Do you remember how a few years ago virtual NFT images were sold for astronomical sums and were considered almost the future of all digital art? At the time, it seemed that non-fungible tokens (NFTs) were capable of transforming the very notion of collecting, investing, and even the cultural value of digital objects.

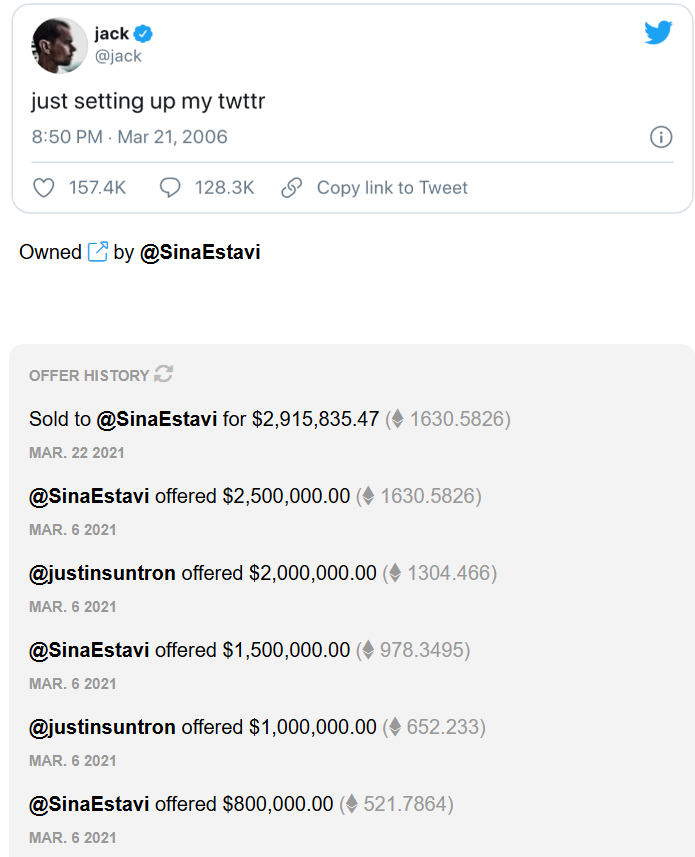

For example, in 2021, the first tweet by Twitter founder Jack Dorsey was sold for $2.9 million. The transaction was recorded on the auction platform Valuables. The buyer was Hakan Estavi, the CEO of Bridge Oracle.

This event became a symbol of the NFT boom: it seemed that the value of digital content could grow exponentially within just a few weeks. However, today this same NFT is trading for less than $10, clearly demonstrating the enormous volatility of the market and its high level of speculation.

Animoca Brands co-founder Yat Siu, who not only leads the company but is also a passionate NFT collector, noted an interesting phenomenon: despite falling prices, there is a significant community of token holders who purchase NFTs not for speculation or resale, but for the very fact of ownership, participation in digital culture, and support of a particular ecosystem. For these people, the token holds personal, cultural, or social value rather than purely financial value.

Nevertheless, the market that was once characterized by incredible activity and massive trading volumes is now in a state of stagnation. Most NFTs are valued at only a fraction of their peak levels from 2021 and 2022. The “bubble” effect that fueled the hype has gradually faded. The decline in activity was so pronounced that one of the key industry events — NFT Paris, a flagship exhibition in France dedicated to NFTs and digital art — was canceled just one month before its scheduled opening, becoming an alarming signal for the entire community.

Yat Siu emphasizes that NFTs are in a state of stagnation, but by no means dead. Despite the decline in speculative activity and the correction in prices, interest in NFTs remains. Companies such as Animoca Brands continue to develop the Web3 ecosystem, launch new projects focused on the tokenization of real-world assets, integrate blockchain into games and digital collectibles, and support communities of collectors and investors for whom NFTs remain a means of expression, participation, and ownership of a part of digital culture.

In other words, NFTs have already moved beyond being merely a “fashionable speculative toy” and have become part of a more mature, though still evolving, digital and cultural landscape, where the value of a token is determined not only by money, but also by its significance to the community, the project’s history, and the uniqueness of the digital object itself. Market stagnation is a natural stage after rapid growth, a filter that separates projects with real value and long-term potential from short-lived hype-driven spikes.

NFTs have survived the first years of explosive growth and are now entering a phase of “maturation”, during which a core of sustainable communities, technological infrastructure, and new models of interaction with digital content are being formed. According to Siu, it is these factors that will ultimately determine which tokens retain their value and influence in the Web3 world.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.