? Famous trader and financial market veteran Peter Brandt has once again drawn the attention of the crypto community with his sharp forecast. In his opinion, Bitcoin could drop by 50% if a historical pattern similar to the “soybean bubble” of the 1970s repeats.

Broadening top: a rare chart pattern

Brandt notes that Bitcoin’s chart is forming a rare technical structure called a “broadening top.” This formation usually indicates increased volatility and precedes significant asset declines. In trading, it is considered a signal of a possible major reversal, when the market loses a stable direction and investors become uncertain.

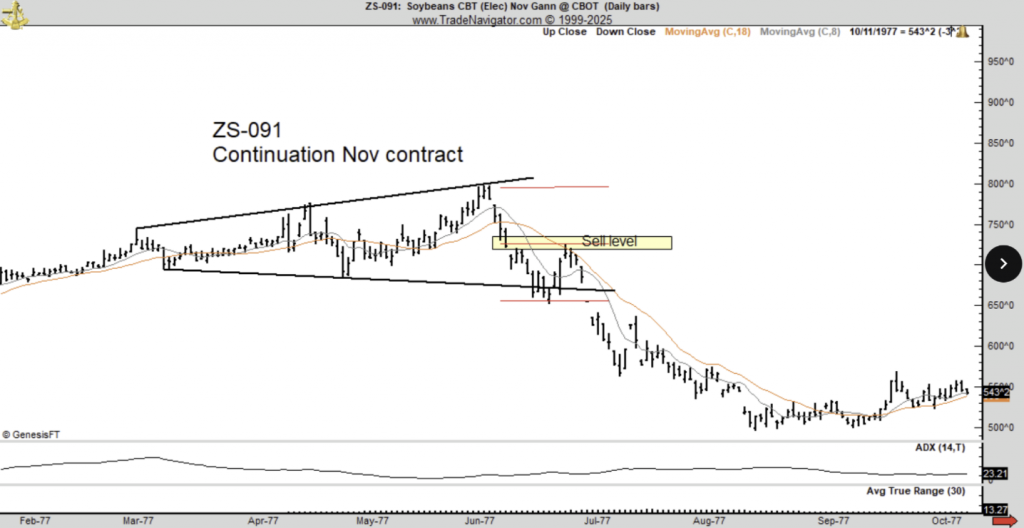

Price chart of soybeans in 1977. Source: Peter Brandt

“Bitcoin is forming a rare broadening top on the chart,” Brandt said. “In the 1970s, soybeans formed the same top, after which their price fell by 50%. History tends to repeat itself.”

Historical analogy: the 1970s soybean bubble

The 1970s became one of the most volatile decades in economic history. During that period, soybean prices soared due to a combination of global shortage and speculative interest from investors. However, when supply exceeded demand, prices collapsed, leaving many market participants with losses. Brandt sees a direct analogy with Bitcoin, where price growth is supported by active speculative demand and corporate investments, and weak correction signals can trigger a decline.

Consequences for corporate investors

The trader warns that a Bitcoin decline will not be limited to crypto assets alone. Companies — major Bitcoin holders — could also come under pressure. For example, Michael Saylor’s company, Strategy, is already experiencing the consequences of volatility. MSTR shares have lost 10.13% in the past 30 days amid pressure on corporate Bitcoin reserves due to declining net asset value.

The “final pump” may not happen

The market veteran believes that the long-awaited strong Bitcoin rally (“final pump”) may not occur. Instead, the price could drop to bearish levels around $60,000. For many investors who bought the asset above these levels, this would be a serious signal to review portfolios and reduce risks.

Optimists believe in growth

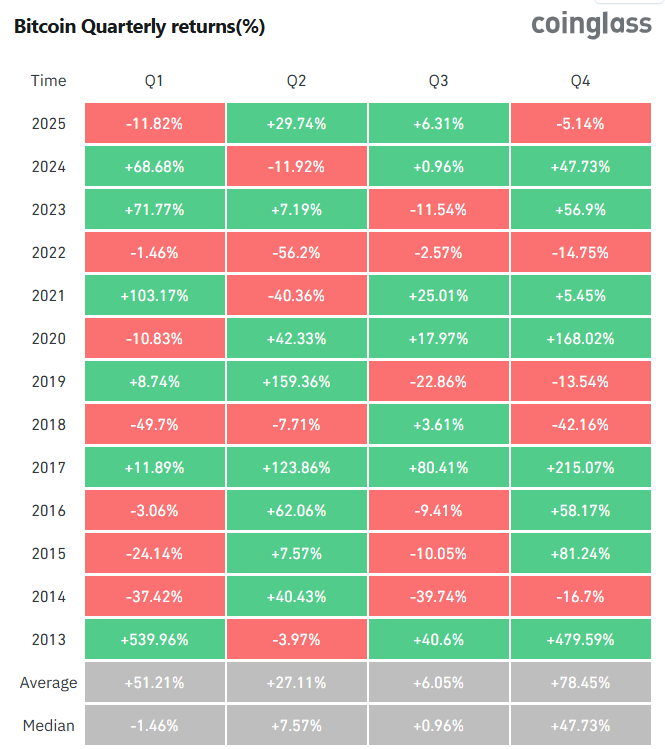

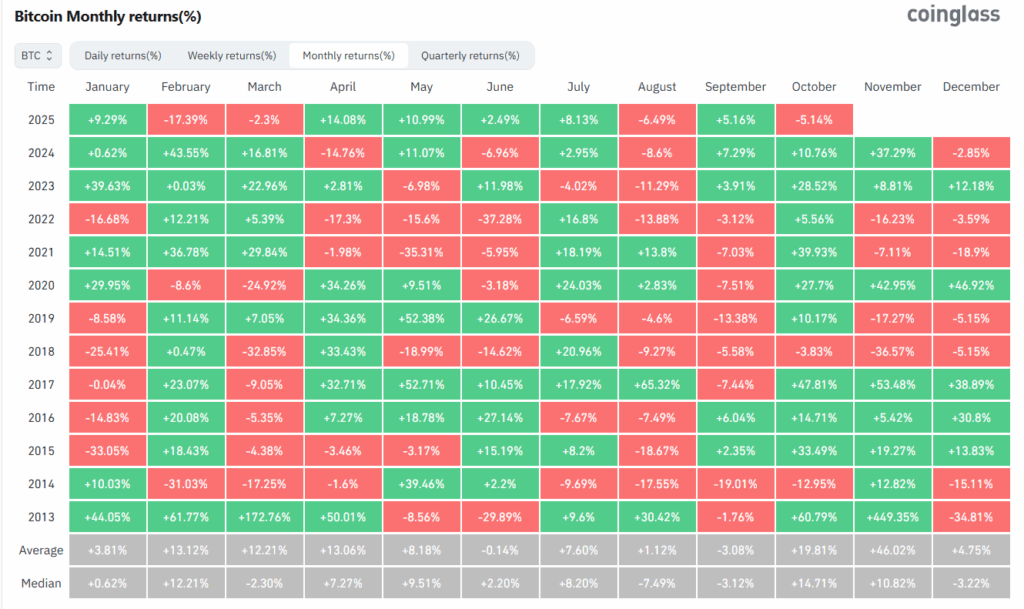

Most crypto industry analysts, however, continue to forecast Bitcoin growth. For example, BitMine chairman Tom Lee believes the price could reach $250,000 by year-end. Historically, the fourth quarter is traditionally considered the strongest for Bitcoin — average returns for this period are 78.49%, according to CoinGlass. October also traditionally shows high market demand and activity.

Bitcoin quarterly returns (%)

Bitcoin monthly returns (%)

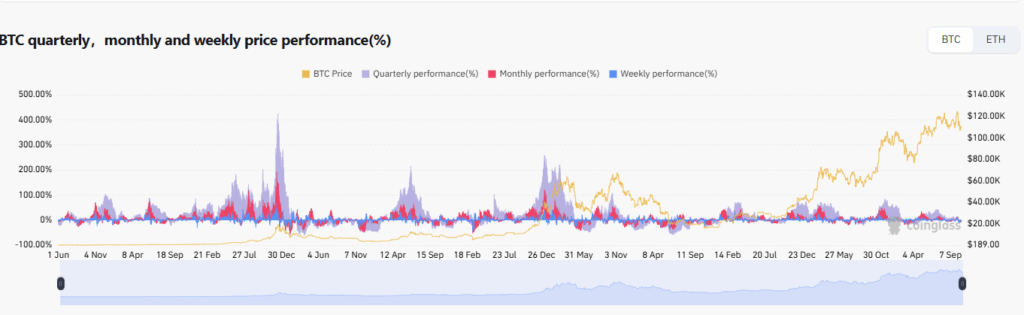

Quarterly, monthly, and weekly BTC price dynamics (%)

Fear and greed index — at extreme fear

Despite a historically bullish period, current market sentiment shows caution. The fear and greed index today shows “extreme fear” at 25 points. Market tension increased after statements by former US President Donald Trump about trade tariffs, which scared investors and triggered a broad decline after record highs.

? Conclusion

Peter Brandt’s forecast reminds us that the crypto market remains extremely volatile and is influenced by both technical signals and external economic and political factors. Investors should remember: high returns are always accompanied by high risks, and historical analogies like the soybean bubble can serve as valuable lessons.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.