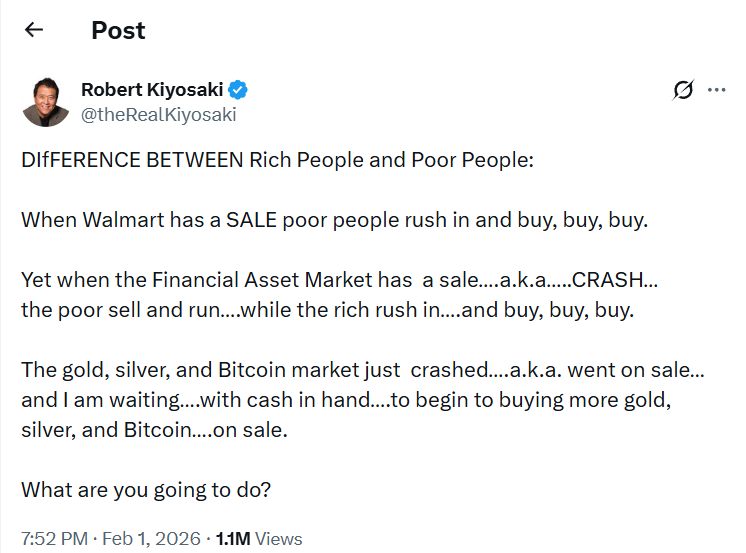

American entrepreneur, investor, and author of the bestseller “Rich Dad Poor Dad” Robert Kiyosaki once again drew the attention of markets by drawing a clear and harsh parallel between consumer behavior in retail trade and people’s reactions to financial market crashes. According to him, it is precisely in such moments that the fundamental difference in the thinking of the poor and the rich becomes especially evident.

Kiyosaki noted that the logic of most people works selectively and often against their own financial interests. “When Walmart has a sale, poor people rush and buy, buy, buy. But when there is a sale in the financial asset market, meaning a crash, the poor sell and run, while the rich rush and buy, buy, buy,” he said.

In the investor’s view, this is the key psychological mistake that keeps people in poverty for years. They are willing to actively spend money on discounts in stores but are unable to act calmly when real assets become cheaper due to panic in the markets.

Commenting on recent price movements, Kiyosaki emphasized that he sees the sharp decline in gold, silver, and bitcoin prices not as a catastrophe, but as an opportunity.

“The gold, silver, and bitcoin market has just crashed, meaning it has gone on sale, and I am waiting with cash in hand to start buying more gold, silver, and bitcoin on sale,” he noted. After that, the entrepreneur directly addressed his audience with a rhetorical question: “What will you do?”

For many years, Kiyosaki has consistently repeated that fear of making a mistake is one of the main causes of financial problems. People are afraid to buy an asset in times of uncertainty, but without hesitation they buy goods that create no long-term value. In this context, he calls bitcoin a unique opportunity, emphasizing that for the first time in history the path to large capital has become available not only to elites, but also to ordinary people.

At the same time, the investor regularly warns about systemic risks to the global financial architecture. He speaks of a high probability of “the biggest crash in world history,” which he believes will be the result of central bank policies. Kiyosaki sharply criticizes the Federal Reserve and the US Treasury for constant expansion of the money supply and advises avoiding so-called “printed assets,” that is, instruments whose value is based solely on trust in fiat money.

Among the most promising areas, he traditionally highlights real assets. First of all, this refers to gold and silver, as well as cryptocurrencies. In addition to bitcoin, Kiyosaki has repeatedly called Ethereum one of the best assets on the market, emphasizing its technological foundation and long-term potential.

The entrepreneur has also spoken openly about his own investments, stating that he owns “millions” in bitcoin. In his forecasts, he remains extremely optimistic, previously claiming that the price of BTC could rise to $200,000 by the end of 2025. At the same time, he constantly stresses that psychology, not intelligence or starting capital, plays the decisive role in financial success.

In his latest comments, Kiyosaki said that he is increasing investments in bitcoin, gold, silver, and Ethereum amid growing economic tensions in the United States. He again warned about the “approach of a massive crash” and accused regulators of “printing fake money.” In a longer-term perspective, the investor allows that in 2026 bitcoin could be worth up to $250,000, and silver up to $100 per ounce.

Notably, the price of silver recently exceeded the $120 per ounce level, which, according to Kiyosaki’s supporters, confirms his theses about the undervaluation of real assets and distortions in the financial system.

At the same time, despite openly bullish forecasts, Kiyosaki emphasizes that he does not ignore risk management. He said that he partially locked in profits by selling bitcoins worth $2.25 million. According to him, the assets were bought at around $6,000 per 1 BTC and sold near the $90,000 level. The proceeds were directed not toward consumption, but toward the purchase of two surgical centers and the launch of a billboard advertising business, once again confirming his principle of transferring profits from financial assets into real businesses and sources of cash flow.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.