? Tesla shareholders have officially approved a new compensation package for CEO Elon Musk, which, upon meeting certain conditions, could earn him up to $1 trillion in company stock (as we mentioned earlier).

This is likely the largest compensation program in corporate history. The decision is significant not only for Tesla itself but also for the entire tech innovation industry.

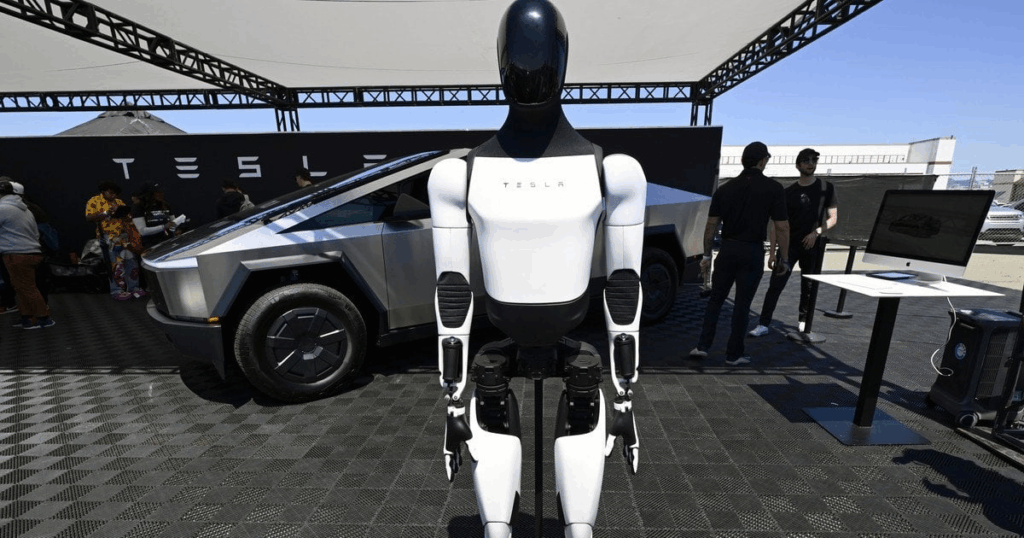

According to the company, over 75% of shareholders supported the initiative, confirming their trust in Musk as a strategic leader and visionary. Appearing at the shareholders’ meeting surrounded by Optimus robots, Musk declared:

“Tesla is not just entering a new chapter. We’re starting an entirely new book.”

How the new compensation package works

Under the terms of the agreement, Musk will not receive a fixed salary or bonuses. His income depends entirely on the company’s performance — profitability, margins, and market capitalization. The package is divided into 12 tranches, each triggered when specific targets are met.

To receive the full amount, Tesla must raise its market capitalization from the current $1.5 trillion to $8.5 trillion within the next ten years. Analysts note that such growth will require not just scaling production but achieving a fundamental technological leap that takes Tesla far beyond the realm of car manufacturing.

Restoring trust and strengthening Musk’s influence

This decision is especially important after the Delaware court previously annulled Musk’s earlier $56 billion pay plan, citing a lack of transparency in the approval process. The new package is seen as a “restoration of trust” and an effort to solidify Musk’s position within the company.

Musk currently owns about 15% of Tesla’s stock and has openly stated his intention to increase his stake to 25% to maintain control over strategic decisions, including AI development.

Tesla builds the ‘Terafactory’ — the heart of the future

Alongside the compensation decision, Musk announced the construction of a massive factory to produce artificial intelligence chips, which he called the “Tesla Terafactory.”

According to Musk, the current supply from TSMC and Samsung is no longer sufficient to meet Tesla’s ambitions in AI, robotics, and autonomous driving.

“We’re not just building cars. We’re building the factory of the future — an ecosystem of machines that think, learn, and interact with one another. To make this a reality, we need our own chips, our own energy, and our own manufacturing,” Musk emphasized.

He noted that the factory will produce at least 100,000 semiconductor wafers per month, and the new chips will be three times more energy-efficient than Nvidia’s Blackwell models.

A video fragment of the presentation can be viewed on our Telegram channel.

Plans for Tesla’s own AI processors

Tesla is actively developing its fifth-generation AI processors — AI5 — with mass production expected in 2027. The next generation, AI6, according to Musk, will double performance by mid-2028.

These processors will form the core of Tesla’s autonomous driving, robotics, and internal AI systems. Musk also mentioned possible collaboration with Intel, saying the two sides “haven’t signed an agreement yet, but it’s probably worth discussing.”

What it means for the market

The shareholders’ decision and the simultaneous announcement of the “Terafactory” effectively cement Tesla’s status not just as an automaker but as a technology corporation comparable to Nvidia, Google, or Apple.

Analysts say the new compensation package represents Tesla’s transition into a phase of deep integration of artificial intelligence into its products and manufacturing processes.

? “If Tesla truly launches its own AI chip production, it will become not only the largest player in the EV market but also one of the pillars of the future AI infrastructure,” according to a report by Wedbush Securities.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.