☕ Dutch Bros (BROS) shows steady growth: seasonal offerings may boost stock performance

About the company

Dutch Bros is a fast-growing coffee chain with 1,043 locations across 19 U.S. states, known for its vibrant brand personality, energetic marketing campaigns, and consistent sales growth. The company is recognized for fresh beverages, attention to quality, and active engagement with a loyal audience, creating a “community” effect around the brand. In recent years, Dutch Bros has focused on menu expansion, innovative products, and seasonal offerings, positively impacting foot traffic and average checks.

New seasonal beverages

To boost sales during the fall, the chain introduces new flavors designed to attract both regular and new customers:

- Caramel Pumpkin Brulee — a harmonious blend of sweet caramel and pumpkin notes;

- Cookie Butter Latte — a creamy beverage with cookie flavor and smooth texture;

- Candied Cherry Rebel — based on the popular Rebel energy drink, with a cherry twist.

These new offerings emphasize the company’s strategy of regularly updating its menu to maintain customer interest and encourage repeat purchases.

Financial performance

Dutch Bros demonstrates strong fundamentals:

- Q2 2025: EPS of $0.26 (+37%), revenue up 28%;

- Average sales growth over the last 8 quarters is 31%, confirming the resilience of the business model and brand popularity;

- 2025 revenue forecast: $1.59–1.6B, same-store sales growth around 4.5%;

- Analysts expect EPS in 2026 to reach $0.88 (+30%), highlighting further growth potential.

Strong financials are driven not only by increased customer traffic and higher average checks but also by effective cost management, digital service implementation (mobile ordering, loyalty program), and smart marketing.

Technical stock analysis

Dutch Bros shares continue their upward trend, nearing a buy point of $77.88, a key signal for growth-focused investors. Technical indicators support the current trend:

- Shares have recovered the 50-day moving average, indicating a break above recent correction levels;

- Trading volume is increasing alongside rising prices, signaling institutional investor support;

- Relative Strength Line is recovering, confirming further upside potential.

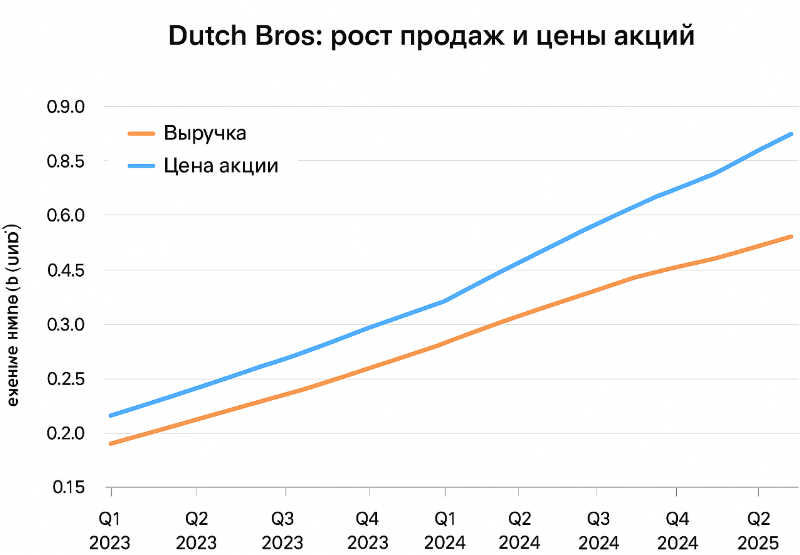

Dutch Bros Sales and Stock Price Growth (Q1 2023 – Q2 2025)

| Quarter | Revenue ($B) | Stock Price ($) |

|---|---|---|

| Q1 2023 | 0.38 | 55.2 |

| Q2 2023 | 0.40 | 58.7 |

| Q3 2023 | 0.41 | 61.5 |

| Q4 2023 | 0.44 | 63.8 |

| Q1 2024 | 0.48 | 66.1 |

| Q2 2024 | 0.50 | 68.3 |

| Q3 2024 | 0.52 | 70.5 |

| Q4 2024 | 0.55 | 72.8 |

| Q1 2025 | 0.58 | 75.0 |

| Q2 2025 | 0.60 | 77.2 |

Conclusion and outlook

Dutch Bros demonstrates steady growth from both fundamental and technical perspectives. New seasonal beverages sustain consumer interest and may drive additional foot traffic, positively impacting sales.

The stock remains in an upward trend, institutional investors continue accumulating positions, and financials show stability and potential for further profit growth. For short-term traders and growth-focused investors, monitoring the buy point and sales dynamics is crucial, as current market conditions provide opportunities to capitalize on a positive trend.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.