? From Fake AML Services to Counterfeit Millions: How Not to Become a Victim

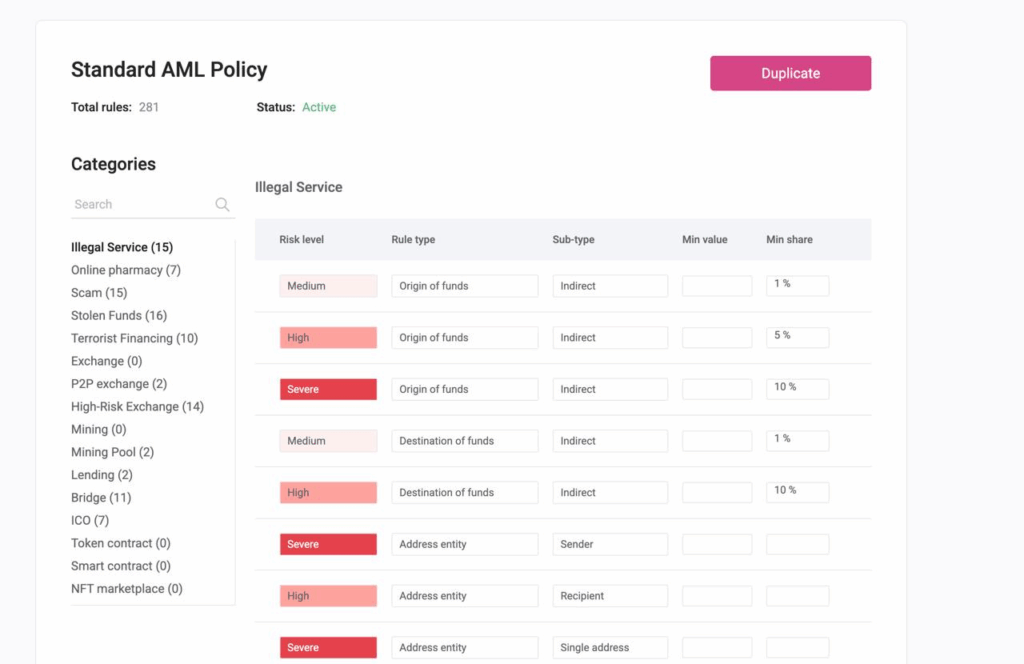

When exchanging cryptocurrencies, users face increasingly sophisticated scams. Scammers actively exploit terms like AML (Anti-Money Laundering) and KYT (Know Your Transaction), creating the illusion of legitimate checks. Under the guise of security, they steal funds and sometimes entire fortunes.

AML Trap: When Your Wallet Is at Risk

One common scam involves fake AML checks requiring wallet connection (what a crypto wallet is and why it’s needed has been discussed on our site).

Scammers create entire ecosystems of fake platforms mimicking well-known cryptocurrency verification services. The user believes they are performing a standard suspicious activity check, but in reality, they sign a malicious smart contract.

Attack scenarios vary. Fake domains are often created that are visually almost identical to real services, luring victims with promises to check the wallet against suspicious addresses, redirecting them to a fake site or showing a pop-up window requesting connection via WalletConnect.

In another scenario, scammers demand wallet “synchronization” under the pretext of AML verification required to withdraw funds.

There are also schemes imitating WalletConnect interfaces or popular exchanges, where KYT monitoring is used as a pretext to connect the wallet. Any such connection gives scammers full access to assets, and funds instantly disappear through automated wallet drainers that completely empty accounts.

Pseudo-Millions on the Screen: How You Are Fooled by “Large Balances”

More sophisticated scams use the tracking mode in older wallets like Electrum or Mycelium. This function allows importing another address and displaying its balance and transaction history on the screen without having private keys.

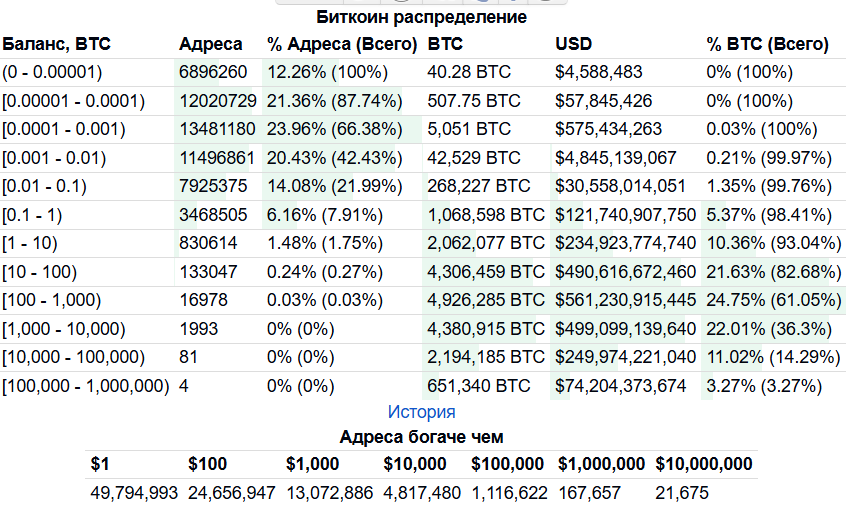

Scammers target addresses from the top 100 richest Bitcoin wallets according to Bitinfocharts.

On an old Android device, balances of tens of thousands of bitcoins appear, marked as “imported.” To an untrained user, this seems convincing.

To increase credibility, scammers provide screenshots, videos, and sometimes even involve a notary, who confirms the presence of the app and the displayed amounts without understanding the technical details of tracking mode.

The scheme is built through a chain of trusted acquaintances. A wealthy and conscientious person, who understands cryptocurrencies only in general, is approached by a contact asking for help to “withdraw” a large amount of bitcoins, citing difficulties in finding a reliable exchange channel.

Experts identify two main scenarios. The first is direct robbery, where a meeting is arranged to transfer or exchange funds, and the victim is forced to send their crypto under the threat of physical harm.

The second, more common scenario involves locating the real holder of USDT or other tokens via trusted connections. Scammers ask to confirm funds on a live video and manipulate the victim into showing a QR code to pair the wallet. After scanning, tokens instantly transfer to the scammers.

Psychological techniques are actively used, creating a sense of mutual verification and transparency. The victim believes they are demonstrating honesty, while in reality, they hand over full control of their assets.

The Secret Path of Stolen Tokens: Money Laundering Schemes

Once scammers gain access to a wallet via a malicious smart contract, they initiate an automated fund transfer process. Tokens are first sent to intermediary addresses fully controlled by scammers, followed by a complex multi-step trail obfuscation.

Stolen funds often pass through decentralized exchanges like Uniswap or SushiSwap, where tokens are converted to other assets to complicate tracking. Exchanging to stablecoins USDT or USDC is popular since they are easier to convert to fiat.

Next, cryptocurrency mixers like Tornado Cash or other privacy services are used to mix stolen funds with legitimate transactions, breaking the visible link between the source address and the final recipient.

For additional masking, scammers use bridge protocols to transfer assets across blockchains, e.g., moving Ethereum to Polygon or Binance Smart Chain, making tracking harder by standard blockchain analysis.

The final stage involves withdrawal through centralized exchanges with minimal KYC requirements in jurisdictions with lenient regulations. P2P platforms are also often used, allowing crypto to be exchanged for cash without extra checks.

Methods to Protect Against Crypto Scammers

Protection can be achieved in several ways. The key rule is never to connect a wallet to suspicious sites, even if they look official. Legitimate AML services work only with public addresses and do not require access to private keys.

Check URLs, use trusted sources, and regularly review wallet permissions via services like revoke.cash. Hardware wallets like Ledger or Trezor add protection by requiring physical transaction confirmation, though they do not fully prevent social engineering attacks.

Special attention should be paid to DeFi protocols: carefully review smart contract terms and avoid granting unlimited token allowances. The combination of technical tricks and psychological manipulation makes modern scams especially dangerous. Scammers exploit the natural desire to help, trust in acquaintances, and superficial knowledge of crypto, turning even cautious users into victims.

Ultimately, vigilance, skepticism, and a basic understanding of crypto wallets remain the best protection.

?️ In a world where technology can deceive as well as humans, caution and common sense are your most reliable shield.

By the way, here you can buy legendary hardware wallets for beginners with all basic functions!

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.