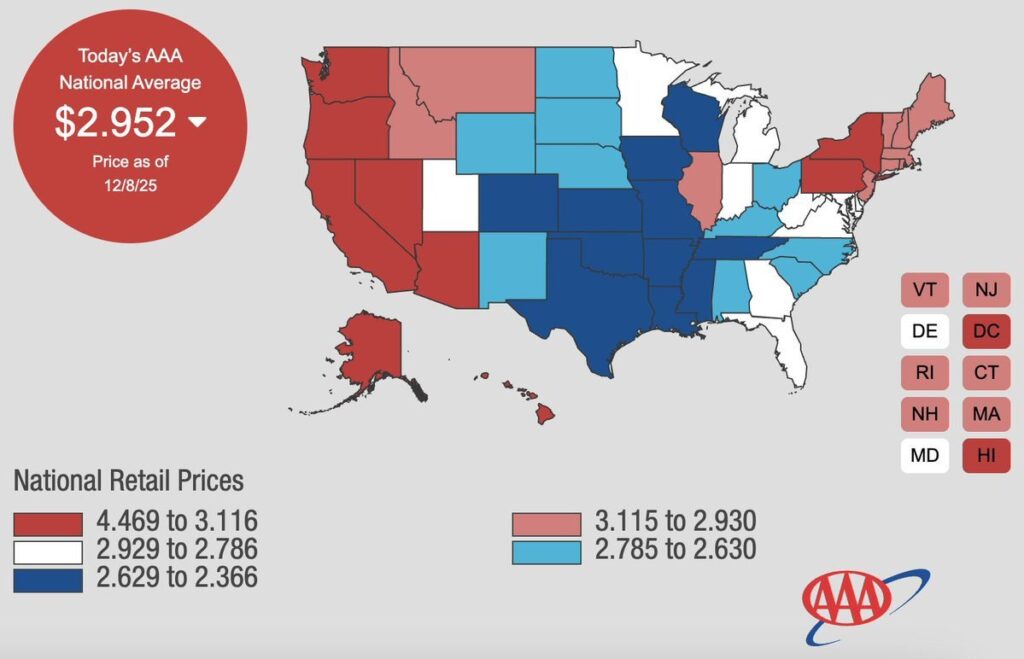

The average price of gasoline in the U.S. has fallen to $2.95 per gallon, for the first time since 2020. This price level not only reflects seasonal factors but also signals deeper dynamics in commodity markets and consumer demand.

The decline in fuel costs is usually associated with several key processes:

- Slowing economic activity.

Reduced demand for energy often indicates cooling consumption and production. If transport, logistics, and industrial activity decrease, oil prices respond with declines. - Increased oil production and supply.

The U.S. continues to operate near record production levels, providing the domestic market with excess supply. With weak demand, this strengthens the downward price trend. - Seasonality: the winter factor.

During the cold months, gasoline consumption traditionally decreases, putting additional pressure on prices. - Declining inflation expectations.

Gasoline is one of the fastest and most demand-sensitive components of the consumer basket. Its price drop usually leads to a decrease in short-term inflation expectations, which is favorable for the Federal Reserve.

Against this background, a natural question arises: does the drop in gasoline prices indicate a weakening of overall inflation? The answer is more complex than it seems.

Fuel prices are highly volatile and can respond quickly to short-term factors, but overall inflation depends on many structural components — services, rent, medical expenses, wages. Therefore, low gasoline prices alone do not eliminate inflationary pressure in other segments.

Nevertheless, markets are reacting. Falling energy prices strengthen expectations of a more dovish Fed. Optimistic forecasts have even appeared suggesting the regulator might consider a rate cut sooner than expected.

For now, one fact is clear: gasoline prices are in a steady downtrend, and this is a factor the Fed will inevitably take into account when assessing consumer price dynamics, demand, and the state of the economy.

If the trend continues, inflationary pressure will decrease, and room for monetary policy easing will expand.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.