? Only a few days remain until the U.S. Federal Reserve meeting, which we have already mentioned, and this event has become the main focus of attention in financial markets worldwide. Investors, analysts, and traders are preparing for the September 16–17 meeting, which is expected to result in a 0.25 percentage point rate cut. However, the key question is not just the rate cut itself, but the tone of Fed Chair Jerome Powell’s signal regarding the future path of monetary policy.

U.S. Market: New Records

U.S. stock indices continue to reach historical highs. The technology sector and companies related to artificial intelligence are leading. Nvidia has returned to strong growth, Tesla posted its best jump in months, and Meta is preparing to surprise investors at its annual Connect conference.

At the same time, new stars are emerging in the shadows of giants — Rocket Lab and GE Vernova. These companies are not yet widely known but are showing performance comparable to the market leaders.

Asia: Different Pace, Same Trend

In South Korea, indices hit record highs thanks to the growth of Samsung and SK Hynix shares. China presented mixed data: retail sales and industrial output were weaker than expected, yet indices remain near 10-year peaks. Hong Kong exchanges are at 4-year highs, confirming sustained investor interest in the region.

Cryptocurrencies: Awaiting a Breakout

For the crypto market, the upcoming Fed decision is also critical. Last week, U.S. spot ETFs for bitcoin and ether recorded net inflows for five consecutive trading days. Bitcoin ETFs attracted $2.34 billion, while ether funds added another $638 million. This demonstrates not only institutional interest but also the growing role of cryptocurrencies in investment portfolios.

Bitcoin’s strategic challenge remains unchanged: breaking above $117,000. If this fails, the market risks entering an extended consolidation range with a lower boundary around $112,000. Such a scenario could occur if macroeconomic drivers are weaker than expected.

Arthur Hayes’ Forecasts

Arthur Hayes, co-founder of BitMEX and a prominent figure in the crypto industry, continues to argue that the traditional four-year bitcoin cycle is no longer relevant. According to him, the move toward $200,000 is a long-term scenario extending to the end of the decade. In an interview with Kyle Chasse, he emphasized that the market underestimates the impact of global macroeconomic liquidity.

Consensus, he says, is that the Fed, the U.S. Treasury, and central banks of other countries will continue printing money and buying bonds, creating a foundation for risk asset growth.

Altcoins: Solana vs. XRP

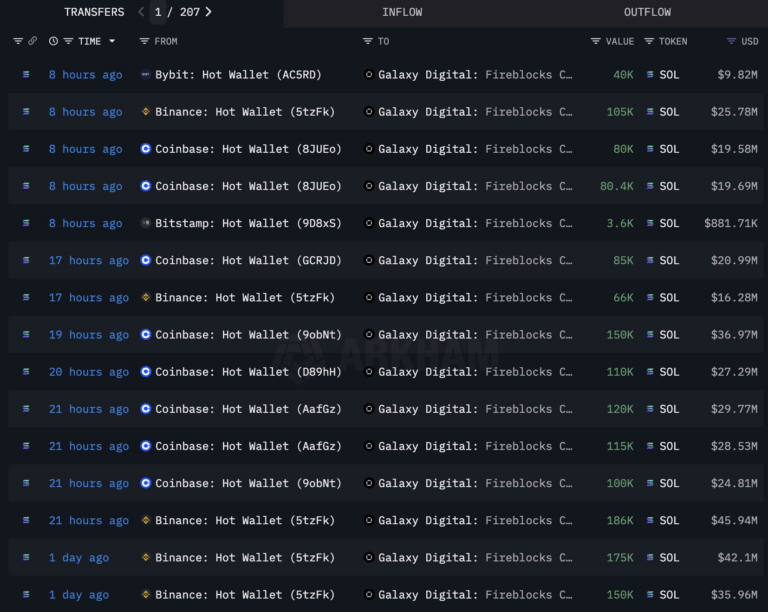

Galaxy Digital continues to actively increase its Solana positions: over the past five days, the company invested $1.55 billion, including an additional $306 million purchase. This makes SOL one of the main candidates to lead the market in the coming months.

Meanwhile, XRP shows the opposite picture: large holders have reduced their positions by $160 million over the past two weeks. This unloading puts pressure on the price and explains why market participants are increasingly focusing on Solana.

Regulatory Agenda: New Signals from the SEC

The U.S. maintains a tense regulatory environment, but there are signs of easing. The Securities and Exchange Commission (SEC) stated that it plans to first warn crypto companies of potential violations before imposing sanctions. This approach may reduce uncertainty and regulatory risks for the industry.

? Conclusion

Financial markets enter the new week at historical highs. Investors continue to seek a balance between tech giants, industrial companies, and cryptocurrencies. The main intrigue is the Fed meeting on September 16–17, which will determine the market’s direction for the rest of the year.

The question is urgent: will the rate cut become a new growth impulse, or is it an event already fully priced in? The answer will affect not only bitcoin’s future but also the trajectory of global markets in the coming months.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.