As cryptocurrency adoption continues to grow rapidly around the world, tax authorities in various countries are strengthening control and reporting rules for income derived from digital assets. Cryptocurrencies are becoming increasingly integrated into financial systems: they are accepted as a means of payment, used for investment, value storage, and even for settlements between companies. At the same time, governments are demanding greater transparency of income earned from trading, staking, mining, and other digital asset operations, introducing mandatory reporting and tightening taxation.

Nevertheless, there is a group of states and jurisdictions that offer favorable tax conditions for crypto investors, traders, blockchain project developers, and entrepreneurs operating in the digital economy. These jurisdictions pursue a strategy of stimulating innovation, attracting capital, and developing local crypto ecosystems by offering low or zero tax rates on income derived from cryptocurrencies and digital assets.

In this context, investors and market participants increasingly consider not only the asset itself but also the optimal legal environment in which to conduct their activities. Jurisdictions with favorable tax regimes become attractive to companies, startups, and individuals seeking to minimize tax costs without violating the law.

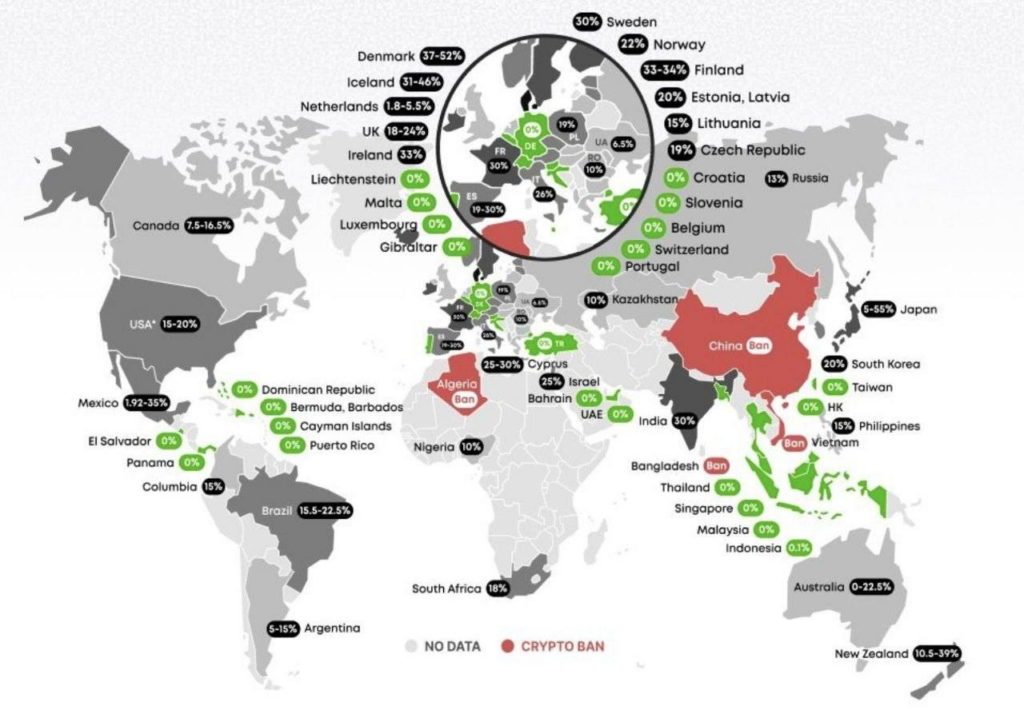

Below are countries and territories that are known or position themselves as locations with zero or very low taxation on cryptocurrency income (including trading, capital gains, and income from digital assets), as well as the factors that make them attractive.

Countries and jurisdictions with zero or minimal cryptocurrency tax

- United Arab Emirates (UAE)

The UAE offers a zero personal income tax rate for individuals and companies in free economic zones, no capital gains tax, and preferential regimes for financial and digital firms. The country is actively developing a regulatory framework for the crypto and blockchain industry. - Cyprus

The Cypriot jurisdiction attracts crypto businesses with a corporate tax rate of 12.5% (one of the lowest in the EU) and simplified taxation schemes. Income of individuals from long-term holding of cryptocurrencies is often exempt from tax. - Portugal

Portugal is often referred to as one of the most crypto-friendly countries in Europe: income of individuals from exchange, trading, and capital appreciation of crypto assets is exempt from capital gains tax, subject to certain conditions. - Panama

Panama offers a territorial taxation system under which income earned outside the country is not subject to taxation. This makes it attractive for crypto investors operating in international markets. - Singapore

Singapore is known as a financial hub of Asia with a liberal tax regime: there is no capital gains tax, no tax on cryptocurrency appreciation income for individuals in ordinary investment operations, and corporate rules are favorable for digital assets and fintech. - Malta

Malta positions itself as a “blockchain island” with a clear regulatory environment and favorable conditions for crypto companies. The country offers low effective tax rates for resident companies and preferential regimes for holding structures. - Barbados

Barbados offers zero taxes on income from crypto assets under certain conditions for resident companies, as well as incentives for international business companies, making it attractive for structuring crypto businesses. - Bermuda

Bermuda is known for a strict regulatory framework combined with the absence of direct taxes on capital gains, corporate, and personal income from cryptocurrencies, which attracts crypto and blockchain companies. - Cayman Islands

A jurisdiction with no personal income tax, no capital gains tax, and no corporate tax, with a developed offshore sector, widely used by crypto funds and investors for asset structuring. - Hong Kong

Despite changes in the economic landscape, Hong Kong currently maintains the absence of a capital gains tax, which is considered favorable for traders and long-term cryptocurrency investors. - Mauritius

Mauritius offers incentives for companies and individuals and the status of a financial center with a strong focus on digital assets; many types of international income are exempt from taxation. - Vanuatu

Vanuatu is a small jurisdiction with no personal income tax, no corporate tax, and no capital gains tax, making it attractive for crypto traders and investors. - Gibraltar

Gibraltar offers tax incentives for technology and fintech companies and is known for its regulatory framework for DLT firms, as well as a favorable tax rate for certain types of income. - Liechtenstein

Liechtenstein has progressive regulation of digital assets through the “token and trusted technology” framework, as well as advantageous tax regimes for crypto funds and holdings. - Slovenia

In Slovenia, individuals are exempt from capital gains tax when selling cryptocurrencies for euros, provided this is not part of regular trading activity; corporate rules can also be favorable if conditions are met. - Switzerland

Switzerland offers favorable tax regimes in a number of cantons; cryptocurrencies are treated as assets, from which individuals are exempt from capital gains tax in certain cases, while special tax optimization schemes may apply to businesses. - Uruguay

Uruguay is actively developing its digital economy; taxation of cryptocurrencies for individuals may be exempt, and the country aims to become a technology hub in Latin America. - El Salvador

El Salvador was the first country to recognize bitcoin as legal tender and also offers favorable conditions for crypto assets at the national level, including tax incentives. - Puerto Rico

Although the territory belongs to the United States, many investors use local tax incentives (such as Act 60 / Act 20 / Act 22 statuses) to reduce capital gains taxes and income from crypto investments, provided residency requirements are met.

What investors need to understand

So-called “crypto tax havens” with zero tax are not just lists of countries. To legally benefit from a preferential regime, it is necessary to:

- assess tax residency requirements (often requiring long-term residence or substantial investment);

- comply with reporting, transparency, and anti-money laundering rules (AML/KYC);

- take into account differences between taxation of individuals and legal entities;

- follow international standards (such as CRS/FATCA) to avoid unexpected obligations in other jurisdictions.

Many countries with favorable tax regimes seek a high level of regulation of the crypto industry, combining tax incentives with obligations to comply with financial standards and investor protection. This makes such jurisdictions attractive but requires a careful approach, thorough planning, and consultations with professional tax advisors.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.