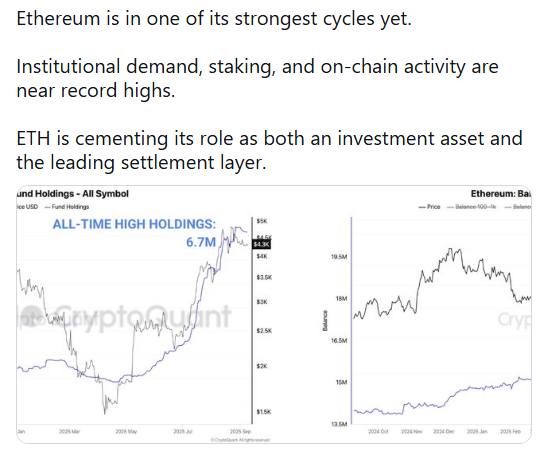

? CryptoQuant analysts state that the Ethereum blockchain is in its historically most powerful phase of development. According to them, this surge is driven by several factors at once — high institutional demand, large-scale staking, and record on-chain activity.

Ethereum is gradually solidifying its status as one of the key assets in the global financial market. According to CryptoQuant data, in September 2025, the network shows multiple historical highs. Institutional funds have doubled their Ethereum reserves since April 2025, bringing them to 6.5 million ETH, while large holders with balances from 10,000 to 100,000 ETH now control over 20 million coins.

“This increase in institutional participation confirms high interest in the network, but a significant portion of ‘smart money’ is already in play, leaving limited room for short-term growth,” experts note

Another record is the number of coins locked in staking — 36.15 million ETH. This reduces circulating supply and increases trust among market participants. Daily smart contract calls exceeded 12 million, confirming Ethereum’s leadership as the “programmable layer” of the modern financial system. Recently, the staking queue surpassed $3.6 billion, setting a new record.

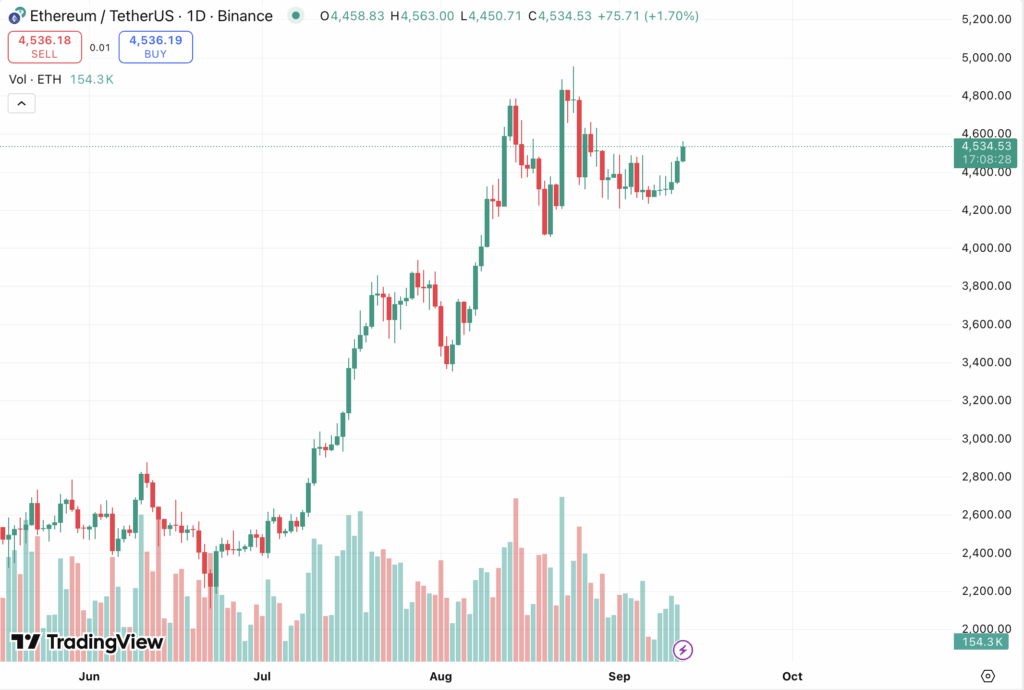

Regarding price action, Ethereum recently reached nearly $5000 and paused at the historical resistance level around $5200. The declining inflow of ETH to exchanges indicates reduced selling pressure, positively affecting the asset’s stability.

On August 24, 2025, Ethereum set a new all-time high on Binance at $4956, after which the price corrected and currently trades at $4534. Analysts pointed to a consolidation period around $4400 as a potential support before the next growth phase

Daily chart of ETH/USDT on Binance. Source: TradingView.

Institutional interest is also confirmed by recent major transactions. BitMine purchased 46,255 ETH for over $201 million, bringing its holdings to 2.126 million ETH valued at $9.24 billion, making it the largest corporate Ethereum holder.

Strategic vision from industry leaders plays a key role. Consensys founder Joseph Lubin believes Ethereum can become the foundation of the future financial system. Widespread adoption on Wall Street could increase the coin’s value hundreds of times and potentially rival Bitcoin as a base digital asset.

? CryptoQuant experts emphasize that despite recent corrections and declining exchange reserves, demand for Ethereum remains high. All of this makes the current Ethereum development cycle one of the strongest and most promising in blockchain history.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.