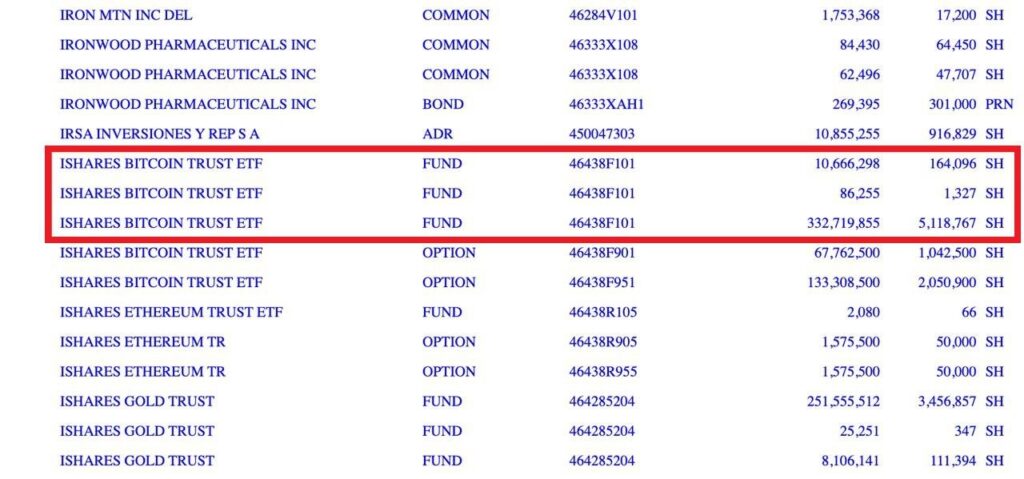

? One of the largest banks in the world — JPMorgan Chase & Co. — continues to expand its presence in the cryptocurrency sector. According to the latest data from the U.S. Securities and Exchange Commission (SEC), the bank owns 5,284,190 shares of BlackRock’s Bitcoin ETF (iShares Bitcoin Trust, IBIT). The total value of the holdings is estimated at approximately $343 million, up 64% from the previous reporting period.

The growth in investment is particularly notable given JPMorgan’s traditionally cautious stance on cryptocurrencies. Bank CEO Jamie Dimon has repeatedly criticized Bitcoin, calling it a “bubble” and a “speculative instrument.” However, the institution’s actual actions tell a different story — the financial giant not only analyzes the crypto market but actively participates in it through regulated products.

Why This Matters:

BlackRock’s ETF has become the main catalyst for institutional interest in Bitcoin. Since its launch, the fund has accumulated billions of dollars, providing convenient and secure access to BTC for large investors who do not wish to hold cryptocurrency directly.

According to Bloomberg analysts, institutional purchases through ETFs have been the key driver of Bitcoin’s growth in 2025 — from around $40,000 to over $100,000 per coin.

What JPMorgan’s Move Means:

Market observers say the bank is diversifying clients’ portfolios and its own investments, preparing for a potential restructuring of the financial system. Amid rising U.S. government debt, a weakening dollar, and high inflation, crypto assets are becoming part of a “new defensive toolkit” — alongside gold and strategic commodities.

Additionally, JPMorgan is developing its own blockchain projects. Using the Onyx network, the bank is already testing tokenized deposits and corporate payments, as well as working on integrating digital assets into international settlements.

Context:

BlackRock’s ETF (ticker IBIT) is the largest among all U.S. Bitcoin funds. Its assets under management have surpassed $20 billion, ahead of competitors from Fidelity and ARK Invest.

JPMorgan’s purchase may signal the beginning of a new phase of institutional entry into the crypto market — when even those who were previously skeptical of Bitcoin now see it as a strategic asset for long-term investment.

? Analyst Quote: “When the largest U.S. bank buys the largest Bitcoin ETF — this is no longer a trend, it’s a new financial standard,” notes a CoinDesk expert.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.