? Can Bitcoin dethrone gold as the world’s top store of value?

Analysts at Bitwise Asset Management believe — yes.

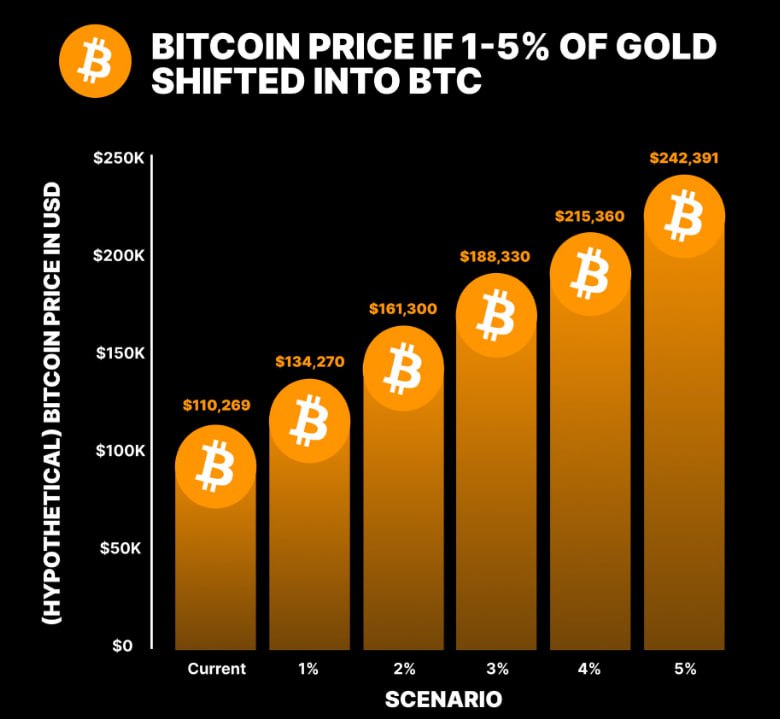

According to their estimates, if just 5% of the global capital invested in gold shifts to Bitcoin, the cryptocurrency’s price could surge to $242,000.

Even a modest reallocation of 1–2% could push BTC to $130,000–160,000, making it the main beneficiary of a global asset revaluation.

From “eternal metal” to digital equivalent

For centuries, gold has symbolized wealth and stability.

But with the rise of digital technologies and growing inflationary risks, traditional capital protection tools are giving way to new — flexible, tech-driven, and highly liquid — alternatives.

Today, the total gold market cap is about $16 trillion, while Bitcoin’s value stands at around $2.2 trillion.

The gap is enormous — but that’s exactly where the growth potential lies.

If investors shift even 5% of their “gold portfolio” to crypto, BTC’s market cap could expand by several trillion dollars.

Bitwise notes that the shift is already underway: institutional funds, asset managers, and banks are gradually adopting new strategies.

Bitcoin is evolving from a “speculative asset” into a core component of diversified portfolios — much like gold was in the 20th century.

Why gold is losing ground

Gold has always been seen as a “safe haven” in turbulent times.

But the world has changed.

The rise of cryptocurrencies introduced new ways to hedge against inflation.

Bitcoin, with its limited supply of 21 million coins, is viewed as digital gold — but faster, lighter, and borderless.

Technological progress has made gold less appealing: it produces no yield, requires storage, and isn’t ideal for quick capital movement.

Bitcoin, on the other hand, can be transferred within minutes, across borders, with no intermediaries.

In 2025, gold prices indeed rose 58% to $4,300 per ounce, largely driven by fear — from geopolitical tensions to monetary uncertainty.

Yet Bitcoin outperformed it, rising 63% in the same period — proving that digital gold is already competing with the physical one.

How macroeconomics boosts Bitcoin

The main driver behind capital rotation is monetary policy.

With the U.S. Federal Reserve expected to cut interest rates, investors are seeking higher-yielding assets.

Against this backdrop of global monetary easing, cryptocurrencies look particularly attractive — enabling capital mobility, inflation protection, and portfolio diversification.

Additionally, more countries are enacting clear crypto regulations, reducing legal uncertainty and boosting institutional confidence.

Together, these factors could propel BTC beyond its $126,000 all-time high — and possibly above $200,000.

Why Bitwise’s forecast seems realistic

Bitwise Asset Management has a strong track record in crypto analysis.

The firm helped pioneer Bitcoin ETFs in the U.S., and its models account for real capital flows and institutional behavior.

According to Bitwise, even a small reallocation from gold to crypto could shift the balance dramatically.

Many funds are already treating BTC as a “hedge asset” — similar to gold, but with greater upside potential.

The growing presence of institutional players — from banks to insurers — is also stabilizing the market.

Bitcoin is becoming part of the new financial mainstream.

What other experts say

Not only Bitwise, but also Digital Assets Hub, Galaxy Digital, and ARK Invest confirm:

Bitcoin is gradually emerging as a hedge against inflation and currency risk.

In a world of geopolitical turmoil and weakening fiat currencies, it has shown remarkable resilience.

Over the past year, BTC gained 63%, outperforming all major traditional assets.

If Bitcoin holds above $100,000, it will send a strong signal for institutional inflows and cement its status as true “digital gold.”

Potential risks

Of course, analyst optimism doesn’t mean zero risk.

Volatility remains high, and regulatory uncertainty persists.

Tax changes or the rise of CBDCs (central bank digital currencies) could temporarily cool investor interest.

Yet, in the long term, experts agree: structural growth is inevitable.

Wider BTC adoption in payments, finance, and investments is building sustainable demand, while Layer 2 innovations (Lightning Network, Runes, Taproot Assets) are making the Bitcoin network faster and cheaper.

Conclusion: Digital Gold Becomes Reality

Bitwise’s forecast isn’t just a bullish scenario — it reflects a global shift.

The financial world is moving toward digitalization, and investors are seeking new ways to preserve wealth.

If even 5% of the gold market’s capital flows into BTC, Bitcoin’s price could indeed surpass $240,000.

And that’s no longer a crypto dream — it’s a logical projection of how 21st-century investment logic is evolving.

? Bitcoin is becoming not just gold’s alternative, but the symbol of a new financial era — one of digital reserves and global decentralization.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.