This question is increasingly heard not on marginal forums, but in reports by the largest banks, analytical centers, and investment funds. China’s behavior, the dynamics of gold, and the nervous moves of U.S. politics are forming a picture that is becoming harder and harder to ignore.

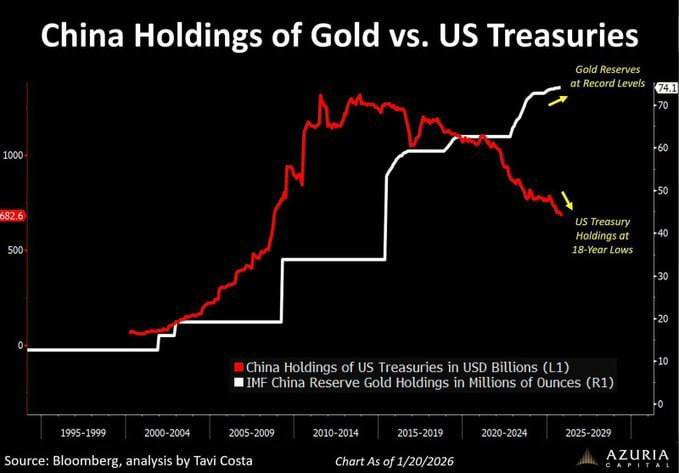

China is consistently reducing its holdings of U.S. Treasury bonds. As of today, the volume of these holdings has fallen to around $680 billion — the lowest level in the past 18 years. This is not a sharp collapse, but a slow, systematic exit stretched over time. At the same time, Beijing is increasing its gold reserves. Officially, the People’s Bank of China reports holdings of 2,306 tons of gold — a record for the country. But the key word here is “officially.”

Goldman Sachs and a number of other analytical institutions suggest that China’s actual gold accumulation may be several times higher than the declared figures — up to ten times more. In other words, China may be holding a significant portion of its reserves outside public reporting. Why is this being done? Such an approach is traditionally used in periods of preparation for major shifts — currency, geopolitical, or systemic.

Gold, meanwhile, is reaching new historical highs. And this is important to emphasize: the rise in gold is not happening against the backdrop of panic among retail investors, but amid institutional demand. Central banks, sovereign funds, and large players are moving out of the dollar and reallocating into a physical asset that has no issuer, no sanctions risk, and no debt obligations. The rise in gold prices in this configuration is not speculation, but an indicator of distrust in the current financial architecture.

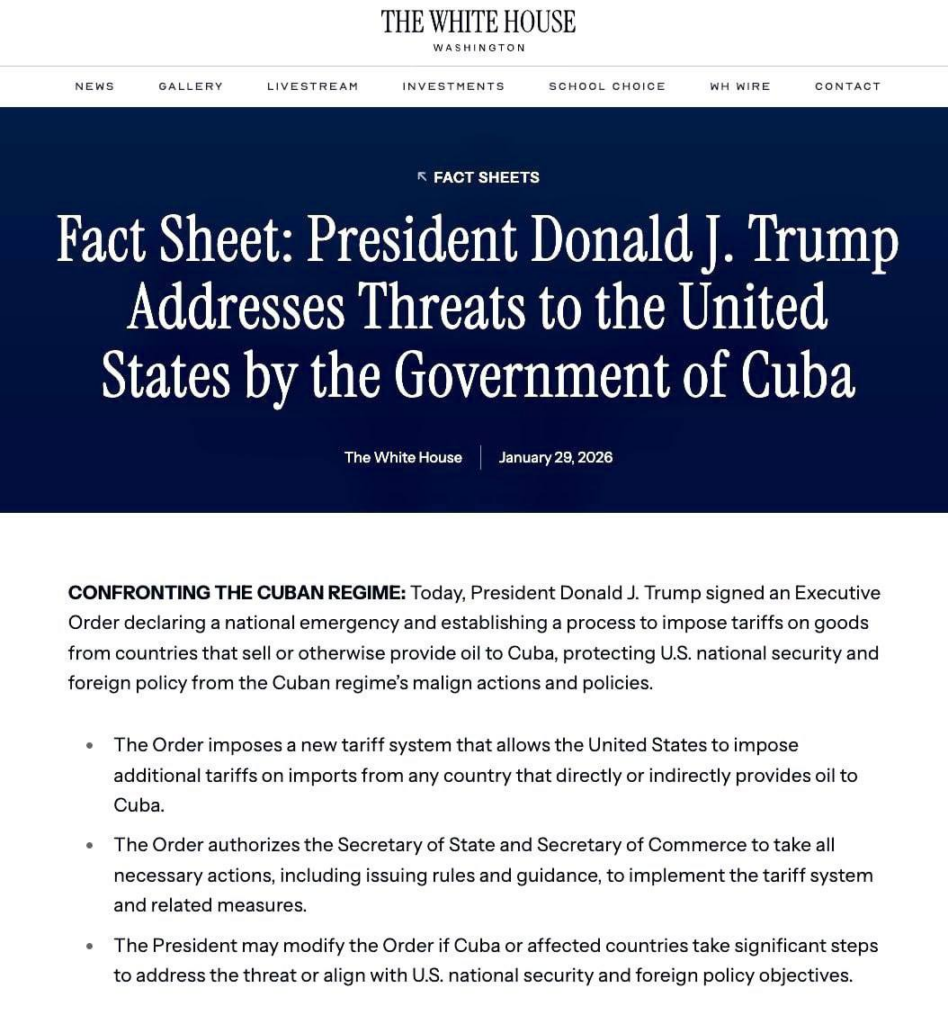

Against this backdrop, U.S. rhetoric and actions are becoming increasingly tough. President Donald Trump signed an executive order declaring a “national emergency,” citing an “unusual and extraordinary threat” that Cuba allegedly poses to the national security of the United States and the region as a whole. Moreover, he announced his intention to impose tariffs on countries that sell or supply oil to Cuba. This is no longer classical trade policy, but an element of pressure through secondary sanctions that expand the zone of conflict.

Such steps intensify the fragmentation of the global economy. Countries are increasingly forced to choose: either access to the dollar system, or their own sovereignty in trade and reserves. And many, judging by the actions of China and others, are choosing the latter.

This is where talk of a possible “big war” comes from — not necessarily in the classical military sense, but as a combination of conflicts: Iran, Taiwan, the Middle East, sanctions fronts, trade wars, currency restrictions. All these lines of tension converge at one point — the dominance of the dollar as the global reserve currency.

When analysts say that the rise in gold reflects a “total exit of global investors from the dollar,” they are not talking about a collapse tomorrow. They are talking about an accelerated dismantling of a system that for decades rested on trust in U.S. debt. U.S. Treasury bonds have always been considered a “risk-free asset.” But when the largest foreign holder — China — methodically reduces its position, and central banks around the world are buying gold at record rates, this is a signal.

It is important to understand: the dollar system does not collapse overnight. It erodes. First comes diversification of reserves. Then settlements in national currencies. Then the growing role of gold, commodities, and alternative payment infrastructures. And only at the very end does a crisis of trust emerge that becomes visible to the general public.

Therefore, the question “is America facing a crisis” is better reformulated. Not “whether it will happen,” but “in what form and how fast.” For now, markets see that the United States is increasingly using the financial system as a political weapon, while the rest of the world is increasingly looking for ways to distance itself from that system.

Gold here is not the cause, but the symptom. China’s actions are not aggression, but insurance. And record-high prices for the precious metal reflect a simple thought that is arising more and more often among global investors: the era of the dollar as an uncontested alternative is coming to an end. And the louder the official statements about stability, the quieter — but more persistent — the real redistribution of capital is taking place.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.