? For the 17th anniversary of the Bitcoin white paper (you can read about that historic day here), our editorial team decided to explore how and why “money without borders” turned into “digital gold.”

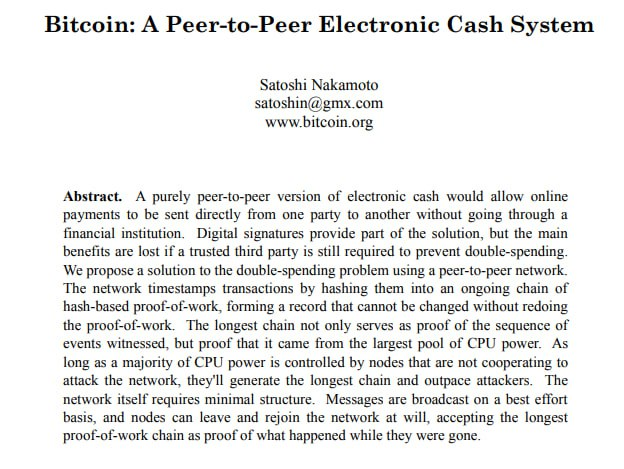

On October 31, 2008, as the world was still reeling from the global financial crisis, a member of the cypherpunk mailing list, Satoshi Nakamoto, published a document that changed history — the Bitcoin white paper.

The idea was bold: to create electronic money without banks, authorities, or permissions. Trust — not in people, but in code. For many, it was an act of digital defiance. No one could cancel a transaction, freeze an account, or track where you sent your funds. Free money — at last, literally. In the paper, Nakamoto described a system where users themselves validate transactions through a network of nodes. Every operation is recorded in a shared ledger — the blockchain. This solved the core problem of digital currency — the “double spending” issue, where the same token could be sent twice.

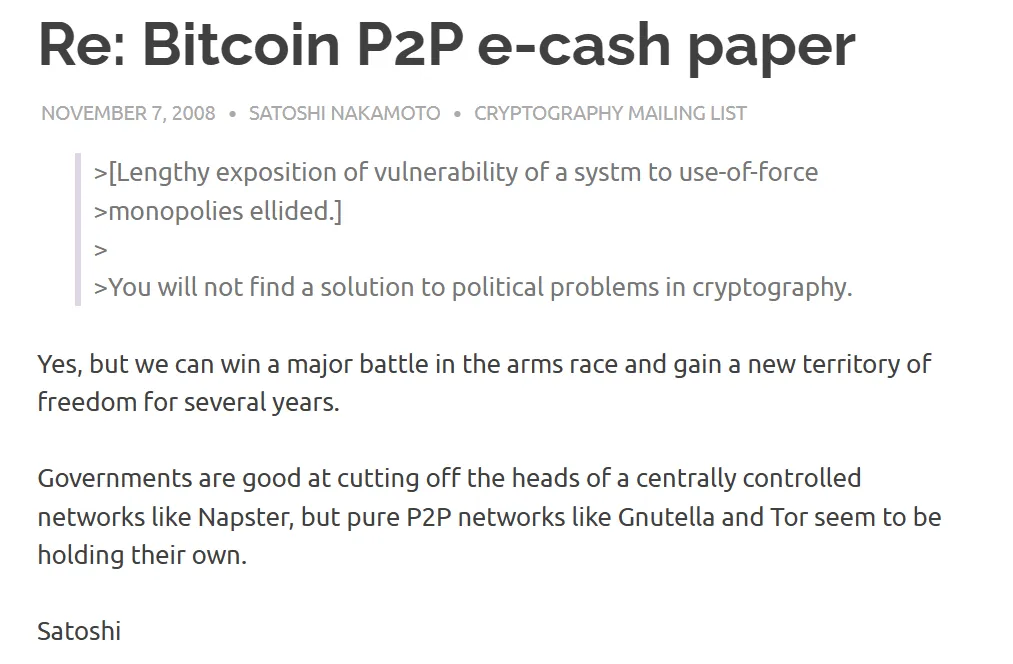

Letter by Satoshi Nakamoto. Source: SatoshiNakamoto.me.

In banks, humans or algorithms monitor this; in Bitcoin, mathematics does. Proof-of-Work became the mechanism that made the system resistant to fraud and external control.

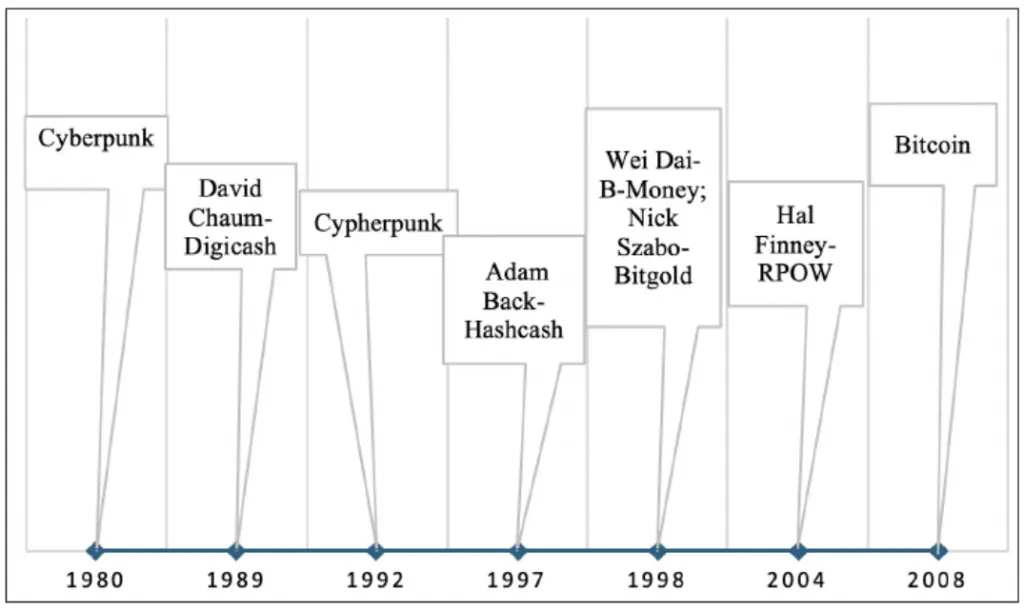

Nakamoto didn’t invent decentralization or anonymity; he used existing concepts developed by cypherpunk programmers and libertarian economists, themselves inspired by the Austrian School.

Evolution of the ideology and technical solutions of digital money. Source: From Cyberpunk to Cypherpunk: The Technical and Ideological Roots of Bitcoin study

The early crypto years were pure utopia: forums, laptop mining, buying pizza for bitcoins, and belief in decentralization ideals. But once price appeared — money followed. And with money came regulators, exchanges, banks, and lawyers.

Exchanges like Mt. Gox — and later Coinbase, Bitstamp, and Binance — brought crypto to the masses. But in return, users got centralization, KYC, AML, and bureaucracy. Bitcoin became “gold” but lost part of its anonymous soul.

In 2017, the block size debate marked a turning point. SegWit and Lightning Network paved the way for scalability, but also split the ideology. Some wanted fast payments; others — digital gold. In the end, Bitcoin became a store of value, not a daily payment tool.

In 2020–2021, the pandemic cemented Bitcoin’s “digital gold” status. As central banks printed money like never before, many realized Satoshi had built not just code — but a hedge against inflation. The arrival of MicroStrategy, Block (formerly Square), and Tesla was a turning point: for the first time, big business recognized Bitcoin as a legitimate asset class. The price soared to $69,000, hitting an all-time high, and El Salvador made it legal tender — something even major central banks hadn’t dared.

But crypto runs in cycles: euphoria is always followed by hangovers. The 2022 Terra/Luna collapse triggered a chain reaction that took down FTX and dozens of “too-big-to-fail” projects. The crisis reminded everyone that centralized structures were precisely what Bitcoin was meant to eliminate. That’s when many rediscovered an old truth: “not your keys, not your coins.”

A few years later, the first cryptocurrency is back on top. For the public, it’s a symbol of stability; for regulators, a respectable asset. But with recognition came a price — the loss of the very freedom that started it all.

The launch of Bitcoin ETFs marked the final stage: big money entered the cypherpunk domain, turning a symbol of independence into a Wall Street product. Meanwhile, KYC/AML rules erased the anonymity once built into the system.

Still, for those who remember why it all began, nothing has changed. They keep their coins in hardware and cold wallets, use mixers, DeFi tools, and maintain digital hygiene.

Correspondence of Satoshi Nakamoto. Source: SatoshiNakamoto.me.

In 2024, Donald Trump returned to the White House and announced the creation of a national Bitcoin reserve. The “tool of hackers and libertarians” became part of state strategy. Paradox? No — inevitability. Power always wants its share of decentralization.

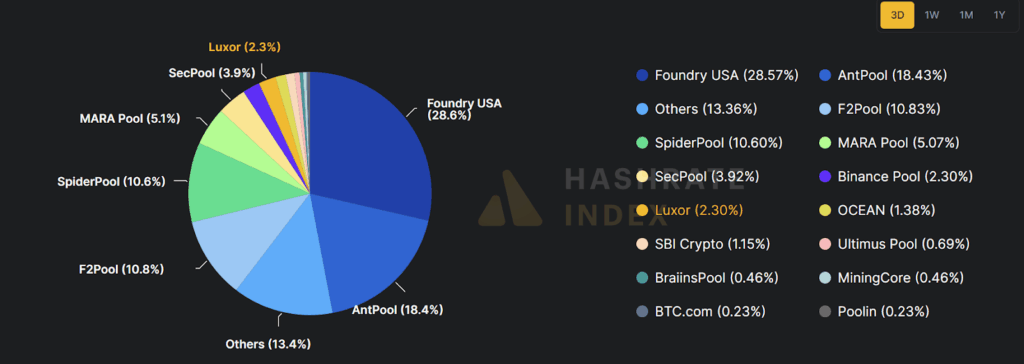

Today, nearly 50% of Bitcoin’s hash rate is controlled by just two pools — Foundry USA and AntPool. What was meant to be a “network of equals” is slowly becoming a new hierarchy. As states roll out CBDCs — their “controlled” digital currencies — Bitcoin remains the last bastion of monetary freedom. Yet even it is adapting: new KYC standards, transaction monitoring, and sanctions lists are reshaping the landscape.

Distribution of mining power. Source: Hashrate Index.

Mining, too, is evolving — increasingly powered by renewables. Ironically, environmentalists and crypto-enthusiasts are finally on the same side.

In 2025, artificial intelligence entered the crypto industry. Neural networks now optimize mining, algorithms analyze transactions, and even the Bitcoin white paper is dissected by ChatGPT and its peers. A technology born to fight centralization now coexists with the most centralized power of the 21st century — AI.

? The Finale

Bitcoin began as an experiment — an attempt to build a system where money doesn’t depend on banks, politicians, or borders. What seemed utopian in 2008 became a movement, and later, an entire economy. In 17 years, Bitcoin evolved from a geek curiosity into a global asset rivaling gold and bonds in investor portfolios. But its significance goes beyond price.

Bitcoin is a symbol of trust in mathematics rather than governments — a manifesto of digital independence, proving that value can exist without intermediaries. Today, it’s held not just by coders and investors but by nations, funds, and billionaires. Around it, an entire infrastructure has emerged — ETFs, derivatives, hardware wallets, institutional custodians. Bitcoin has become more than currency — it’s a new form of economic sovereignty.

Bitcoin isn’t just numbers in a blockchain — it’s a philosophy where everyone is their own bank. And as time shows, this idea has proven far more resilient than even its creator imagined.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.