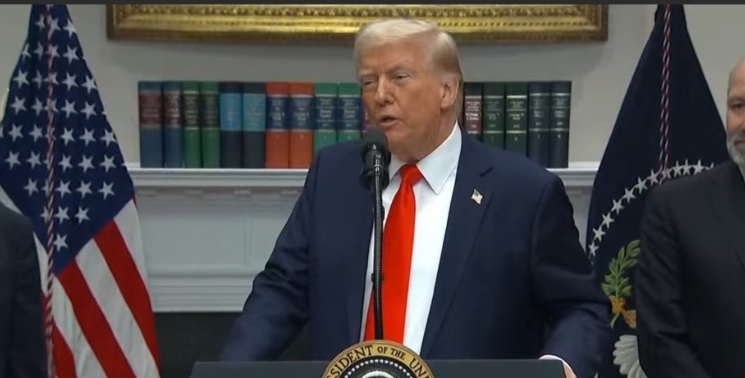

? Former U.S. President Donald Trump made a loud statement that immediately sparked heated discussions in political and financial circles. According to him, Bitcoin and other digital assets could in the future be used to service and even partially repay the U.S. national debt, which has already surpassed $35 trillion and continues to grow.

Context: Why This Statement Matters

- The U.S. national debt has long been a source of debate and concern. Every year, Congress raises the debt ceiling, while the budget deficit remains chronic.

- Cryptocurrencies are still a relatively new asset class, but their market capitalization in 2025 hovers around $2 trillion. Using them to manage the debt of the world’s largest economy is a revolutionary idea.

- Trump has always been prone to making resonant statements. But this remark was particularly provocative, as it directly links the fate of the U.S. dollar — the world’s leading currency — with a decentralized digital asset that many regulators still view as a threat.

Possible Scenarios for Using Bitcoin in Debt Management

- Direct asset conversion: The U.S. could accumulate Bitcoin in its treasury reserves and use it as partial collateral when issuing new bonds.

- Partial debt repayment: In theory, revenues from digital asset operations (for example, taxation of the crypto sector or issuance of “crypto bonds”) could be directed to service the debt.

- Hybrid model: The dollar remains the primary settlement currency, but instruments denominated in BTC or backed by it are launched in parallel.

Market and Expert Reactions

The crypto market reacted instantly — Bitcoin’s price ticked upward, and analysts began speculating on how realistic the idea could be.

- Skeptics argue that Bitcoin’s capitalization is far too small to meaningfully impact U.S. debt. BTC is just a fraction compared to the volume of American obligations.

- fraction compared to the volume of American obligations.

Supporters see it as a step toward recognizing Bitcoin as a legitimate global asset and a 21st-century reserve currency. If the world’s largest economy formally integrates it into its debt policy, it could upend the global financial system. - Lawyers and regulators stress legal barriers: using BTC at a government level would require significant legislative changes, as well as answers to the question of how to handle the cryptocurrency’s volatility.

Political Undertones

Trump has always enjoyed challenging established norms. His new rhetoric may be aimed at:

- attracting the attention of the crypto community and investors,

- positioning himself against Biden and the Democrats, who are traditionally more cautious toward cryptocurrencies,

- using the national debt issue as ammunition in the election campaign.

What This Means for the Crypto Market

Even the discussion of including Bitcoin in the U.S. debt strategy could have enormous consequences:

- BTC could solidify its status as “digital gold” at a state level;

- central banks worldwide may follow the U.S. and begin accumulating crypto in reserves;

- institutional investors would accelerate market entry, anticipating price growth and higher recognition of crypto assets.

? Conclusion

Trump’s statement is not yet a plan or a program, but a loud political signal. The very fact that a former U.S. president is linking the debt issue to Bitcoin already shows how far crypto has entered public and financial consciousness.

If this idea develops further, the world may witness the largest financial experiment in history — where a state attempts to use a decentralized digital asset to solve a problem that even the dollar cannot fix.

A video fragment of the speech is available on our Telegram channel.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.