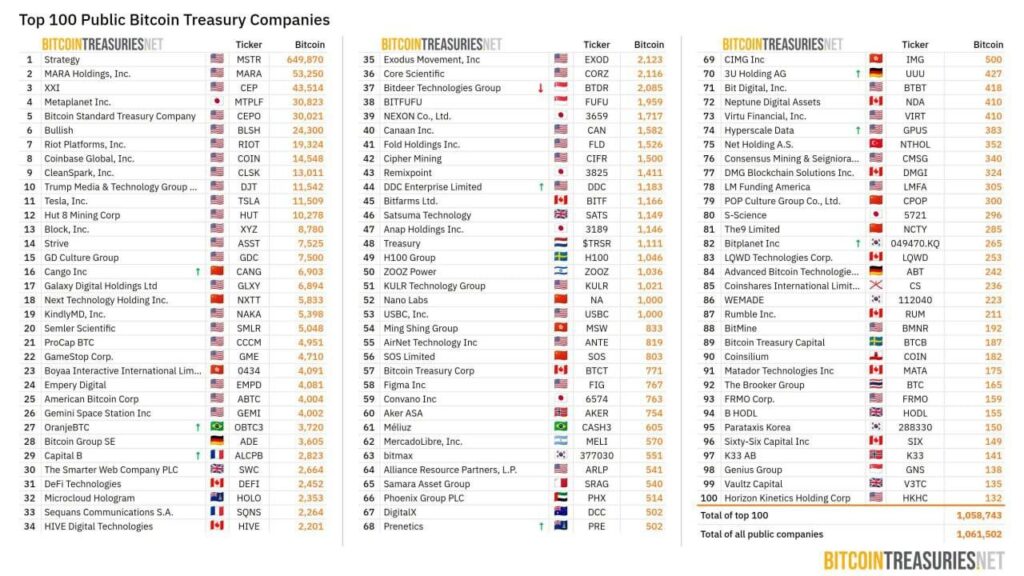

The largest public companies holding bitcoin treasuries (as of November 30, 2025)

Every year, the corporate map of bitcoin holders becomes more interesting: if earlier BTC on the balance sheet was considered almost exotic, now it is turning into a full-fledged strategic asset for hundreds of public companies around the world.

The Bitcoin 100 ranking shows who is betting on digital gold not in words, but at the level of corporate reporting.

At the top of the list, as always, dominate the giants for whom bitcoin has become not just part of capital, but a fundamental part of their financial strategy.

As of November 30, 2025, the total volume of BTC in the reserve funds of the 100 largest public companies reached an impressive 1,058,743 BTC. This is almost a state-level accumulation, comparable to the national gold reserves of small countries. In fact, the corporate sector has turned into an independent megawhale in the cryptocurrency market.

Dynamics over the last 7 days

The corporate bitcoin reserve market lives its own life – calling it calm would definitely be wrong. Over the week, the following happened:

8 companies increased their bitcoin holdings.

From small increases to significant additional purchases – companies continue to strengthen their digital reserves, reacting to the market, strategic plans, or corporate ambitions.

1 company reduced its position.

The reasons in such cases may vary – from asset rebalancing to covering expenses or shifting investment priorities.

This ratio clearly shows the overall trend: the corporate sector continues to accumulate bitcoin, and the desire to “sit on a barrel of BTC” is becoming increasingly widespread.

Why this ranking is important

- It shows institutional adoption of cryptocurrency.

- It demonstrates competition between corporations for a digital asset with limited issuance.

- It reflects the long-term strategy of global technological, financial, and industrial leaders.

- It allows assessing how large BTC holdings are distributed and who forms the real “wall of demand”.

Given bitcoin’s total market capitalization, such volumes in the hands of public companies often raise questions about future availability of free supply. In other words: corporate wallets are gradually turning into modern safes with digital ingots.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.