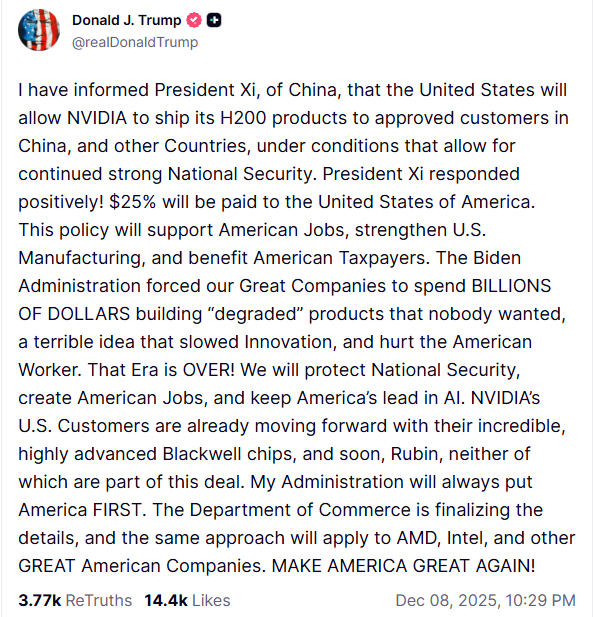

Nvidia is once again in the spotlight: the company has received permission to sell its H200 chips in China. This event is already being called one of the key technological turns of the end of the year. The Trump administration has officially given the green light for H200 deliveries to so-called “approved clients”, which automatically opens access for Nvidia to the largest and fastest-growing artificial intelligence market. For a company that has long been under pressure from strict export restrictions, this step looks not just like a loosening, but a strategic breakthrough.

The Chinese market remains the main driver of global investments in AI infrastructure. After the H20 model failed to meet expectations, Nvidia was in urgent need of a product capable of regaining market share in the region. The permission to sell the H200 effectively creates a new window of opportunity. The official restrictions have not disappeared: premium architectures Blackwell and Rubin remain prohibited, meaning that Chinese customers’ access to the most advanced technologies is still blocked. But even within the limits of restrictions, the H200 remains a product that can bring the company multi-billion-dollar revenue.

It is important to consider that Nvidia will not be operating in a vacuum. Competitors AMD and Intel have received similar licenses, which means the market is entering a phase of open competition for Chinese contracts. TSMC also benefits, since increased chip production for U.S. and Chinese orders directly boosts the load on its factories. The global AI ecosystem is receiving another powerful impulse, and suppliers of computing infrastructure will have to work at full capacity.

The market reacted immediately. Nvidia’s shares showed growth and approached important technical levels. This is a signal that investors see the approval as a positive catalyst. Nevertheless, it should be remembered that sales to China are subject to an additional charge of about 25 percent, and there are regulatory clarifications that may smooth out the initial impact on profitability. Investors should take into account that each such move by the U.S. is accompanied by a complex system of conditions.

The conclusion is simple but strategically significant. Nvidia continues to strengthen its position as the leader of the global AI revolution despite geopolitical turbulence. For long-term investors this looks like an opportunity, although the strategy of buying on pullbacks still remains more balanced. The administration itself emphasizes that the deal is intended to simultaneously strengthen jobs in the U.S. and ensure national security, which means such decisions will continue to remain under strict control.

In 2026, the artificial intelligence market may enter a phase of major deals, production capacity expansion, and new technological records. Nvidia appears to intend to stay one step ahead of the others.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.