When Satoshi Nakamoto launched Bitcoin in 2009, it’s unlikely he imagined that ten years later this word would appear in evening news, and students would debate Ethereum’s price in university cafeterias. Since then, cryptocurrency has become more than a programmer’s experiment — it is a full-fledged phenomenon, with exchanges, regulators, millions of investors, and, of course, skeptics.

Today the main question is: is cryptocurrency a bubble ready to burst, or the future of the global financial system? Let’s break it down.

What is a “financial bubble”?

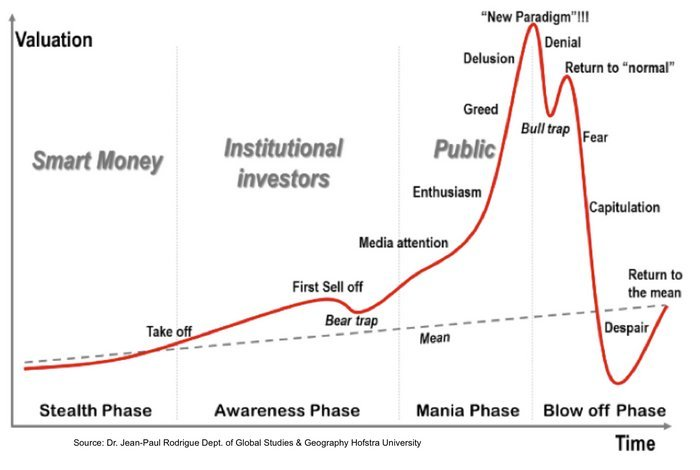

A financial bubble occurs when an asset’s price grows too quickly, detached from its real value. History provides many examples: the Dutch Tulip Mania of the 17th century, the dot-com bubble of the early 2000s, the 2008 mortgage crisis. The scenario is the same: prices rise on emotion and hype, then crash suddenly, leaving investors with “paper” or digital tokens nobody wants.

Arguments for cryptocurrency being a bubble:

Extreme volatility

-

Bitcoin can rise 20% in a day and lose half its value in a week. For a currency you want to pay with, this is highly inconvenient.

-

Hype and FOMO

Many newcomers buy crypto because “everyone is buying” or “I must hurry before it rises.” Classic bubble behavior. -

Lack of fundamental value

Gold has industrial use; stocks represent businesses that generate profit. Cryptocurrency often has value only because someone is willing to pay more.

Examples: Bitcoin crash from $20,000 to $3,000 in 2018, Terra/Luna collapse in 2022.

Arguments for cryptocurrency being the future:

Decentralization and independence from banks

-

No central bank can “print money” in crypto networks, protecting against inflation caused by political decisions.

-

Global accessibility

Crypto can be sent in seconds across cities or continents — without banks, queues, or high fees. -

Blockchain technology

Blockchain is more than money: smart contracts, decentralized apps (dApps), NFTs, asset tokenization. The tech is already used in logistics, healthcare, and real estate. -

Institutional investor interest

In 2015 crypto mainly attracted enthusiasts; today, major funds, banks, and even governments are involved. Bitcoin ETFs alone in 2024-2025 raised billions.

Or maybe the truth is in the middle?

Perhaps cryptocurrency is both a bubble and the future.

Many projects, tokens, and memecoins are worthless and will eventually vanish. Yet the idea of digital, decentralized money will likely persist and evolve. Like the Internet in the 90s: hundreds of companies failed, but the technology became the foundation of a new economy.

Investor guidance:

-

Don’t invest everything — only risk what you can afford to lose.

-

Diversify — don’t stick to a single coin; consider Bitcoin, Ethereum, and reliable altcoins.

-

Follow news and regulation — laws and regulator decisions can instantly affect prices.

-

Learn the technology — understanding blockchain reduces the risk of falling for hype.

? Conclusion:

Cryptocurrency is not just a “new toy” for speculators or “magic money from thin air.” It’s an early-stage tool. Yes, there are bubbles, scammers, and noise, but the potential is enormous. History shows technologies that provide real value survive crises and move forward. The question isn’t “will the bubble burst,” but who will stay afloat when the foam settles.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.