Senior commodity markets strategist at Bloomberg Intelligence, Mike McGlone, suggested the possibility of a sharp decline in Bitcoin’s price down to $10,000. He wrote about this in a note on X (formerly Twitter), commenting on a recent statement by Strategy co-founder Michael Saylor made at the Economic Club of Miami event.

During his speech, Saylor stated: “We buy Bitcoin with money we cannot afford to lose.”

According to McGlone, this statement alone is a warning signal and reflects the current state of the market. The strategist reminded that Strategy (formerly MicroStrategy) was one of the key catalysts for the Bitcoin rally in 2020, when the price of the first cryptocurrency was around $10,000. At that time, the company’s aggressive BTC accumulation strategy became an important psychological and market factor, driving institutional interest.

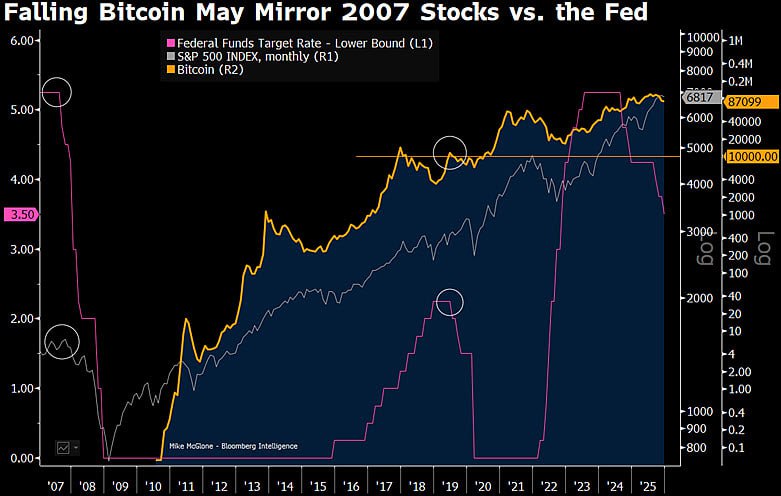

However, McGlone believes the situation has fundamentally changed. According to him, the drivers that previously fueled growth have largely already been realized and priced in by the market. He highlighted the launch of Bitcoin spot ETFs, the official recognition of its benefits by U.S. political and financial elites, and the broader adoption of cryptocurrencies in the financial system.

The expert emphasized that the market no longer lives on expectations — the key events have already occurred, which significantly reduces the potential for further growth on the previous basis. Under such conditions, McGlone believes the asset may return to more “fundamental” levels that previously served as equilibrium points.

The strategist also pointed to the overall state of the crypto industry. He noted that while there was only one Bitcoin in 2009 as a unique digital asset, today, according to CoinMarketCap, there are around 28 million different cryptocurrencies and tokens on the market. This dilution of supply, according to McGlone, reduces scarcity effects and increases competition for investor attention and capital, even if most of these assets have no long-term value.

Given these factors, he suggested that Bitcoin could retest levels around $10,000, which had previously played a key role in its market history.

McGlone’s statement sparked a sharp reaction in the crypto community. X users actively criticized the forecast, pointing out logical inconsistencies in the argument. One commenter asked rhetorically: “Why didn’t gold return to $20 when ETFs appeared, countries began recognizing gold, and ownership ceased to be illegal?”

Other participants noted that the large number of altcoins does not pose a real threat to Bitcoin, as most lack decentralization, a reliable security model, and long-term economic logic. In their view, Bitcoin remains a unique asset that cannot be directly compared to the rest of the crypto market.

It is worth noting that this is not McGlone’s first pessimistic forecast regarding the first cryptocurrency. He had previously stated that Bitcoin could fall to $50,000, calling it overvalued in the current macroeconomic cycle. His views traditionally remain more conservative compared to most Bitcoin enthusiasts, making his comments regularly the subject of heated debate in the crypto community.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.