The question of whether it is possible to “guess” a private key to someone else’s Bitcoin address regularly resurfaces amid price rallies and myths about hacks. The short answer is simple and boring: the probability is practically zero. Not “very small,” but so close to zero that it can be ignored in the real world.

Bitcoin uses elliptic curve cryptography. A private key is a number in the range of roughly 1 to 2^256. This is not just a large number – it is an astronomically vast space of possible values. The total number of private keys is comparable to the number of atoms in the universe multiplied by billions. Even if you harnessed all existing and future computers of humanity and forced them to brute-force keys nonstop since the Big Bang, the odds would still be negligible.

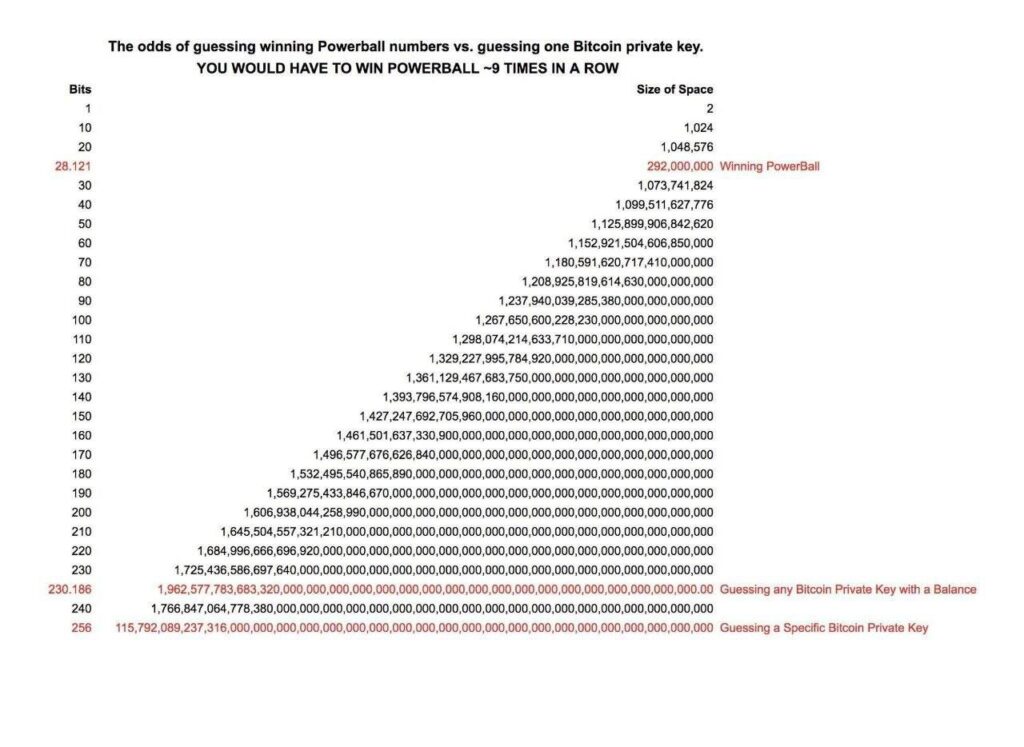

Analysts at The Smarter Web tried to explain this in human terms and offered a comparison that sounds almost mocking. The probability of randomly guessing the private key to a specific Bitcoin address is comparable to winning the lottery eight times in a row, and then repeating that feat another 292 million times in a row. This is not a colorful metaphor, but an attempt to visualize the scale of the probability.

It is important to distinguish between theoretical and practical possibility. Theoretically, brute-forcing keys is possible because the space is finite. Practically, it is unattainable. Even the most powerful modern supercomputers can check only a tiny fraction of possible keys. With each additional bit of security, complexity doubles, and here we are talking about 256 bits. This level of protection is excessive even by the standards of government-grade cryptographic systems.

This leads to an important conclusion: real-world Bitcoin wallet hacks are almost never the result of key guessing. Funds are lost not because someone “guessed” a private key, but because of human error. Phishing, malware, leaked seed phrases, storing keys in the cloud, weak passwords, trusting dubious services – these are the real sources of risk. Bitcoin’s cryptography remains one of the most reliable elements of the entire system.

Sometimes the argument of quantum computers comes up. Yes, in theory, a sufficiently powerful quantum computer could change the rules of the game. In practice, such machines do not exist, and before they do, Bitcoin and other blockchain systems have time to migrate to quantum-resistant algorithms. This would not be a sudden catastrophe, but an evolutionary process that the crypto community is closely monitoring.

In short, the picture is clear. Guessing a private key to someone else’s Bitcoin address is not a strategy, not a threat, and not a “hidden risk,” but a mathematical abstraction. The probability is so small that it is outweighed by virtually every other risk, from user mistakes to simply losing access to one’s own wallet. If someone seriously talks about key guessing, they either do not understand the scale of the numbers involved or are selling the illusion of easy money. And the market, as we know, is ruthless toward such illusions.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.