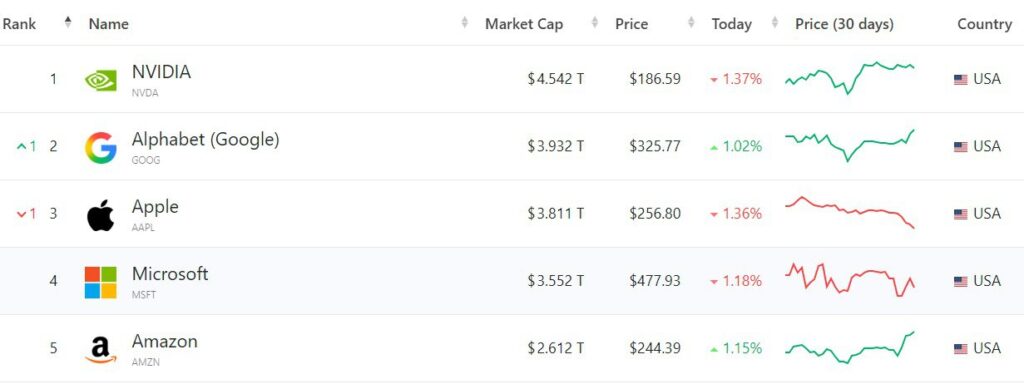

Google’s parent company, Alphabet, has, for the first time since January 2019, surpassed Apple in market capitalization, climbing to the second spot among the world’s most valuable publicly traded companies. This is reported by Barron’s, citing data from Dow Jones Market Data.

During trading on January 7, Alphabet shares rose by 2.2%, while Apple’s stock prices remained almost unchanged. As a result, Google’s market value reached an impressive $3.878 trillion, according to CNBC. In comparison, Apple’s market capitalization remained nearly the same that day, allowing Alphabet to secure the second position.

Over the past year, Alphabet’s market cap increased by 66%, one of the largest jumps among technology companies. The main factors behind this growth were the surge of investor interest in artificial intelligence, including the launch of Google’s new AI model Gemini, as well as a more lenient-than-expected antitrust decision regarding the company. These factors together created a strong boost to stock growth and reinforced Google’s market position.

In comparison, Apple’s shares grew only 9% in 2025, reflecting a more moderate, though steady, growth for a company that remains one of the most recognizable and profitable corporations in the world.

The most valuable publicly traded company remains Nvidia, with a market value exceeding $4.6 trillion. Alphabet’s breakthrough highlights an interesting market dynamic, where technology giants compete not only in innovation but also for investor attention and capitalization.

Overall, the top twenty largest global companies remain predominantly American: only four of the top twenty are non-U.S. companies.

These are TSMC from Taiwan (6th), Saudi Aramco from Saudi Arabia (9th), China’s Tencent (15th), and South Korea’s Samsung (17th). The remaining positions are held by major U.S. corporations, underscoring the dominant position of the United States in the technology sector and financial markets.

The situation demonstrates how critical the artificial intelligence market has become in valuing companies. Growing interest in AI and related products makes companies like Google attractive to institutional and private investors, while the release of new technologies, especially in AI and cloud services, directly impacts market capitalization.

Alphabet’s growth also illustrates how quickly leadership positions can change on the global technology stage. In recent years, Apple had long held second place after Amazon and Nvidia, but Google’s innovative breakthroughs and strategic decisions have allowed it to secure a strong position near the top of the ranking.

Conclusion: Alphabet is becoming not just a technology giant but a global center of influence, capable of shaping market directions and attracting massive investment flows. The competition between Google, Apple, and Nvidia demonstrates that today’s leadership in market capitalization is directly linked to innovation, regulatory decisions, and the ability to manage market attention, rather than merely historical achievements or brand recognition.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.