Strategy’s Michael Saylor has once again given the market a reason to talk about the potential Bitcoin purchase during a correction. Amid the drop in the price of the first cryptocurrency below the $88,000 mark and growing concerns related to the Bank of Japan’s policies, the company seems prepared to continue its aggressive accumulation strategy.

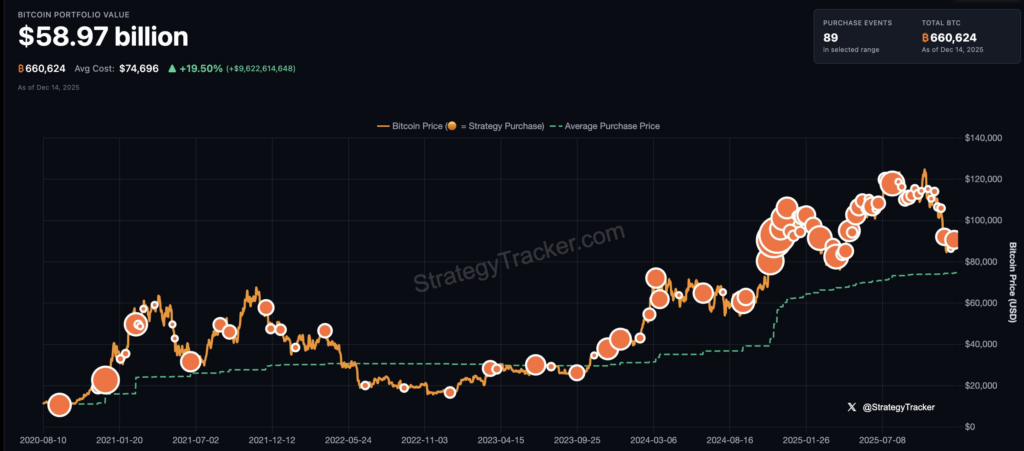

On Sunday evening, Bitcoin dropped to a two-week low of around $87,600 on Coinbase. This decline happened amid overall nervousness in global markets and the anticipation of decisions from major central banks. Almost immediately after this, Saylor posted a familiar but concise message on social media platform X: “Back to the orange dots,” accompanied by a chart of the Strategy Bitcoin portfolio. Historically, such posts have almost always preceded new cryptocurrency purchases by the company.

The latest large transaction by Strategy occurred on December 12, when the company acquired 10,624 Bitcoin. This was the largest single purchase since the end of July, reaffirming Saylor’s commitment to the chosen strategy. Currently, Strategy holds 660,624 Bitcoin, which is approximately $58.5 billion at current prices. The average purchase price is about $74,696 per coin, allowing the company to remain comfortably profitable even after a significant market correction.

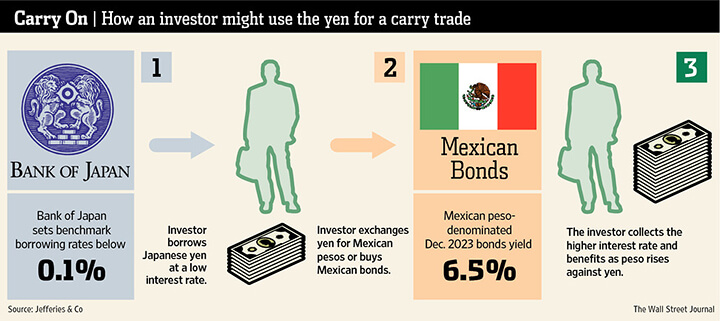

Additional pressure on the market is attributed by analysts to the situation surrounding the Bank of Japan. The expected decision on interest rates raises concerns that a new wave of sell-offs might begin, linked to the closure of carry trades. Japan traditionally plays a key role in the global financial system and is one of the largest holders of U.S. government debt. In the past, rate hikes by the Japanese central bank have coincided with sharp declines in the crypto market and other risk assets.

NoLimit expert noted that many investors underestimate the potential impact of the Bank of Japan’s actions on Bitcoin. According to him, sharp shifts in Japan’s monetary policy could trigger a chain reaction across global liquidity markets. The prediction platform Polymarket estimates a 98% probability that the Bank of Japan will raise its interest rate by 0.25% as early as this Friday, further adding to market tension.

Justin d’Anethan, Head of Research at the consulting firm Arctic Digital, told Cointelegraph that expectations of tighter policy in Japan are fueling fears of a renewed sell-off in carry trades. This, in turn, is weighing on all risk assets, including cryptocurrencies, technology stocks, and emerging markets.

At the same time, not all analysts share the pessimism. An analyst known by the pseudonym Sykodelic believes that the market has already priced in the Bank of Japan’s decision in current valuations. In his view, financial markets move in anticipation of events rather than at the moment they actually occur. He predicts that in the near term Bitcoin will remain within a broad range of $80,000–$100,000, as traders are waiting for a new strong catalyst that may never materialize.

By the time of writing, Bitcoin had already recovered above the $89,000 level, although this still represents one of the lowest prices since the beginning of December. At that time, the market also experienced a sharp correction after falling to around $84,000. The current dynamics fit well into a pattern observed in recent weeks: Sunday sell-offs amid low liquidity followed by buybacks from large players.

Strategy’s behavior in this situation appears illustrative. The company consistently uses corrections as an opportunity to increase its positions, acting against short-term market fears. This countercyclical approach has already become a hallmark of Michael Saylor and his team.

From a deeper analytical perspective, the correlation between the Bank of Japan’s decisions and cryptocurrencies may be partially overstated. Carry trades traditionally have a stronger impact on currency pairs and equity indices, while Bitcoin in recent years has increasingly shown signs of being an independent asset class with its own supply-and-demand dynamics.

From the standpoint of machine data analysis, the current volatility falls within the historical norm for December, which is considered one of the most turbulent months for the crypto market. In this context, analysts recommend paying attention not only to macroeconomic factors, but also to institutional flows through Bitcoin ETFs, as well as miner behavior. These factors may have a more direct and tangible impact on Bitcoin’s price than expectations surrounding decisions by individual central banks.

Overall, the situation demonstrates that for large institutional players, the current correction is seen not as a reason for panic, but as another window of opportunity. Strategy, judging by the signals, remains committed to its long-term strategy and is ready to use any market weakness to further increase the share of Bitcoin on its balance sheet.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.