? Friday’s trading in the US reminded us that the “bullish” trend is more alive than ever. Despite mixed index moves during the day, the week ended on a positive note — with Dow Jones reaching historic highs.

Main index dynamics:

- Dow Jones: +0.1% daily, +1.7% weekly. New record high! Leaders: UnitedHealth (UNH), Salesforce (CRM), Amgen (AMGN).

- S&P 500: -0.3% daily, but +0.9% weekly. Index remains near record levels.

- Nasdaq: -0.4% daily, but +12% YTD — tech still outperforms, though with caveats.

- Russell 2000 (small caps): -0.6% daily, +3% weekly. A sign investors are eyeing the “smaller players” again.

Strong sectors:

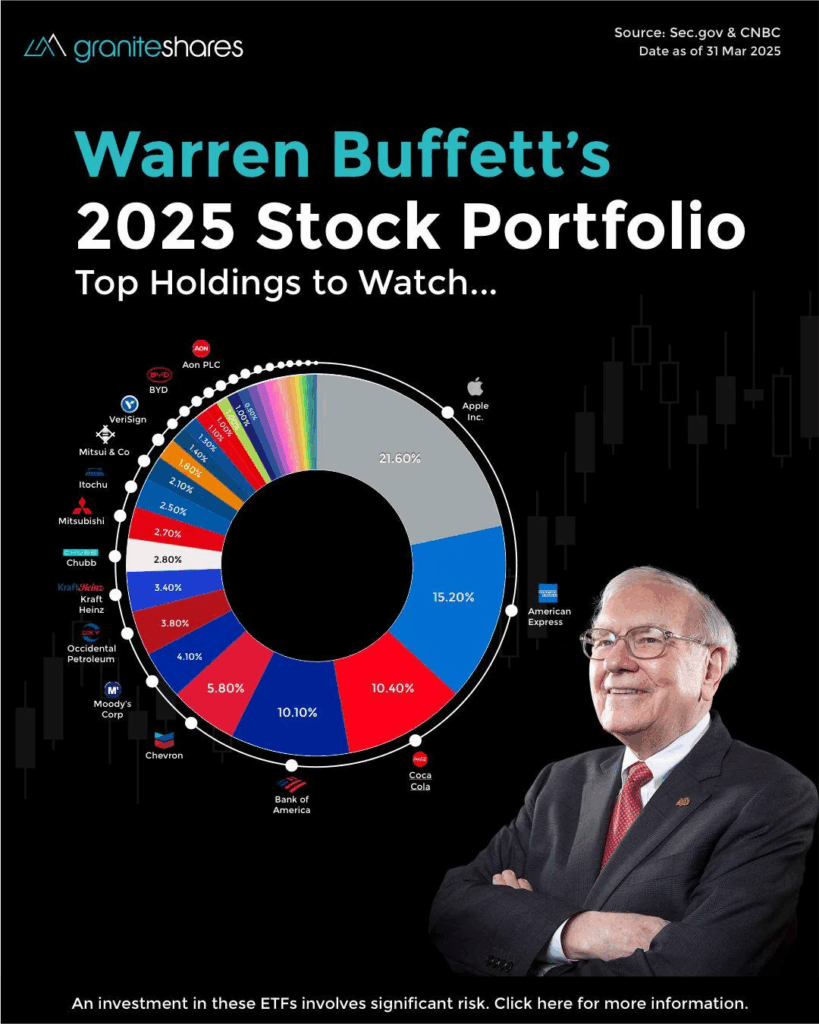

Healthcare — Buffett’s Berkshire Hathaway boosted its UnitedHealth stake, pushing UNH shares up +12%!

Real estate — steady investor interest amid dovish rate signals.

Solar energy — rally fueled by expectations of new “green” subsidies.

Restaurants & diversified healthcare — consistent capital inflows.

Weak sectors:

Coal — green energy trend hurts fossil fuels.

Automakers — pressured by EV competition and expensive credit.

E-commerce — weaker earnings, cooling consumer demand.

Gaming — sector struggles with revenue decline.

Semiconductors — especially Applied Materials (AMAT), down 14.1% after disappointing results.

Key events this week:

- Housing starts data.

- S&P flash PMI.

- Jerome Powell’s speech at Jackson Hole — markets await signals: policy easing or cautious stance?

Trader ideas:

Buy / hold: UNH, CRM, AMGN.

Avoid / short: AMAT, e-commerce, autos, gaming.

? Bottom line: The market stays strong — Dow writes new history, Buffett shows that “old school” healthcare investing can be just as profitable as flashy tech. But caution in IT and retail is needed: not everything that shines on Nasdaq is gold.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.