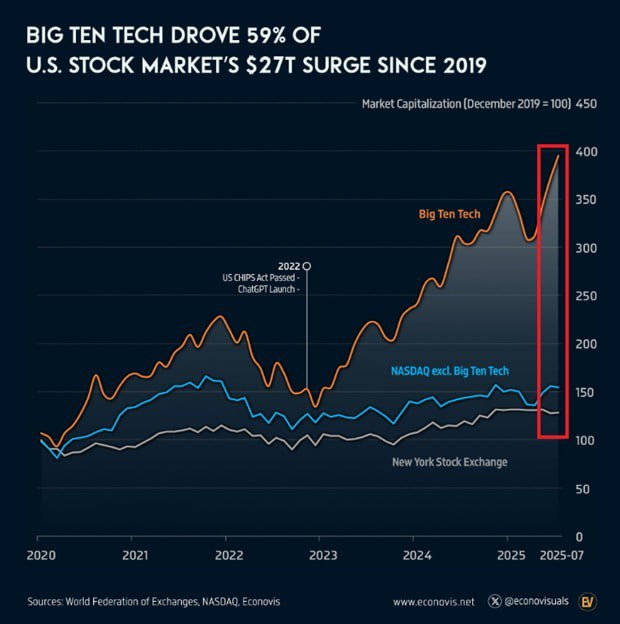

? Since 2019, the U.S. stock market has shown significant growth, but this growth has been highly concentrated. According to analysts, just ten companies have been the main drivers of the rally. These include tech giants such as Alphabet, Amazon, Apple, Broadcom, Meta, Microsoft, Netflix, Nvidia, Palantir, and Tesla.

The scale of their impact is remarkable.

The shares of these companies have risen by an average of +295% since 2019, contributing $16 trillion out of the $27 trillion total increase in the U.S. stock market capitalization. This means that the remaining thousands of companies together delivered only $11 trillion in growth – less than half of the overall increase.

This distribution highlights the extremely high market concentration: a small group of companies defines almost 60% of the entire index’s dynamics. In other words, the market depends heavily on the performance of these giants – primarily technology and innovation leaders that managed to sustain strong growth even amid global economic challenges.

What does it mean for investors?

- Concentration risk: investors relying on index funds should realize that indices like the S&P 500 or Nasdaq Composite are heavily driven by these ten companies. Any significant decline in their stock prices could drag down the entire index.

- Growth drivers – tech and innovation: most companies on the list are tied to technology, software, internet services, cloud platforms, AI, and electric vehicles. Their rise reflects the central role of technology in the global economy.

- Analogy with the crypto market: just like the stock market, the crypto market has its “top assets” that set the pace for the entire industry. The most notable example is Bitcoin (BTC). History shows that without strong growth in BTC, altcoins rarely experience broad upward momentum, as their capitalization and trends are tied to the leading cryptocurrency.

? Bottom line

The concentration of market growth around just ten companies illustrates a domino effect in financial markets: the leadership of a handful of assets shapes the overall trend, and without their support, growth becomes fragile.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.