Yesterday’s session in the US markets showed a typical picture of what traders call “healthy fatigue” in the market. The indices barely moved, creating an illusion of calm, but beneath the surface capital was actively being reallocated: money was leaving some assets and flowing into others, setting the stage for future moves.

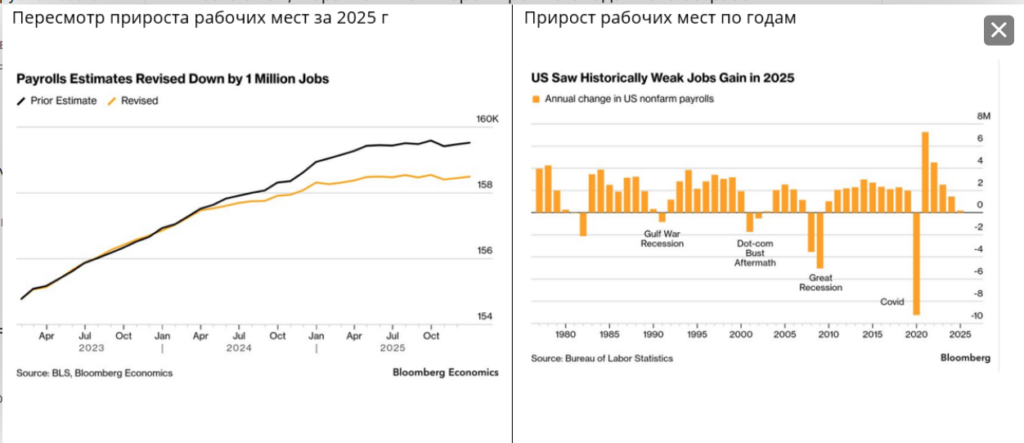

The main macroeconomic event was the US employment report, which came in stronger than expected. The economy added 130,000 new jobs, while forecasts had pointed to only 70,000. The unemployment rate declined to 4.3%.

This signals that the economy is holding up better than analysts anticipated, creating a mixed effect for equities: on the one hand, there are no clear signs of recession, but on the other, the Federal Reserve is unlikely to rush into cutting rates. The yield on 10-year Treasury bonds immediately jumped to 4.17%, reflecting expectations of a tighter monetary stance.

Looking at the internal structure of the market, several notable trends stand out. Nasdaq remains under pressure: over the last ten sessions there have already been five “distribution days,” pointing to active selling by institutional investors. This is not a full correction yet, but it is a concerning signal – major players are taking profits in the most hyped sectors.

NYSE, meanwhile, is holding up better. The S&P 500 remains near its highs, while the equal-weight index has reached a new record, indicating that the market’s strength is broader than just a handful of mega-cap companies.

Sector shifts are also clearly visible. Software stocks showed weakness again: Unity dropped 26%, Shopify fell 7%, and nine software groups declined by more than 2%. This highlights a clear rotation of capital away from overhyped and overpriced segments.

On the opposite side, chips and AI infrastructure emerged as leaders. Strong earnings from DIOD, GFS, and AEIS supported a 2.5% rise in the SMH ETF, while Vertiv returned to the spotlight thanks to the ongoing data center and AI theme.

Energy and industrials also posted gains. XLE climbed 2.6% as oil prices moved higher, while XLI advanced as investors continued to look for cyclical opportunities. At the same time, the travel sector cooled sharply, with JETS losing 3.3%, reflecting a decline in overall risk appetite.

The global picture confirms this trend. In Asia, South Korea reached new all-time highs: Samsung shares rose 6%, while SK Hynix gained 3.5% on expectations of a boom in AI memory such as HBM4. Japan also set a new record, with its index moving above 58,000 points, reflecting market confidence in the government’s pro-growth policies. The AI supply chain remains a global driver, fueling growth trends in the technology sector worldwide.

The conclusion is simple: the market is not falling, it is reallocating. Money is leaving hyped software names and flowing into chips, industrials, and energy. The indices are flat, but the internal dynamics are highly active. This is a classic pause phase before the next move. In the current environment, it is more important to select the right stocks than to focus solely on index direction. It is still too early to aggressively add exposure, but moving entirely into cash would also be a mistake.

The practical strategy for now is gradual positioning in growth leaders with tight stops, focusing on strong companies and avoiding weak groups. If Nasdaq can reclaim its 50-day moving average, the market will gain fuel for a new impulse. For now, this is more of a chess match than a sprint: each move is calculated, and the outcome is shaped by precise steps rather than sudden bursts.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.