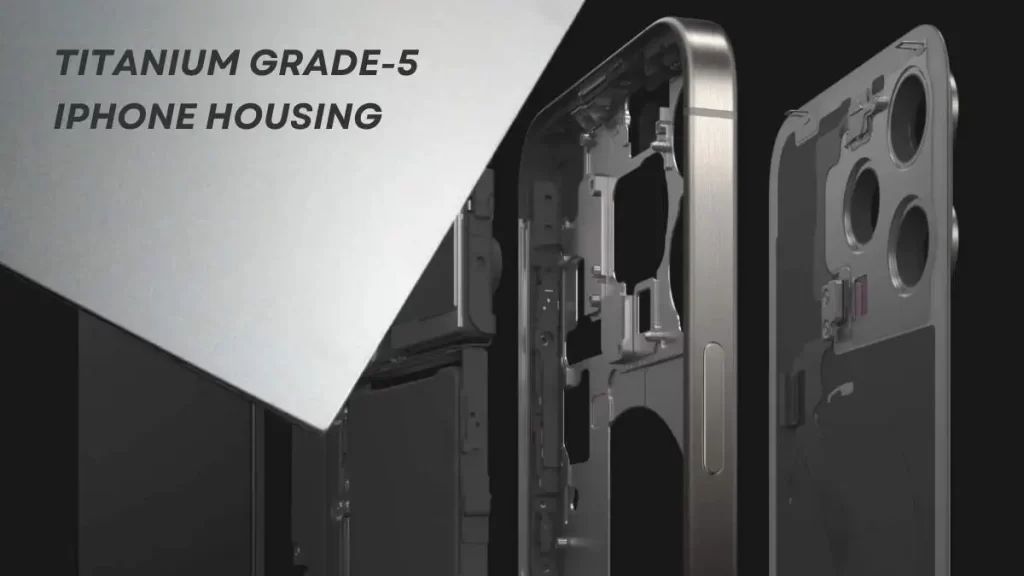

Now another metal – titanium. Not long ago, Apple proudly announced iPhone cases made of titanium, turning this material into a marketing symbol of premium quality. However, in the latest models, they abandoned this idea. The reasons are several:

- titanium is expensive to process, which increased the production cost;

- the titanium case turned out to be not so “invincible” – complaints about scratches and loss of appearance appeared rather quickly;

- amid the global shortage of materials, Apple decided to optimize costs by replacing titanium with more familiar yet technologically optimal alloys.

This iPhone story reflects a broader trend: even the largest corporations are balancing between image and economic rationality. Titanium prices on global markets fluctuate, and its removal from smartphone production may lead to reduced demand and thus to a revaluation of the metal’s real worth.

An interesting parallel emerges: gold is getting more expensive despite its limited practical use. Silver and titanium have clear industrial applications, yet they are often undervalued by the market. The question is whether we’re living in an era where fashion and investor psychology are stronger than real economics.

After all, gold is rising in price because of its symbol of reliability, while titanium is falling because it lost its symbol of premium status. And silver remains in the shadows, though it may become the true “workhorse” of future energy and technology.

? So the real investigative question is this:

- What if one day the world decides that silver is the new “gold standard” for the green economy?

- Are we heading toward an era of rethinking the value of familiar metals – where gold becomes just a beautiful decoration, and silver and titanium form the foundation of technological progress?

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.