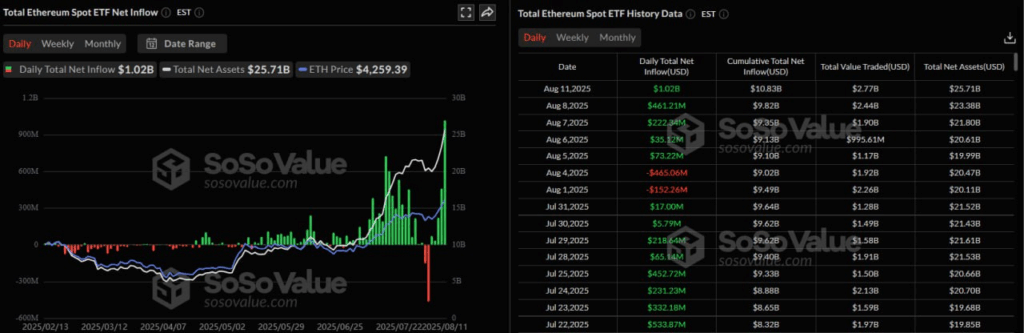

? In the past 24 hours, spot Ethereum ETFs have received over $1 billion, marking a historic record for instruments based on the second-largest cryptocurrency by market capitalization.

This surge likely comes as Ethereum (ETH) recently broke above the psychologically important $4,000 level for the first time since December 2024.

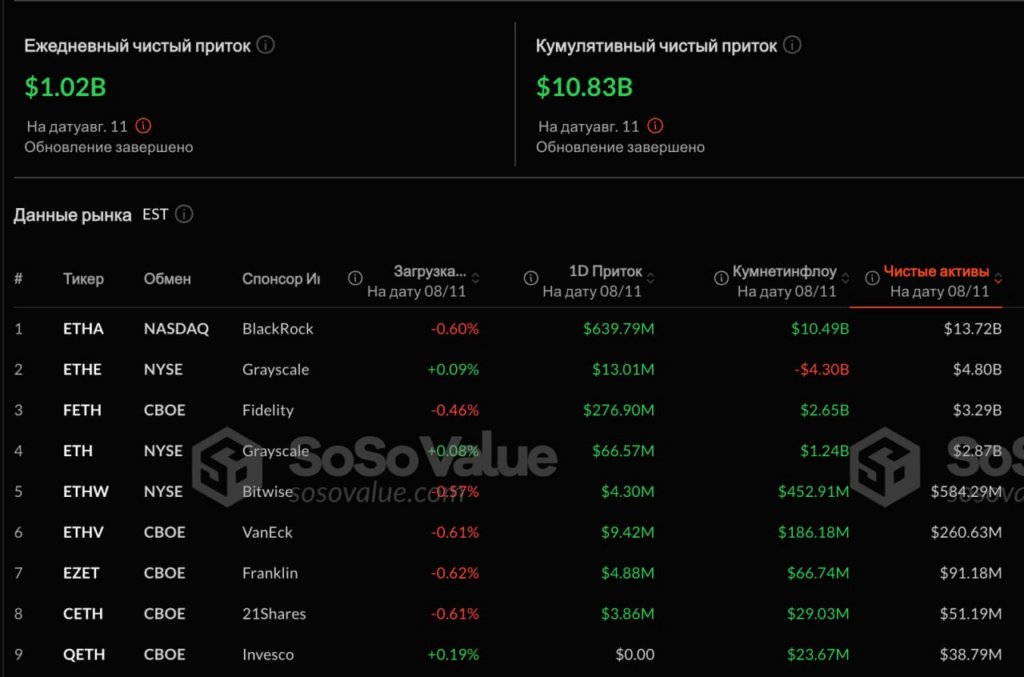

Leading the inflow was the ETHA fund from BlackRock. By the end of the latest trading session, total capital inflow into spot ETFs based on ether reached $1.02 billion.

The total assets under management of Ethereum ETFs now amount to $25.71 billion, equivalent to 4.77% of ETH’s total supply.

Nick Ruck, Director at LVRG Research, told The Block:

“Investors increasingly view Ethereum as a store of value and the foundational layer for decentralized finance and Web3 innovations. The demand reflects growing institutional confidence in ether’s long-term potential.”

? The record-breaking inflow into Ethereum ETFs could be an important signal for the entire crypto market, indicating ETH’s strengthening position in the eyes of both retail and institutional investors.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.