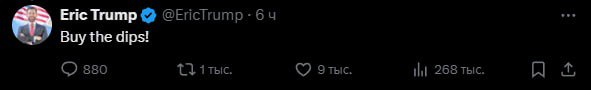

? On his X (formerly Twitter) page, he posted a brief message: “Buy the dips!”. This is a classic piece of advice traders often give when the market falls — “buy on the dips” — suggesting a good entry opportunity.

Pump

If investors take Eric’s advice seriously, we could see short-term gains. The crypto market is known for its volatility, and such statements can trigger rapid buying. However, it’s important to remember that these moves are often short-lived and can be speculative.

Dump

On the other hand, if the market doesn’t react to the advice or interprets it as a sell signal, prices may fall. Investors might see it as a sign of instability or uncertainty.

Sideways Movement

The market might remain in a sideways trend, without a clear move up or down. This could be due to the lack of new market-driving factors or participants waiting for additional signals before making decisions.

? Summary

Eric Trump’s “Buy the dips!” advice can be interpreted differently depending on market sentiment. It’s important to consider such recommendations in the context of the overall market situation and your own investment strategy.

Celebrity advice like Eric Trump’s can influence the market for several reasons, especially in the crypto industry:

Media & Hype Effect

When a well-known figure makes a statement, it draws attention from millions. Even a short tweet can spark discussions and media coverage, boosting market activity.

- People see “Buy the dips” and decide to buy, even if the technical picture doesn’t support it.

- This creates short-term price gains (pump).

Herd Behavior

Investors often follow the actions of others. If they see a famous person recommending buying:

- Some follow the crowd to not “miss out”;

- Others might sell, thinking the “market is inflated.”

Short-Term Speculation

Advice affects short-term trends, especially for liquid and volatile assets. Large traders sometimes use these signals to profit from price swings:

- Buying before the expected pump;

- Selling immediately after the rise to lock in gains.

Institutional and Algorithmic Reactions

Some funds and trading algorithms monitor social media and news for mentions of celebrities. Their actions can amplify the effect: algorithms may automatically buy/sell, increasing volatility.

Minimal Long-Term Effects

It’s important to understand that celebrity advice usually doesn’t affect an asset’s fundamentals:

- If the project is weak or the market is falling — meme tweets won’t help;

- If the asset is strong — a short-term pump may only accelerate the trend.

? Conclusion:

Advice primarily affects short-term price fluctuations and trader behavior, especially in crypto. For long-term investing, its impact is limited, but it can create opportunities for speculative gains.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.