The property of Google’s French subsidiary has been placed under arrest — and the situation is developing into a far more complex international legal knot than it may appear at first glance. A Paris court issued an order to freeze 100% of the shares of Google France in preparation for the review of a claim by Google’s Russian “daughter” (LLC “Google”), which is attempting to recover dividends withdrawn shortly before its bankruptcy. The amount in question is €112 million — a substantial figure even by the standards of multinational corporations.

This measure was reported to RBC by Artur Zurabyan, partner at the law firm Art De Lex, representing the interests of the bankruptcy trustee of LLC “Google.” According to him, the court’s decision aims to prevent Google from attempting to change its corporate structure or initiate the bankruptcy of Google France to complicate the recovery. In other words, the French court “froze” the asset to prevent any sudden moves.

The legal background dates back to July 2024, when the bankruptcy trustee Valery Talyarovsky applied to the Moscow Arbitration Court to declare invalid the dividend payment to Google International LLC. The court agreed with the arguments, finding that the transaction was carried out to evade repayment to creditors. The disputed dividends amounted to €112 million, approximately equivalent to 10 billion rubles.

However, this is only part of a larger dispute: according to Zurabyan, the bankruptcy case also challenges the transfer of funds from Russia after 2018 totaling over 140 billion rubles (about €1.4 billion). Since Google no longer has assets in Russia, recovery is carried out through foreign jurisdictions — something Russia has been handling fairly consistently in recent months.

The next key stage will be the Paris court’s substantive review of the Russian “daughter’s” claim. If the court satisfies the claims, the seized property of Google France will be used to settle debts with Russian creditors. That is when the most interesting part begins: France will become the first major European country where a Russian ruling is effectively transformed into financial recovery from a global corporation.

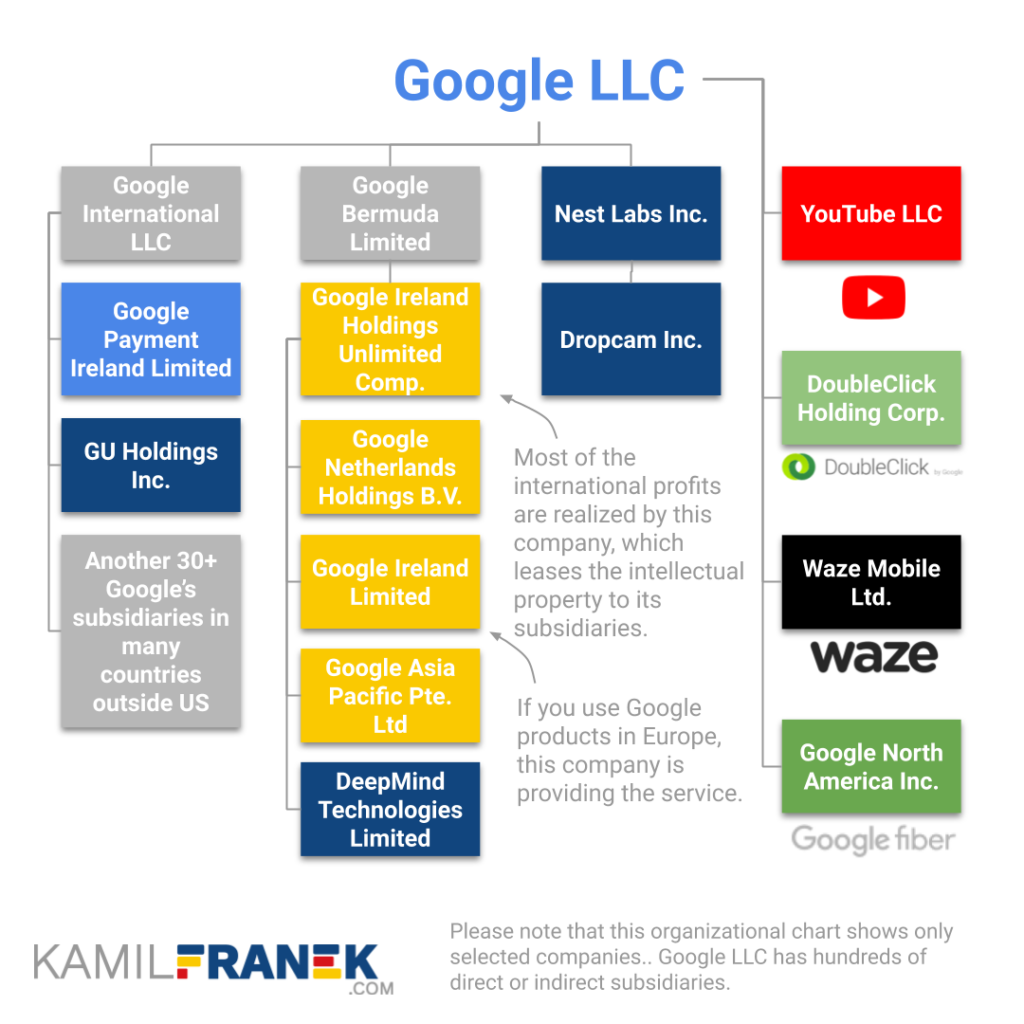

It is worth noting that Google France is the sole shareholder of Google International LLC. The French entity is responsible for selling and reselling Google advertising services in Europe, effectively serving as the corporation’s European “crossroad” for advertising flows. In 2024, its domestic revenue amounted to €1.31 billion, with export sales totaling an additional €434.7 million.

RBC has already sent inquiries to the court and Google France’s press service, but there are no comments yet — the corporation seems to prefer not to rush in responding to such sensitive decisions.

It should be noted: the arrest in France is not the first instance where courts in other countries support the enforcement of Russian arbitration rulings. In May 2025, the Supreme Court of South Africa made a similar decision, freezing Google LLC’s property within the country. Overall, the Russian “daughter” is seeking recognition of court rulings for the recovery of funds in over ten foreign jurisdictions, and the geographic scope of these proceedings continues to expand.

Thus, the Google story is turning into a kind of international marathon: here an arrest, there hearings, somewhere attempts at appeals. And although the corporation is accustomed to being a cumbersome iceberg that even larger icebergs do not touch, this time the ice is beginning to crack around the perimeter in several countries at once.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.