? The global financial system is increasingly at the center of events that are hard to predict and even harder to control. Tools that for decades were considered reliable are no longer delivering the same results. Unsurprisingly, talk of an impending crisis is growing louder, with both cutting-edge technologies and time-tested solutions on the agenda.

On the one hand, traditional finance (TradFi) is actively adopting digital currencies, tokenized assets, and blockchain platforms. On the other, there is a persistent push to return to older mechanisms. One of them is gold monetization — converting a state’s gold reserves into liquid funds without selling them.

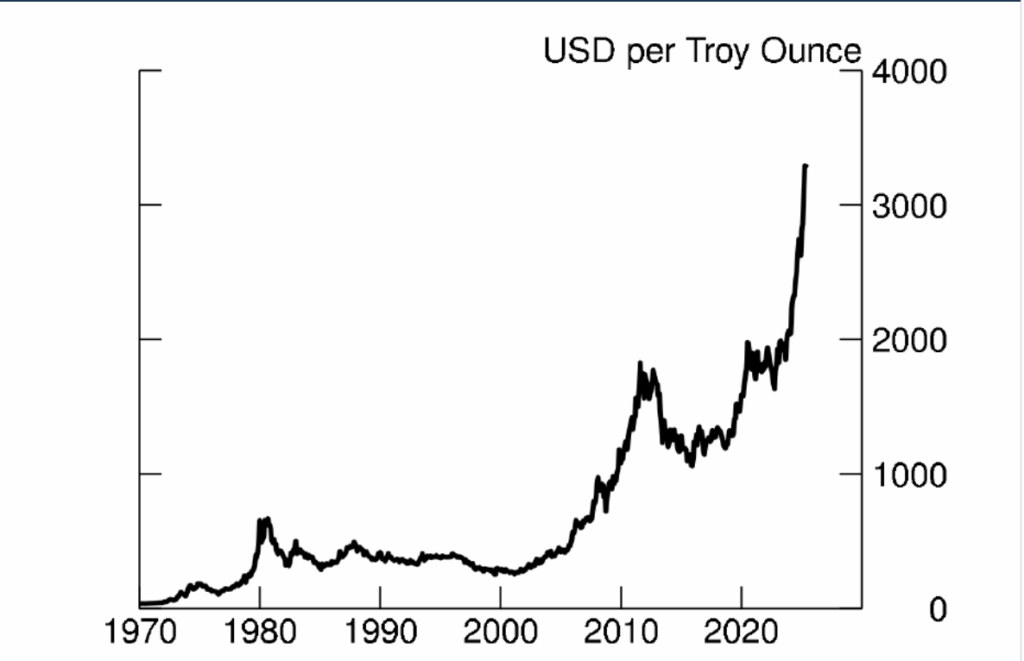

Gold at Half-Century-Old Prices

In the US, gold is still officially valued at $42 per ounce — a standard set in 1973. Today, its real market value exceeds $3,300. What drives gold prices?

On August 1, the Federal Reserve published an analysis of international experiences in revaluing gold reserves. Colin Weiss, the author of the study, noted that in the past three decades, similar steps were taken by Germany, Italy, Lebanon, Curaçao and Sint Maarten, and South Africa.

According to his estimates, if the US revalued its 261.5 million ounces of gold, the budget could gain around $900 billion — roughly 3% of GDP — without actually selling the metal.

How Monetization Works

The mechanism is straightforward: the Treasury issues gold certificates at the new price and transfers them to the Federal Reserve, which credits dollars to the government’s account in return. Formally, this money is backed by gold, but in reality, it is created through the asset’s revaluation. There is no need to increase debt — on the contrary, the proceeds can be used to reduce it or buy back bonds.

History knows examples where this tool has already been used:

- 1933 — Franklin Roosevelt confiscated gold from the public and raised its price from $20.67 to $35 per ounce, which brought significant profit to the budget and expanded the money supply.

- 1971–1973 — after abolishing the gold standard, Richard Nixon and the Treasury raised the price to $42.22 per ounce. This allowed about $800 million to be injected into the economy without selling the metal.

However, as experience from Lebanon and South Africa shows, such measures do not solve deep-rooted problems and do not always yield sustainable results.

Why the Idea is Back

In February 2025, Financial Times reported that the topic of gold monetization was being discussed at the highest levels. Macro strategist Luke Gromen suggested that revaluing gold to $20,000 per ounce could pave the way for issuing up to $5 trillion. According to his calculations, this would reduce the debt-to-GDP ratio from about 122% to 70%.

Luke Gromen emphasized that this scenario is not a fantasy but a “real option, explicitly stated in the Federal Reserve’s documents.” As confirmation, he quoted:

“The Secretary of the Treasury is authorized to issue gold certificates to Federal Reserve Banks for the monetization of gold owned by the Treasury.”

In February, speculation was further fueled by US Treasury Secretary Scott Bessent, who said the government intends to “monetize part of the US balance sheet assets for the American people.”

In the summer, the idea gained support within Donald Trump’s circle. Digital assets adviser Bo Hines stated that the difference between the old and new certificate prices could be the “best way” to build a strategic Bitcoin reserve. Senator Cynthia Lummis had earlier proposed using gold revaluation specifically for these purposes.

On July 10, investor George Gammon suggested in his podcast that amid macroeconomic instability and the policies of US President Donald Trump, the likelihood of gold being revalued to market levels is increasing day by day.

Possible Consequences

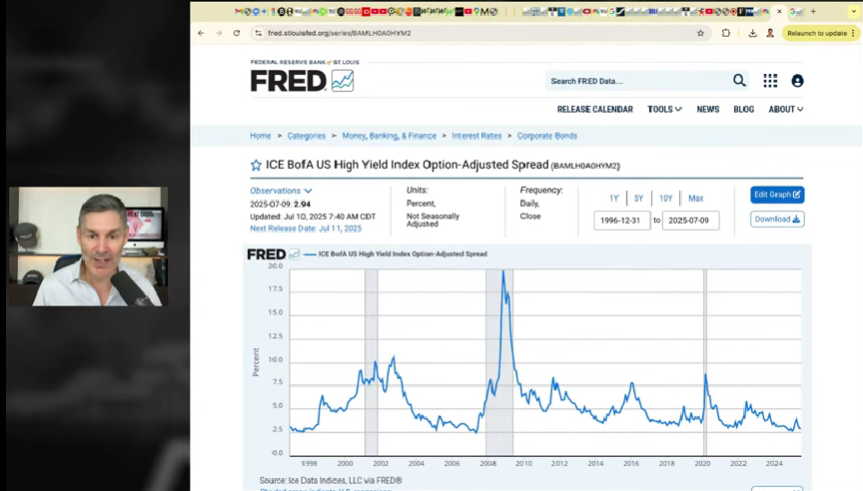

If the gold monetization scenario is implemented, we could expect:

- higher inflation;

- reduced trust in the US dollar;

- capital outflows;

- a persistent budget deficit.

For the cryptocurrency market, this could instead be a stimulus: with fiat weakening, investors would seek alternatives, and Bitcoin could strengthen its position as a new reserve asset.

? However, the emergence of large institutional players and governments carries risks for the very concept of Bitcoin — from tighter regulation to restrictions on its freedom of use. As a result, the first cryptocurrency may gradually lose its status as an independent asset and become an instrument integrated into the traditional financial system.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.