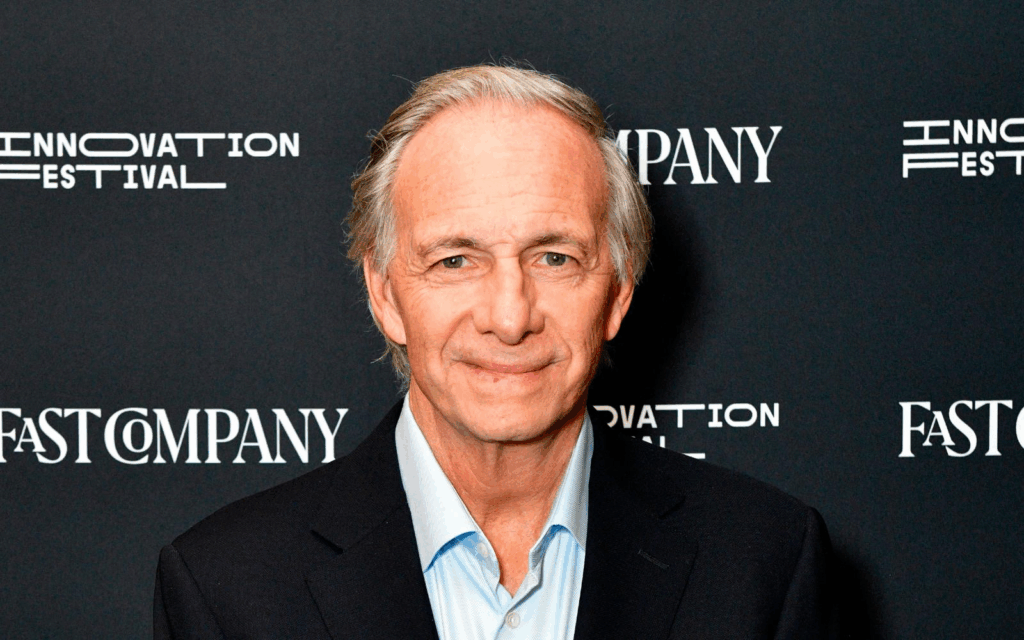

? Ray Dalio — legendary investor and founder of Bridgewater Associates, the world’s largest hedge fund with over $150 billion in assets. His books Principles and The Changing World Order have become essential reading for politicians and economists around the globe. Dalio is known for his ability to view markets through centuries, comparing historical cycles to the present reality.

In a recent interview, he revisited the topic of gold — an asset he calls not just inflation protection, but “the only form of money proven by time.”

“Most people don’t realize that fiat is debt, and gold is money.”

– You seem to view gold differently than most investors. Why?

– Because most people are wrong to think of gold as a metal rather than money. People assume that the dollar is real money, not just a debt instrument. They forget that fiat currencies can be printed endlessly, while gold cannot. That’s because they never lived in an era when gold was the foundation of the global monetary system and haven’t studied the recurring “debt–gold–money” cycles seen throughout history.

For me, gold is not just an asset — it’s a form of liquid money. It doesn’t generate income but preserves purchasing power. When the debt system fails and fiat devalues, gold returns to the pedestal as the only settlement form that doesn’t depend on promises or credit.

“Gold cannot be printed or devalued.”

– Why do you call gold money and not an investment commodity?

– Because gold performs all the functions of money: a store of value, a medium of exchange, and a unit of account. Unlike cash, it cannot be printed and carries no credit risk. That’s why gold is a powerful diversification tool against stocks and bonds — especially during crises, bubbles, or loss of trust between nations.

When markets crash, gold is the anchor of stability. It settles transactions rather than creating new debt. That’s its strength.

“Silver and platinum are good metals — but not money.”

– Why gold, and not silver, platinum, or inflation-protected bonds?

– Silver and platinum can indeed hedge against inflation, but they lack gold’s universality. Silver is driven by industrial demand and thus more volatile. Platinum is rare but niche. Gold, however, is a cultural and historical symbol of wealth recognized worldwide — by both people and central banks.

Inflation-linked bonds are interesting instruments but remain debt securities whose value depends on government creditworthiness. During crises, debt is not protection — it’s risk. Moreover, governments can manipulate inflation figures. Gold cannot be manipulated.

“Gold is insurance against systemic crises.”

– But gold doesn’t generate income?

– True. But for debt to be a reliable store of value, it must provide a decent real return after taxes. Today, real yields are under pressure as governments drown in debt and keep rates artificially low. Investors seek refuge — and find it in gold.

If gold held a portfolio share proportional to its true importance, its price would be much higher. I hold gold not for speculation, but for stability. The optimal allocation, in my view, is 10–15% of a portfolio.

“Hold gold not for profit, but for balance.”

– Gold is at record highs. Should investors still buy?

– The question isn’t about price — it’s about portfolio structure. Gold shouldn’t be treated as a speculative bet, but as a strategic component. Historically, the optimal gold share that provides the best balance between risk and return is around 15%. Yes, such a portfolio yields slightly less, but offers far greater stability and crisis protection.

Personally, I hold gold and offset the “lost yield” by modest leverage to maintain both stability and returns.

“ETFs made gold easier to access but can’t replace physical gold.”

– What’s your view on gold ETFs?

– They improved liquidity and transparency but remain smaller in volume than physical gold holdings or central bank reserves. Physical gold remains the real backbone of the global financial system.

“Gold is the currency you can trust.”

– Is gold replacing U.S. Treasuries as a risk-free asset?

– Yes, especially for central banks and major institutions. They’re reducing holdings of U.S. Treasuries and increasing gold reserves. History shows that gold is far more reliable than any government debt. It doesn’t require trust — it is trust.

? Since 1750, about 80% of the world’s currencies have disappeared, and the rest have been severely devalued. Gold, however, has preserved its value. That’s why I believe gold is not just a metal — it’s a universal, timeless form of money and a true measure of wealth.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.