? Wednesday turned out to be a tense day for the crypto ETF market: on October 29, U.S. spot Bitcoin ETFs recorded the largest outflow in two weeks — $470 million. This came amid a short-term drop in Bitcoin’s price below $108,000 and following mixed macroeconomic events — the Fed’s rate cut decision and Donald Trump’s remarks on trade relations with China (we wrote about the presidents’ meeting earlier).

Leaders of outflows: Fidelity, ARK, and BlackRock

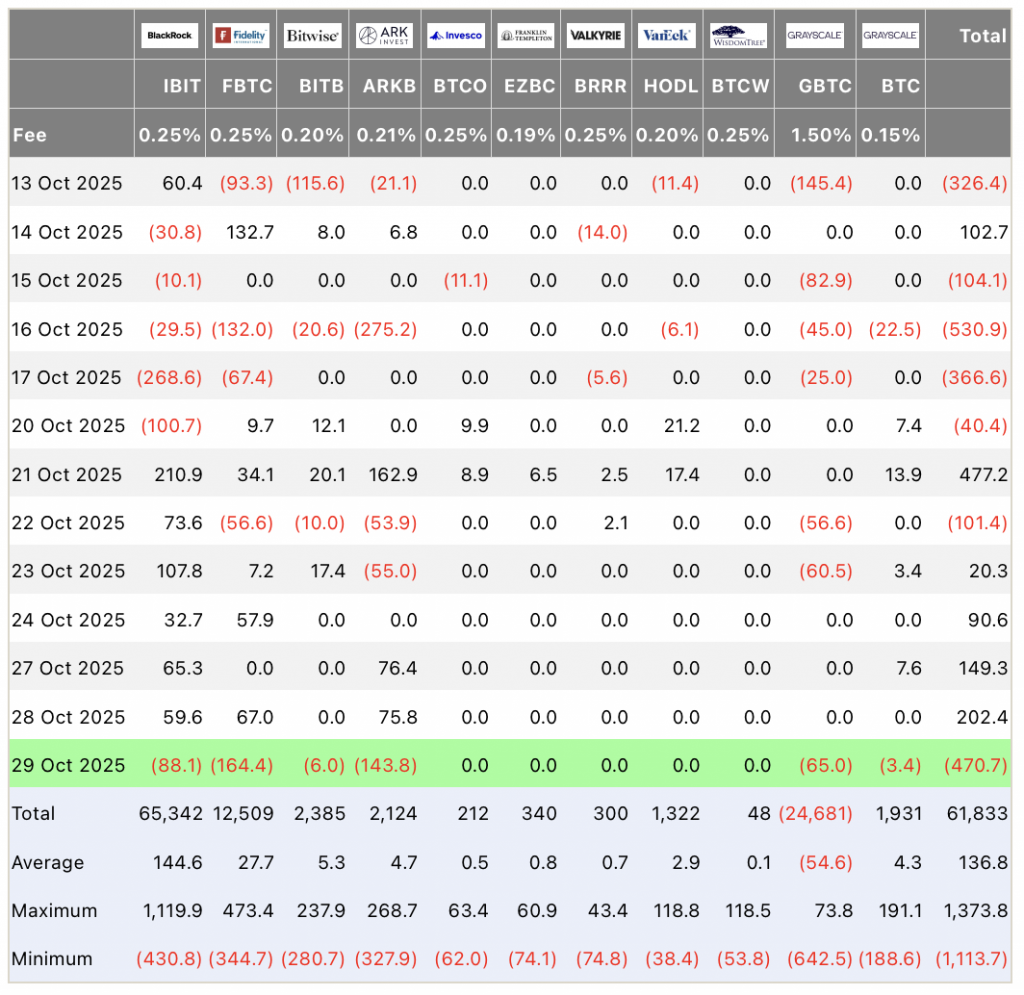

According to the analytics platform SoSoValue, the largest outflow occurred in Fidelity’s FBTC — investors withdrew $164 million.

Second came ARKB from ARK Invest, which lost $143 million, while BlackRock’s IBIT ranked third with $88 million.

Even the legendary Grayscale GBTC, long seen as a barometer of institutional interest, lost $65 million. Only Bitwise’s BITB saw a mild “drawdown” of $6 million.

Capital flows in U.S. Bitcoin ETFs. Source: Farside Investors

This came just days after ETFs were seeing solid inflows: on Monday they added $149 million, and on Tuesday — another $202 million. Thus, Wednesday became a kind of “reality check” for the market, cooling off overly heated optimism.

Impact of Fed decisions and political news

Investors reacted to a combination of contradictory factors. On one hand, the U.S. Federal Reserve cut interest rates by 25 basis points — a move that usually supports risk assets, including cryptocurrencies. However, contrary to expectations, Bitcoin went down, likely due to profit-taking by large holders.

The situation shifted by evening after Donald Trump met Xi Jinping, where both sides discussed lowering trade tariffs and lifting restrictions on rare-earth exports.

Investors viewed this as a potentially positive signal for the global economy, and Bitcoin began to recover, returning to the $111,000–$113,000 range.

Aggregate fund positions and market impact

Even with the outflows, Bitcoin ETFs remain giants of the crypto market: they manage over 1.5 million BTC worth $169 billion, equal to about 7.3% of total supply, according to Bitbo.

The leader remains BlackRock’s IBIT with 805,239 BTC.

Second place goes to Fidelity’s FBTC (206,258 BTC), while Grayscale’s GBTC holds third with 172,122 BTC.

Michael Saylor: “It’s just the market breathing”

Despite the fluctuations, optimism in the crypto industry remains strong. MicroStrategy CEO Michael Saylor once again emphasized that such pullbacks are a natural part of the market cycle. On October 27, he said, “Volatility is the price we pay for freedom,” reaffirming his forecast that Bitcoin will reach $150,000 by the end of 2025.

Institutional influence continues to grow

The October outflows showed that even the largest investors aren’t immune to macroeconomic jitters. However, the share of Bitcoin ETFs in overall supply continues to rise, strengthening their role as a key price-setting mechanism in the market.

? While some are taking profits, others see an entry point — and that balance is what keeps the crypto market alive and unpredictable.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.