Not so long ago, cryptocurrencies were seen as a marginal experiment for enthusiasts and speculators. In 2017, a simple and convenient label dominated: “crypto is a scam.” The industry really did resemble the Wild West back then: thousands of ICOs, promises of quick money, a lack of regulation, and endless stories of fraud. For most traditional financial players, it was something unserious, toxic, and far too risky even to discuss.

By 2021, the tone had changed, but it did not become softer. Instead of a “scam,” the crypto market began to be called a “bubble.” After rapid growth and the emergence of the first major institutional investors, attitudes became more pragmatic: yes, the technology is interesting, but prices are too high, the hype is too loud, and sustainability is in question. Cryptocurrencies looked like another financial fashion that could end as quickly as it began.

But by 2026, it became obvious: the paradigm really has shifted. Today, the world’s largest financial institutions no longer argue about whether “crypto is needed.” They act as if the question is already closed. And the most telling signal is the labor market.

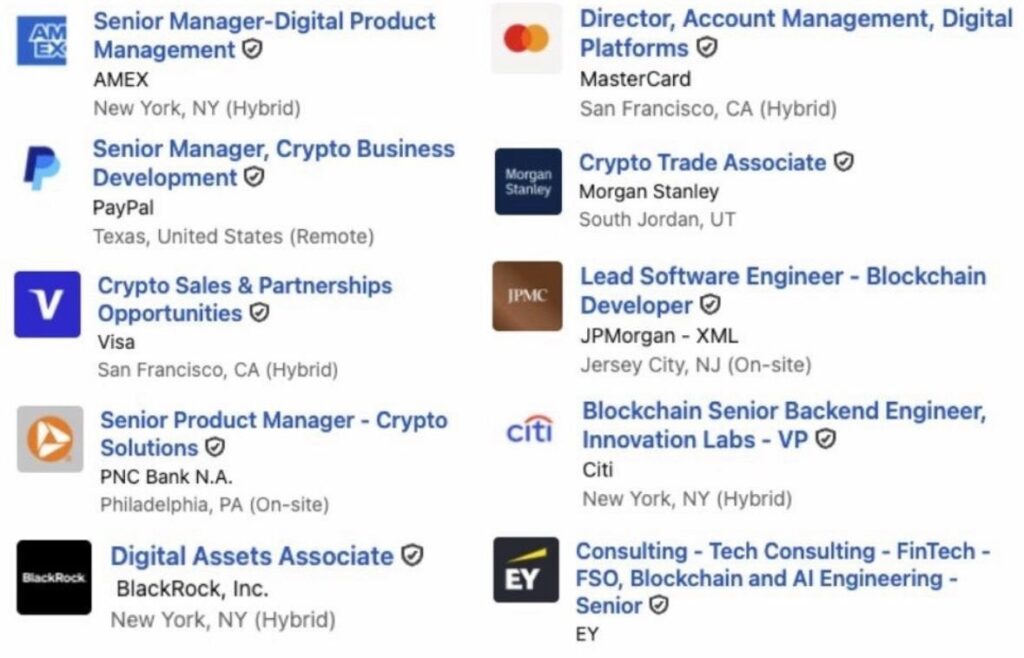

AMEX, PayPal, Visa, JPMorgan, Morgan Stanley, BlackRock, Citi, and other giants are opening positions in digital assets. They are looking for blockchain developers, tokenization specialists, digital market analysts, traders, and experts in crypto settlement infrastructure. These are not startups trying to catch a wave. This is the foundation of the financial system, which for decades built the traditional order – and is now adapting to the new one.

It is important to understand that corporations of this scale do not hire “just in case.” If Visa is looking for engineers for blockchain payments, it means the company sees this as part of its future global payment infrastructure. If JPMorgan is expanding its digital asset teams, then the largest bank in the United States views crypto instruments as an element of financial markets, not as a toy for retail investors. If BlackRock, managing trillions of dollars, is building divisions for tokenization and digital funds, it shows that digital assets are becoming part of the institutional portfolio.

A structural shift is taking place: crypto is no longer a separate world existing “next to” traditional finance. It is gradually being integrated inside.

The reason is simple. Blockchain technology solves real tasks: it speeds up settlements, reduces costs, makes new forms of asset ownership possible, simplifies cross-border payments, and opens the road to the tokenization of everything – from bonds to real estate. And while public discussions continue to revolve around Bitcoin’s volatility, major players are calmly building the infrastructure of the next stage of the financial system.

It resembles the early internet. In the 1990s, it was also considered a toy for geeks. In the early 2000s, it was called a bubble. And then it turned out that the internet did not disappear, but became the foundation of the global economy. The crypto industry is going through a similar path. The only difference is that the speed of change is now higher, and the stakes are much greater. The paradigm has shifted окончательно: if in 2017 crypto was mocked, in 2021 it was feared, then in 2026 it is already being hired. And this is perhaps the most honest indicator of the market’s maturity.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.