? Solana could rise to $274: institutional factors and the ETF outlook

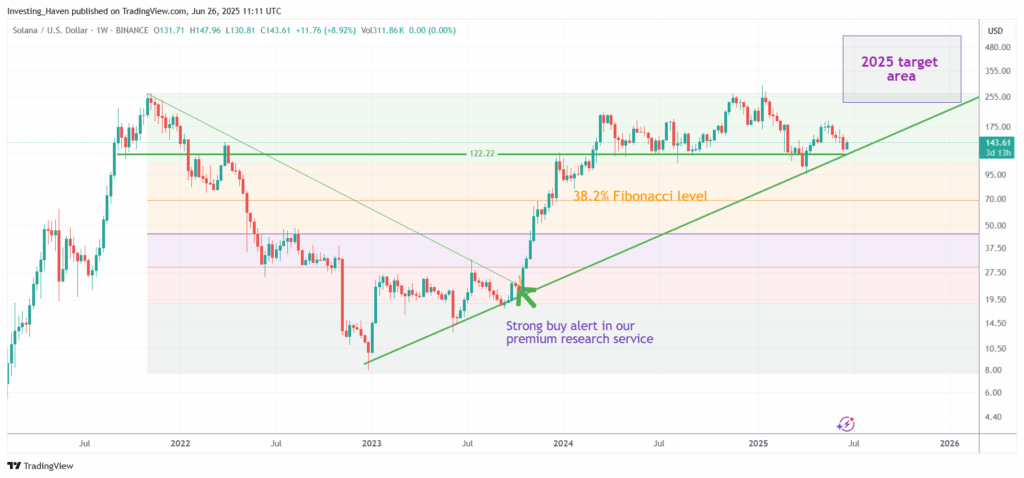

Over the past week, the Solana token (SOL) strengthened by +12.4%, reaching $206. Despite the volatility of the crypto market, many analysts believe Solana still has significant growth potential, especially in light of two key events expected in the coming months.

Key drivers of Solana growth

First, in mid-October 2025, the possible approval of the first Solana-based exchange-traded fund (ETF) is expected. The launch of such an instrument could attract large institutional capital, as an ETF makes cryptocurrency investments more accessible to traditional funds, banks, and retail investors.

Second, there is already growing interest from digital asset funds actively buying Solana. A similar strategy previously proved effective with Ethereum: after the launch of Ethereum ETFs and institutional liquidity inflows, ETH’s price saw multiple growth.

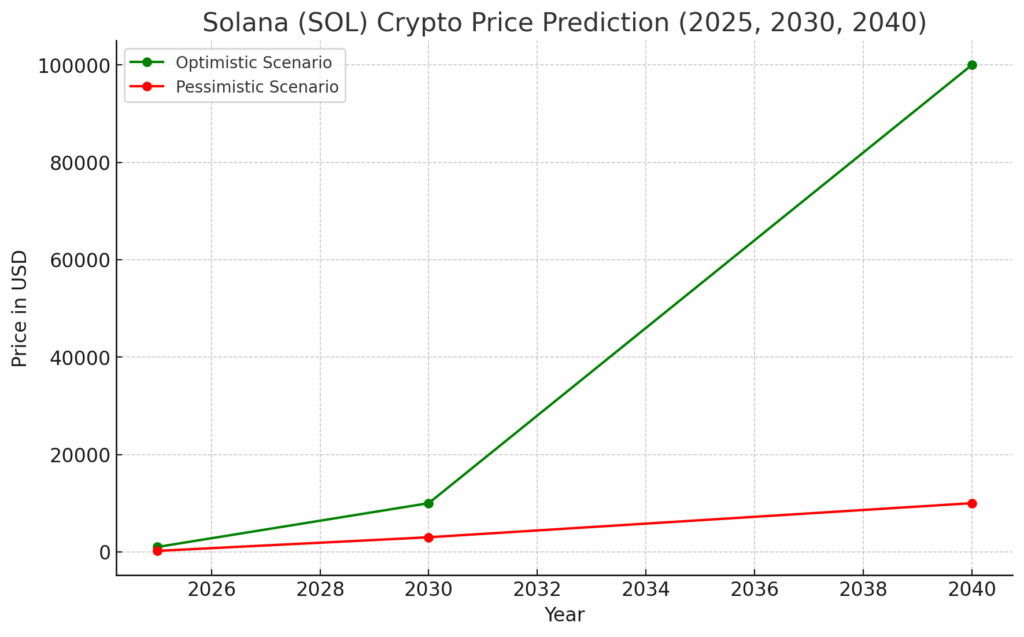

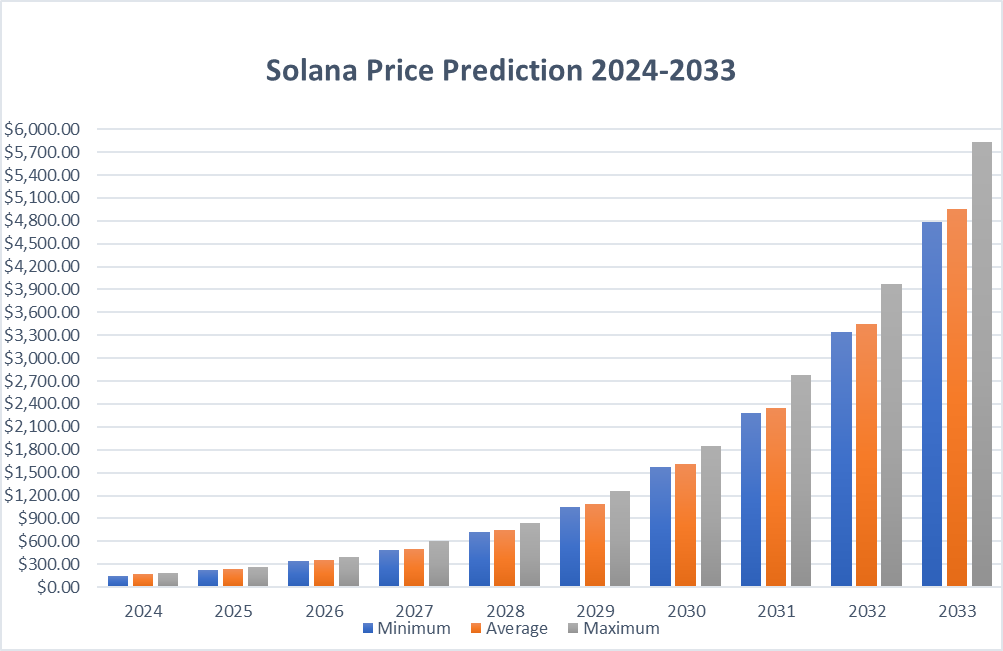

SOL price forecasting models

Analysts highlight several models pointing to potential SOL growth:

- 15x multiplier model: assumes that every $1 of institutional investment could raise SOL’s price by $15. Thus, $2.5B of investment could push the price to $274, and $5B — to $335.

- Expert forecasts: seven leading analysts predict SOL’s 2025 price between $220 and $1,000, with an average estimate of around $425.

- Chart-based forecasts: some models indicate a potential SOL price peak near $369.

Multiplier effect: a lesson from Ethereum

Analysts note an important factor — the so-called “multiplier effect.” For Ethereum, $26B in institutional inflows increased market capitalization from $219B to $554B. Essentially, each $1B invested added about $15B to market cap.

Applying the same model to Solana, currently valued at about $130B, gives approximate target levels:

- $2.5B institutional investment could push the token price to around $274;

- $5B — bring the price closer to $335.

SOL price forecast chart

| Investment amount ($B) | Forecasted SOL price ($) |

|---|---|

| 2.5 | 274 |

| 5 | 335 |

| 10 | 396 |

Fundamental advantages of Solana

Beyond institutional interest, Solana attracts investors with its technical features: high throughput (thousands of transactions per second), low fees, and an active decentralized app ecosystem. Recent months have seen increased activity in DeFi and NFT segments, further strengthening its market position.

Risks and limitations

However, experts warn that Solana’s growth is not guaranteed. Major risks include crypto market volatility, potential delays in ETF launch, and competition from Ethereum, Avalanche, and other blockchains. Regulatory uncertainty in the U.S. and Europe may also affect the speed of institutional inflows.

Conclusion

Solana remains one of the most promising altcoins in 2025. Potential ETF approval and active institutional interest could significantly boost its market capitalization. If the multiplier effect scenario materializes, investors could see the token price in the $274-$335 range. The key factor for success will be the speed and scale of large capital entering the Solana market.

⚠️ Important notes

- Risks: Forecasts are model-based and do not guarantee future results.

- Regulation: Future ETF approval and institutional investments may depend on regulatory conditions.

- Volatility: Crypto markets are highly volatile.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.