Today investors are closely watching several sectors at once — from artificial intelligence and infrastructure to the fashion industry, healthcare and space technologies. A number of stocks have approached technically important levels, making them especially interesting for those looking for entry points in an environment of increased market selectivity.

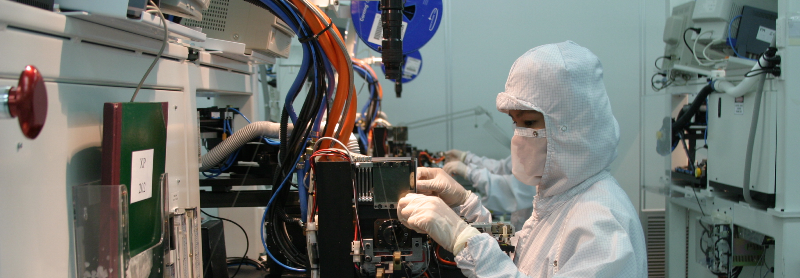

In the technology segment, Fabrinet (FN) stands out — a manufacturer of optical components and solutions for data centers and AI infrastructure. The company is showing strong momentum: in the fourth quarter, earnings per share grew by about 29%, while revenue increased by 36%. The stock has broken out of an 11-week formation, technically strengthening the signal for a continuation of the move. If growth rates are maintained, the upside potential is estimated in the 531–580 range, although much will depend on overall demand for AI and telecom infrastructure equipment.

In the more defensive segment, American Healthcare REIT (AHR) attracts attention. This is a real estate investment trust focused on healthcare properties — clinics, medical centers and long-term care facilities. Against the backdrop of an aging population and steady demand for medical services, the business appears structurally stable. The stock is trading near the 51–53.6 zone, and a dividend yield of about 1.9% adds attractiveness for conservative investors. The ближайший growth target is 55–56, provided that stable cash flow is maintained.

In the consumer sector, attention is focused on Ralph Lauren (RL). The company has strengthened its position through effective marketing, premium brand positioning and more flexible logistics. A breakout above the 380 level has reinforced the technical picture. If positive momentum continues, a move toward the 410–435 range is possible. The fashion sector remains cyclical, but strong brands traditionally recover faster than the broader market.

In the infrastructure story, Construction Partners (ROAD) stands out. The company is involved in building factories, data centers and facilities related to AI infrastructure development. A new technical “handle” around 141.9 forms a potential entry point. The backlog exceeds $3 billion, providing visibility into future revenues. If the infrastructure boom continues, targets in the 155–160 range appear achievable, although volatility in the construction sector is traditionally above average.

Finally, for investors oriented toward more aggressive ideas, Planet Labs (PL) is of interest. The company operates in the field of commercial satellite data, working with government and corporate clients. The stock is holding support at its 10-week moving average, and relative strength remains high, but the business is still unprofitable. The upside potential is estimated around 28–30, yet this is a higher-risk story that largely depends on scaling its contract base.

Overall, among the presented ideas, Fabrinet and Construction Partners appear to be growth leaders focused on infrastructure and the AI trend. Ralph Lauren and American Healthcare REIT offer a more balanced profile supported by sustainable business models. Planet Labs remains a speculative story with high potential, but also with corresponding risks.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.