Silver has unexpectedly entered territory where it was long not expected and has overtaken Nvidia in terms of market capitalization. Amid a sharp rise in prices, precious metals have taken leading positions in the global asset ranking, once again reminding the market that traditional defensive instruments have not disappeared and return to the center of attention during periods of instability.

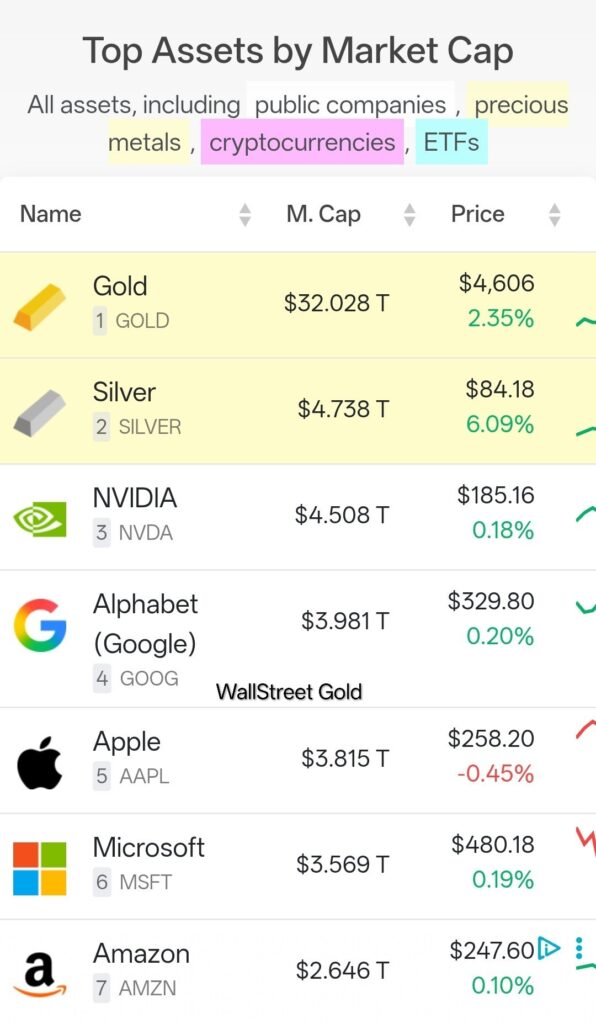

According to data from Companiesmarketcap, a portal that aggregates the market capitalization of public companies, precious metals, cryptocurrencies, and investment funds, the market capitalization of silver reached $4.78 trillion. This allowed it to surpass Nvidia, whose valuation stands at around $4.5 trillion. As a result, one of the main symbols of the AI boom of recent years has temporarily given way to a metal that was used in settlements and industry long before the stock market emerged in its modern form.

In the global asset ranking, gold confidently holds first place with a market capitalization of $32 trillion. This figure is unattainable for any individual company and only emphasizes gold’s special status as a global anchor of trust. Silver took second place, while Nvidia dropped to third. It is followed by Alphabet, the parent company of Google, with a capitalization of $3.98 trillion, and Apple with $3.815 trillion. The picture is illustrative: immediately after gold and silver come the technology giants that only recently seemed to be the unquestioned leaders of the growth era.

It is important to understand how silver’s market capitalization is calculated. Unlike stocks, this is not the market value of a company, but the aggregate value of all silver ever mined. The calculation is made by multiplying the current price of silver by the amount that is estimated to have been extracted from the Earth’s crust to date. This volume is approximately 1,751,000 metric tons. At the same time, Companiesmarketcap analysts emphasize that this figure is approximate. A significant portion of silver has been irreversibly lost or destroyed through industrial use – in electronics, medicine, chemistry, and energy. Unlike gold, which is mostly accumulated and stored, silver is actively “consumed” by the economy, making its effective available supply lower than the nominal figure.

The rise in silver’s capitalization is directly linked to the price rally in the precious metals market. As of 17:33 Moscow time, the price of the March silver futures contract reached $84.81 per troy ounce. This is an extremely high level that would have seemed фантастическим just a few years ago. At the same time, the February gold futures contract was trading at $4,608.2 per ounce, confirming the synchronized rise of the entire defensive asset sector.

The reasons behind these developments lie far beyond the metals market itself. Investors are reacting to a combination of factors: geopolitical tensions, pressure on the US dollar, rising government debt in leading economies, and a general distrust of a financial architecture built on promises. In such an environment, gold and silver are once again perceived not as relics of the past, but as assets outside political and credit risks. Silver also receives additional support from industrial demand, especially in green energy, electronics, and high-tech manufacturing.

It is symbolic that silver has overtaken Nvidia in particular. The company has become the face of the AI revolution and one of the main beneficiaries of technological optimism in recent years. But the market reminds us that even the most advanced technologies do not cancel cycles, fear, and the need for basic forms of value preservation. When the future becomes too uncertain, capital instinctively returns to what has been tested over centuries.

Comparing the market capitalization of silver and Nvidia does not mean that technology is losing relevance or that investors are massively fleeing equities. Rather, it is an indicator of a shift in balance. The market simultaneously believes in AI and hedges against its consequences. It buys the future while insuring the present. And the fact that silver has once again risen above one of the most expensive technology giants in the world points to growing demand for tangible, scarce, and non-issuable assets.

History has repeatedly shown that when precious metals rise to the top of global rankings, it is always a sign of the times. Not necessarily a crisis in the classical sense, but certainly a period when trust in familiar reference points begins to waver. Silver, like gold, does not promise profit growth or technological breakthroughs. It offers something else – a simple and strict rule: value without intermediaries. And judging by current figures, the market is once again willing to pay for it.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.