? One of the most famous anonymous traders in the crypto industry — the whale known as HyperUnit — is back in the game. After earning over $200 million during October’s market crash triggered by the U.S.-China tariff war, the investor is now opening large long positions, betting on a recovery in Bitcoin and Ethereum.

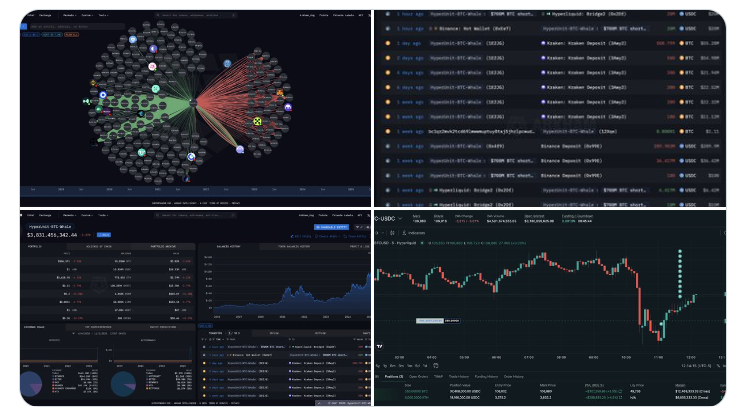

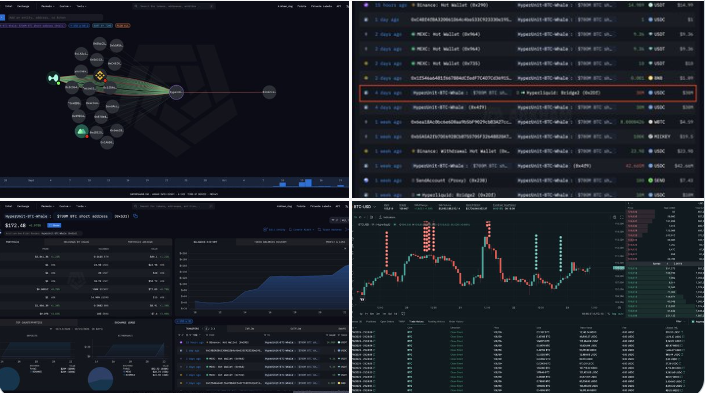

According to Arkham Intelligence, on November 3, HyperUnit placed new orders:

Both trades were opened on the Hyperliquid decentralized derivatives exchange, known for serving large players and funds trading with leverage.

Success story: how HyperUnit outsmarted the market

HyperUnit is no newcomer. His name first appeared in the crypto community back in 2018, when, despite panic selling during the bear market, he purchased Bitcoin worth $850 million. A few years later, his position had grown to nearly $10 billion as BTC reached a new all-time high.

His real breakthrough came in autumn 2025.

On October 10, amid the sharp escalation of the U.S.-China tariff war — as markets tumbled due to mutual export restrictions on technology and rare earth metals — HyperUnit opened massive short positions against Bitcoin, Ethereum, and several altcoins. As a result, he earned about $200 million in just a few days — precisely when most investors were taking heavy losses.

He later executed two more successful trades against the market, catching local tops before corrections.

Analysts at Arkham joked: “HyperUnit caught three tops in a row. Will he guess the fourth — or will this rebound bet be his first miss?”

New bet: faith in a rebound

The trader now clearly believes the market is near its bottom.

At his entry point, Bitcoin was trading at $104,122, and Ethereum at $3,494.

Compared to their all-time highs, BTC remains down 17%, and ETH roughly 30%.

According to the Fear & Greed Index, the market is in a state of “extreme fear” — a reading of 21 out of 100.

1-day BTC/USD chart. Source: Binance

Signs of a possible reversal

Despite the gloomy sentiment, analytics firm Santiment believes the main wave of selling may already be over.

Their data shows that in the past six months, exchange balances have decreased by 208,980 BTC — a sign that investors are moving coins to cold wallets and are not planning to sell soon.

Santiment’s report states: “Although Bitcoin’s market cap has dropped by 14% since early October, the volume of coins flowing into exchanges remains minimal. This indicates reduced selling pressure.”

When exchange inflows decline, it usually signals that the downside risk is limited.

Why it matters

HyperUnit’s decision to open new long positions amid such fearful market sentiment indicates strong conviction in an upcoming rebound.

It may also serve as a signal for institutional investors, who closely track whale movements and often mirror their actions.

Additionally, Bitcoin’s declining exchange supply coincides with the upcoming halving, expected in spring 2026. Historically, each halving has led to significant price increases within 6–12 months after the event.

Context: the market after the October storm

The tariff war that erupted in October delivered a heavy blow to global markets.

The U.S. announced new tariffs on Chinese electronics and AI components, while Beijing retaliated by restricting exports of lithium and rare earth metals — crucial for chip production. Capital markets reacted instantly: within two days, crypto’s total market capitalization dropped by over $300 billion, and Bitcoin briefly fell below $95,000.

However, by late October, the situation stabilized: major funds began returning to digital assets, viewing them as a hedge against currency volatility and geopolitical risks.

What’s next

If HyperUnit’s prediction proves right, the current levels could mark the starting point of a new bull cycle.

Even so, the trader hasn’t disclosed his exact profit targets.

In one of his rare X (formerly Twitter) posts, he wrote succinctly: “When fear is at its peak — growth begins.”

In a market where even experienced funds take losses, HyperUnit remains a near-mythical figure — a man who profits from panic and buys when others are afraid.

? By the way

During the latest drop, whales have been actively accumulating.

In the past 12 hours, a mysterious whale group called “7 Siblings” spent $52.47 million USDC to purchase 14,254 ETH at an average price of $3,681.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.