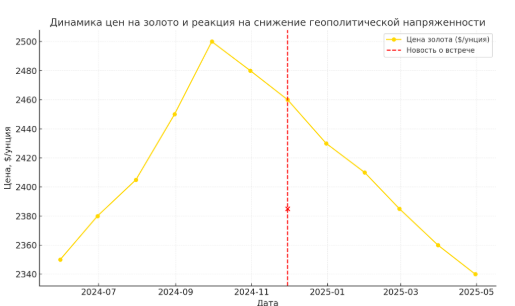

? Geopolitical tensions easing reduce demand for gold as a safe-haven asset

In recent weeks, global financial markets have seen a moderate decline in investor interest in gold (by the way, we write about gold quite often).

One key reason is the news of a potential meeting between US and Russian representatives, perceived as a signal for easing geopolitical tensions.

Traditionally, gold is viewed as a so-called “safe haven” for capital — an instrument investors choose during times of uncertainty, conflict, or market instability.

When risks rise, demand for this precious metal grows, pushing prices up.

However, when markets begin to price in scenarios of diplomatic dialogue and resolution of tense issues, the motivation to hold large amounts of gold weakens. Investors shift their attention to higher-yield, riskier assets — stocks, corporate bonds, or currency instruments.

Fundamental economic factors also play a role. In the coming days, investors eagerly await inflation data from the US. High inflation readings traditionally boost demand for gold as protection against currency depreciation. Yet, if inflation surpasses expectations, it may strengthen the dollar and increase the likelihood of Federal Reserve interest rate hikes, limiting gold’s growth. In short, it’s complicated: gold wants to be both inflation protection and dislikes an overly strong dollar.

Analysts believe such fluctuations in gold demand are short-term and directly dependent on the news flow.

? However, if pressure on the dollar continues, support for gold will be limited — a strong dollar makes gold more expensive for holders of other currencies. Still, there is a high likelihood that gold will maintain its “safe haven” status and gain momentum at the first sign of instability.

Investors remember: gold is not just a metal but an ancient beacon of stability in a sea of financial storms.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.