Goldman Sachs is once again reminding the market that the era when cryptocurrencies were exclusively the domain of enthusiasts and retail traders is firmly in the past. In its 13F report for Q4 2025, the bank disclosed that it holds digital assets worth over $2.36 billion. For an institutional giant of this scale, this is no longer an experiment or a “play for fun”; it is a fully integrated part of its investment strategy.

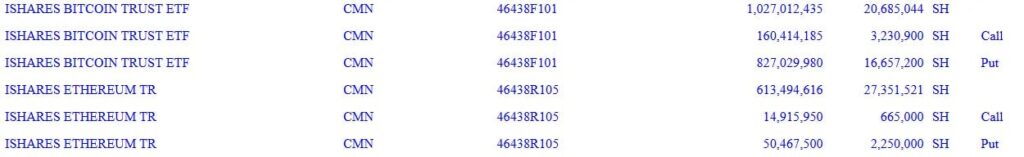

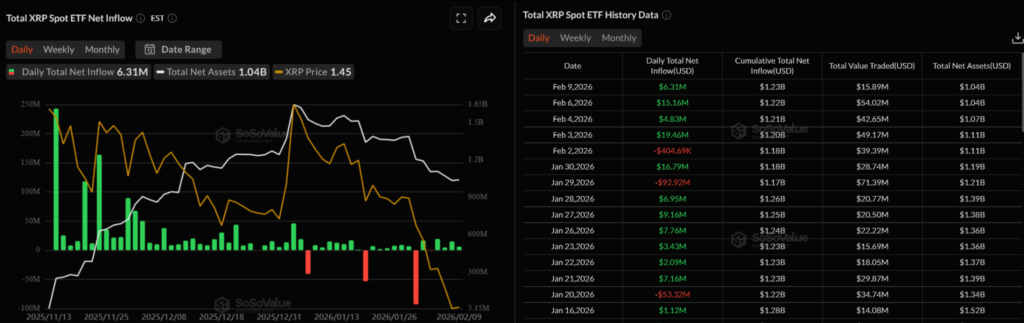

According to the document, the largest share is Bitcoin, approximately $1.1 billion. Another $1.0 billion is allocated to Ethereum. Additionally, the bank holds $153 million in XRP and $108 million in Solana. In total, cryptocurrency positions make up roughly 0.33% of Goldman Sachs’ reported portfolio.

While this percentage may seem small, context matters: Goldman manages trillions of dollars, and even a third of a percent in such a system amounts to billions. This is no longer “dust in the corner” but a significant bet on the fact that digital assets are now part of the global financial landscape.

Equally interesting is how the bank holds these positions. Goldman Sachs does not buy tokens directly or store them in crypto wallets. All investments are made through spot ETFs. This is a crucial point, demonstrating an institutional approach: crypto is allowed in the portfolio only in the form of a regulated instrument embedded in the familiar stock market infrastructure.

In other words, Goldman participates in the growth of Bitcoin and Ethereum while staying within traditional rules: through exchange-traded funds, with reporting, custodians, and a transparent legal structure. It is a compromise between a new market and the old financial school, where crypto freedom always passes through a filter of control and regulation.

However, the report contains another important detail. In Q4, the bank reduced its crypto-ETF holdings by nearly 40%. At first glance, this may seem like a signal of waning interest, but in reality, it reflects portfolio rebalancing.

For major players, such moves are routine. Institutional investors rarely act on a “believe it or not” basis. They manage risk, lock in profits, reduce exposure during periods of uncertainty, and return when conditions become more favorable. For Goldman, crypto is not religion or hype; it is an asset that occupies space in the portfolio exactly to the extent justified by risk and return.

The distribution is also notable. In addition to the two main assets—BTC and ETH—the bank holds positions in XRP and Solana. This indicates that the institutional market is starting to look beyond “digital gold.” XRP is often seen as a bet on payment infrastructure, Solana as a bet on high-performance blockchain systems and the future of applications. In this way, Goldman, even through ETFs, builds a portfolio reflecting different scenarios for the crypto economy.

The mere appearance of such figures in the reporting of one of the world’s largest banks is a significant marker. Just a few years ago, Wall Street publicly approached cryptocurrencies with irony and caution. Today, billions of dollars in Bitcoin and Ethereum are part of official filings.

This does not mean Goldman has suddenly become a crypto evangelist. It does mean one thing: digital assets can no longer be ignored. Even if they account for only 0.33% of the portfolio, they are already present in the system.

This is typically how institutional adoption begins: first the share is small, then it becomes normalized, and eventually the market quietly discovers that crypto is already integrated into the financial order—through ETFs, without revolutions, but irreversibly.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.