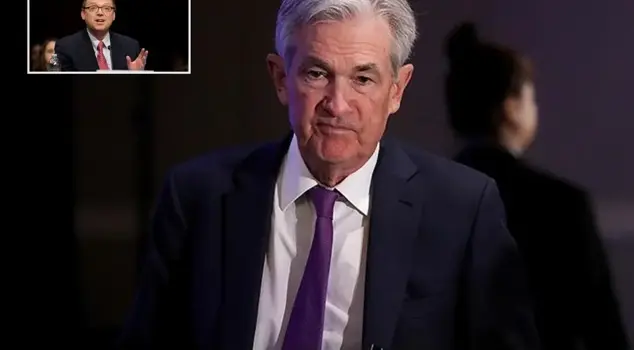

? US President Donald Trump announced his support for economist and former White House advisor Kevin Hassett as the key candidate for the position of Chair of the Federal Reserve System (the Fed). In his statement, Trump emphasized that Hassett has the necessary experience and knowledge to effectively manage the country’s monetary policy amid financial market instability and inflationary challenges.

The markets received this announcement positively, mainly due to expectations that Hassett, if confirmed, would prioritize lowering the key interest rate. Investors expect that monetary easing will stimulate economic growth, increase market liquidity, and support corporate lending. This perception explains the rise in optimism across financial platforms: traders and analysts see Hassett’s potential appointment as a signal of a softer Fed policy and, consequently, greater activity in stock and bond markets.

Senate, so specific steps toward easing rates will depend on the official appointment and subsequent decisions. At the same time, investors are not yet showing excessive concern about possible “Trump control” over the Fed, focusing instead on the direct economic effects of the potential appointment.

From a financial strategy standpoint, Hassett’s appointment may signal an acceleration of the rate-cutting cycle after a period of monetary tightening. Economists point out that this will create both opportunities for lending and investment, and risks of overheating in certain market segments. In particular, industries with high debt loads and rate-sensitive financial assets may receive short-term support.

? Thus, Trump’s announcement not only raises interest in personnel changes within the Fed but also shapes expectations regarding the future trajectory of US monetary policy, influencing the strategic decisions of investors and financial market participants.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.