S&P 500 futures continue to decline, losing another roughly 1%, and the crypto market, as often happens, is dutifully following along. Risk appetite is shrinking, money is flowing out of anything that looks even slightly volatile, and this is now visible not only in individual assets but in overall market sentiment. Indices are falling without panic, but persistently, as if reminding everyone that “quick and painless” was never promised this time.

The most unpleasant moment of the day is Bitcoin’s behavior. BTC has broken below its local upward trend, which had held the market back from a deeper correction for several weeks. From a technical perspective, this opens the door to a test of the $90k area, and if pressure intensifies, even the $87k zone. That is where traders’ attention is currently focused: these are not just round numbers, but areas where previous volumes and buyers’ expectations converge. If they fail to hold, the market could remain stuck for a long time in a mode of cautious decline and nervous bounces.

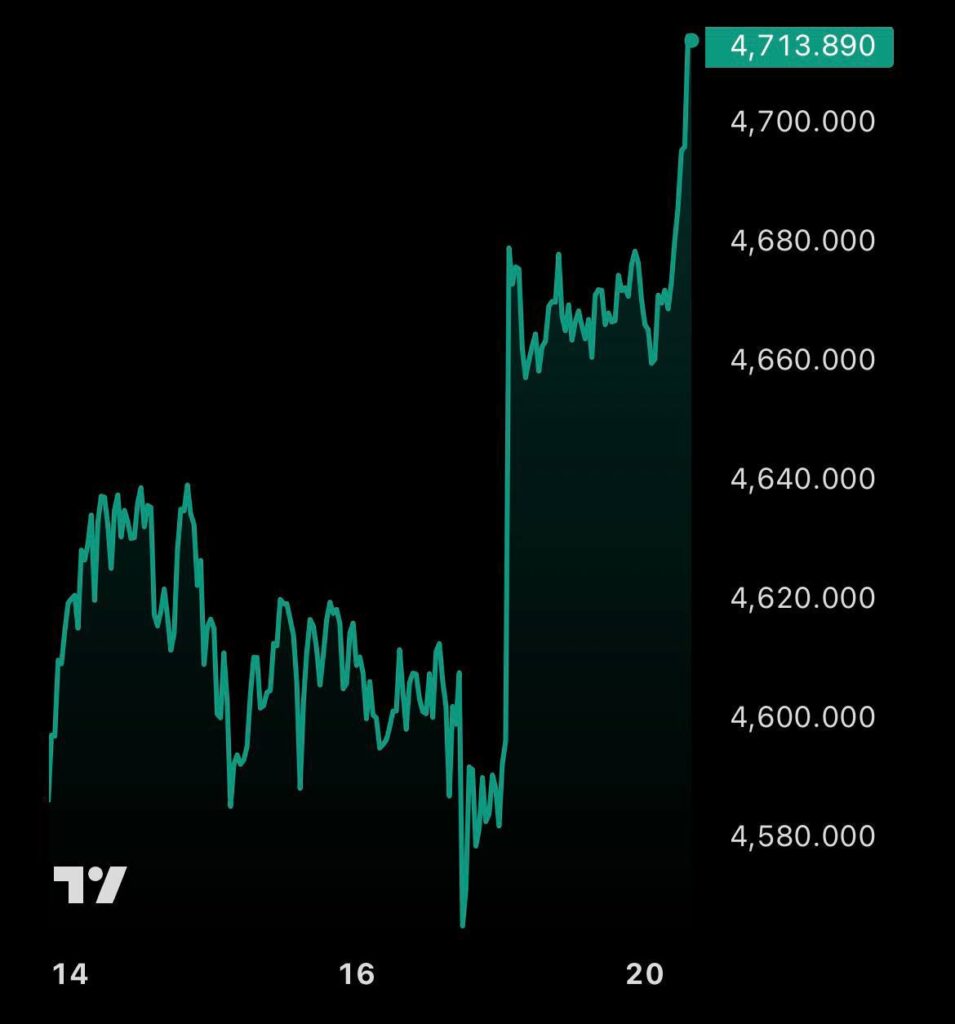

Against this backdrop, defensive assets feel confident — perhaps too confident. Gold continues to set new all-time highs and has firmly established itself above $4,700 per ounce. Silver is following the same path and is trading around $94. Such a divergence between equities and precious metals is a direct indicator that markets are pricing in rising uncertainty, rather than a temporary “cool-off” correction.

Investors are increasingly focused on political factors. News from Davos and discussions related to Greenland and trade relations are in the spotlight. An additional source of tension remains US tariffs against the EU, which are scheduled to take effect on February 1. A significant portion of current expectations is built around this date. The main hope for bulls is a rapid de-escalation of tensions, partial or full cancellation of tariffs, and a return of demand for equities and cryptocurrencies. For now, this looks more like an “if we’re lucky” scenario than a base case.

Separately, the market is digesting fiscal figures from the United States. Donald Trump set a new record by increasing government debt by $2.25 trillion in his first year in office. The reaction in the bond market was quite telling: yields on 10-year Treasuries have returned to around 4.26%. This is not a signal of panic, but of growing distrust in the long-term sustainability of the US financial model. Investors are demanding a higher risk premium, and they are doing so calmly, without hysteria — which is often the most worrying sign of all.

The paradox of the situation is that there is only one piece of good news: almost no one in the mainstream is paying much attention yet. There are no headlines about a “crash,” no mass exodus, no hysterical sell-offs. Which means the process of risk re-pricing may be prolonged and rather painful. Markets like to pretend everything is under control right up until the moment it becomes clear that the control was an illusion.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.