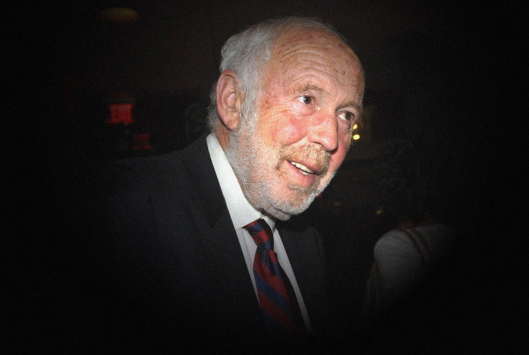

? Jim Simons is the legendary founder of Renaissance Technologies, a person who turned mathematics into a tool for creating billions. At the time of his death in May 2024, his net worth was estimated at $31.4 billion. He started as a mathematics professor and cryptographer during the Vietnam War, and in 1982 founded Renaissance Technologies, a hedge fund famous for its Medallion Fund – the most profitable in history. Medallion’s average annual return exceeded 60% before fees, and even after fees, investors earned tens of percent.

Simons’ success was not due to luck but to a strict system: no intuitive guesses, only data, patterns, and reproducible models. He said himself: “We start not with models but with data. No preconceived ideas. We look for patterns that can be repeated a thousand times.”

Applying Simons’ Philosophy to Cryptocurrency

The crypto market is chaotic, full of noise and hype. But this is exactly where Simons’ approach works particularly well if you remove emotions and focus on repeatable patterns.

Focus only on metrics

Instead of chasing hype around memecoins or waiting for Elon Musk’s tweet, look at real indicators:

- On-chain data: number of active wallets, movement of large addresses.

- Whale activity: when big players start buying or moving assets, it’s a signal.

- TVL (Total Value Locked): indicator of trust in DeFi protocols.

Example: In 2021, the growth of TVL in the Ethereum network predicted the DeFi boom.

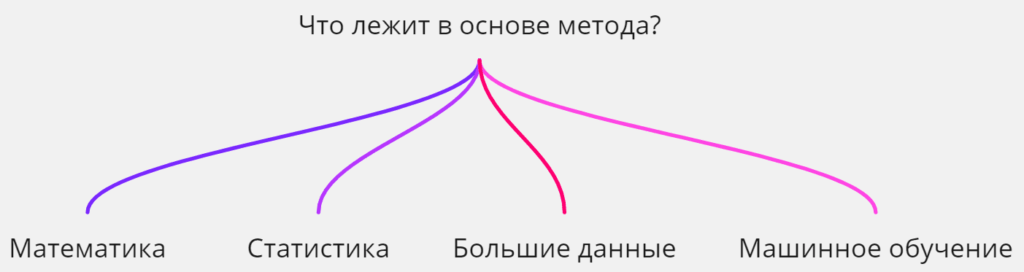

Build reproducible models

Not every spike on a chart matters. Simons taught to find combinations of factors that repeat. For crypto, this could be:

- Increased whale activity + price pullback + rising trading volumes.

- Network upgrade announcement + TVL growth + social media activity.

When multiple factors align, it’s no longer randomness, but a pattern.

Signal systems and automation

Simons and his team used complex algorithms. In crypto, this can be replaced with simpler solutions:

- Setting alerts in TradingView or Glassnode.

- Monitoring news via Twitter/X and Telegram channels.

- Tracking key indicators (RSI, volumes, funding rate).

The main point – remove emotions and follow rules.

Beginner mistakes Simons would avoid

To understand the value of Simons’ approach, look at typical beginner mistakes:

- Trading on emotions. Buying at the peak and selling in panic during drops.

- Blind trust in influencers. Following bloggers instead of checking metrics.

- No strategy. Random decisions without entry/exit rules.

- Ignoring risks. Investing entire deposits in one token or project.

- Expecting miracles. Hoping for x100 returns without considering probabilities.

Simons would call this noise and unnecessary emotions that kill results. His principle: discipline, statistics, and repeatability.

? Conclusion:

- Don’t chase hype; analyze metrics.

- Look for repeatable patterns and build models. Use tools to track signals.

- Use tools to track signals.

- Learn from beginners’ mistakes and turn chaos into a system.

Jim Simons’ secret is simple: you can beat the market by removing emotions and finding the mathematical basis of chaos. In cryptocurrencies, this is especially valuable because the crowd often moves prices faster than fundamentals.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.