? If you think crypto is like some mysterious alien language, don’t worry—you’re not alone. Charts, candlestick patterns, new coins every day—it can all be overwhelming. But in reality, it’s much simpler than it seems. Even if you “understand nothing,” you can start earning calmly. The key is to approach the process as a proven system, not try to predict every price jump.

First Step: Choosing an Exchange

An exchange is like a store, but instead of apples and bread, you trade Bitcoin and Ethereum. For beginners, it’s important to pick a reliable, large platform so you don’t worry about your money.

For example:

- Binance — many features, low fees.

- Coinbase — simple interface, ideal for beginners.

- Kraken — focuses on security, protects your account from hacks.

Registration is simple: enter your email, create a strong password, verify your identity with a passport or ID. Without this, you won’t be able to withdraw large amounts. And enable two-factor authentication—like an extra lock on your safe.

Where to Store Your Crypto

It’s important to understand: keeping large sums on an exchange is not the best idea. Even the largest platforms can be attacked.

Better to use hardware wallets like Ledger or Trezor. Think of them as portable safes that are always with you. Keep only a small amount on the exchange for daily operations.

Simple Strategies for Beginners

Long-term investment (HODL)

No need to chase every coin, analyze charts, or follow the news every minute. Buy Bitcoin, Ethereum, or Binance Coin and hold for months or years. These coins are time-tested; their drops are less severe, and growth chances are more stable.

Stablecoins and Passive Income

Stablecoins (USDT, USDC, DAI) are like digital dollars. Their price barely changes, and some exchanges pay interest—around 4–10% annually. Set up a deposit, leave the funds, and earn daily interest. No magic, just calm earnings.

Auto-Trading with Bots

Bots are programs that buy and sell coins automatically based on set rules. Popular platforms: 3Commas, Bitsgap, Pionex. Minimal risks are achieved with stop-loss (automatic exit if price drops) and take-profit (profit locking). Even while you sleep, the bot works for you.

What a Crypto Bot Is and How It Works

A crypto bot is a program that buys and sells coins automatically. Imagine an assistant constantly scanning the market for opportunities. You don’t need to watch charts every minute—the bot does it.

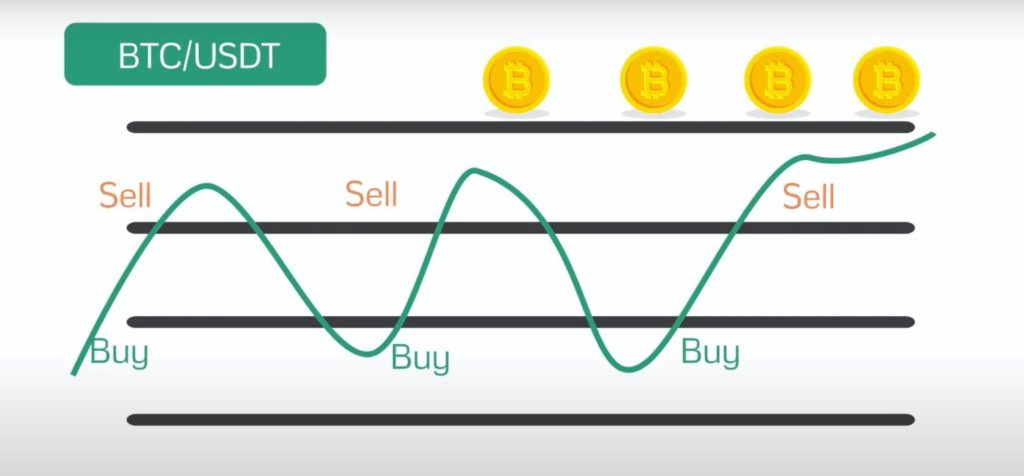

Example: Grid Bot

- Decide to trade Bitcoin between $25,000–$30,000.

- Bot divides this range into segments, e.g., $500 each.

- When price drops to the lower part, bot buys some coins.

- When price rises to the upper part, bot sells part of the coins, locking in profit.

Thus, the bot automatically buys low and sells high day by day.

Setting Up the Bot Step by Step:

- Create an account on Pionex.

- Link your exchange (Binance, Coinbase, etc.).

- Choose a strategy like Grid Bot or DCA Bot.

- Set price range and amount per trade.

- Configure stop-loss and take-profit.

- Launch the bot—it works while you sleep or do other things.

Risks to Understand

Bots aren’t magical. They can’t predict sudden drops or spikes, so losses are possible. To reduce risks:

- Start with a small amount.

- Use stop-loss and take-profit.

- Stick to verified coins and strategies.

- Don’t allocate more than 1–3% of capital per trade.

Simple Beginner Example:

$500 in USDT deposit, earning interest daily (~0.01–0.03%).

Grid Bot with $200 for BTC automatically buys and sells in the set range, locking small profits multiple times a day.

Two sources of income: stablecoin interest + small but regular bot profits—without analyzing complicated charts.

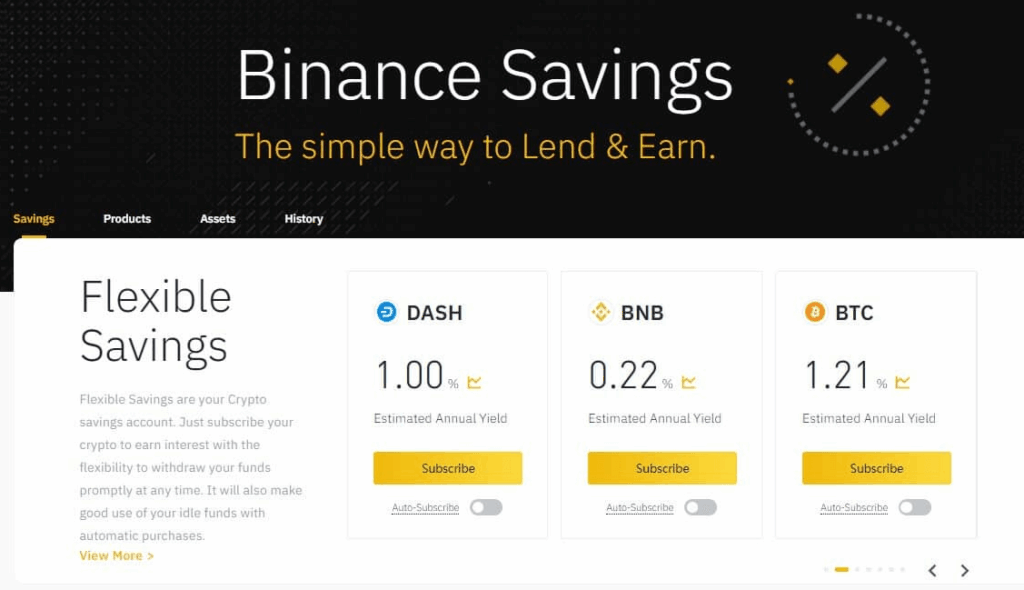

Setting Up Simple Tools

On Binance: Earn → Flexible Savings → choose stablecoin → interest accrues automatically.

For Pionex: create an account, link the exchange, choose strategy (Grid Bot), set price range and amount, set stop-loss → bot starts working.

How to Choose the Right Strategy

Consider your goal: preserving capital, earning steady income, or fast profit?

Stablecoins — for stability.

Top coins — for long-term growth.

Bots — for automation.

Basic risk management: max 1–3% of capital per trade, use stop-loss, diversify funds. Check progress weekly and adjust if needed.

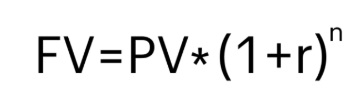

Compound Interest Formula:

FV (Future Value) – final amount; PV (Present Value) – initial amount; r – rate per period; n – number of periods.

Safety First

Never send money to suspicious wallets, don’t trust “get rich quick” schemes, and always update passwords and 2FA.

? Conclusion

Even if you “understand nothing” about crypto, you can start earning with minimal risk. Use large exchanges, store main funds in verified coins or stablecoins, automate processes with reliable tools, and follow risk management rules. Over time, you’ll not only earn but also gradually understand the market, allowing bigger profits—stress-free.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.