✈️ Airlines are on the rise, but stock selection is limited. How should investors act in the current environment?

Since April 2025, the airline sector has shown an impressive growth of nearly 60%. Rising demand for flights after the pandemic, recovery of tourism and business travel, and increasing ticket prices create a favorable environment for the industry. However, despite the overall growth, the airline stock market remains uneven, making it challenging to choose individual shares for investment.

Analysis of individual companies:

- Delta Air Lines (DAL) — one of the largest U.S. airlines, showing stable revenue and passenger growth. However, the stock is approaching the upper edge of the buying zone, indicating a high market valuation and limited short-term growth potential. Investors should exercise caution, take profits, and wait for a possible correction before buying again.

- Ryanair (RYAAY) — a leading European low-cost carrier. The recent break of a support level indicates high volatility. For investors, this signals increased risk: the stock may continue to decline to the next support level or stabilize only after sector correction.

- SkyWest (SKYW) — currently the only major airline whose shares are in a reasonable entry point from a technical perspective. Chart and volume indicators make it attractive for those seeking individual stocks with growth potential.

Alternative to individual stocks — airline ETF

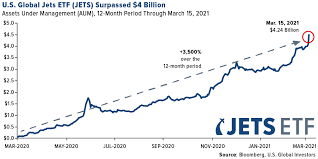

If choosing individual companies is difficult due to overvaluation or weak technical patterns, consider the ETF JETS (U.S. Global Jets ETF). This instrument includes around 50 securities: the largest U.S. airlines (United, Delta, American Airlines) and supporting aviation companies (Expedia, Boeing, etc.).

Current characteristics of ETF JETS:

- The ETF broke the 25.88 level and is currently in a buying zone up to 27.17, indicating growth potential.

- RS rating = 80, meaning it outperforms the sector average.

- In July, airline ticket fares rose 4% according to CPI and UBS data, indicating increased airline profitability.

- Demand for tickets and bookings is accelerating, especially during summer and holiday periods.

Investor risks:

- Potential bankruptcy of weaker market players, such as Spirit Airlines, which adds volatility.

- High fuel and fleet maintenance costs may limit individual company profitability.

- Macroeconomic factors, including oil price growth, inflation, and currency fluctuations, may also impact returns.

Advantages of investing through an ETF:

- Risk diversification due to inclusion of multiple companies.

- Lower volatility compared to buying individual stocks.

- Opportunity to participate in sector growth even with uncertainty about individual companies.

? Conclusion: Currently, ETF JETS appears more attractive than most individual airlines. It combines growth potential with diversification and lower risk than buying individual stocks with overheated charts or unstable technical patterns. For investors seeking exposure to the aviation sector, this ETF is a convenient tool for long- and medium-term investments with a controlled level of risk.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.