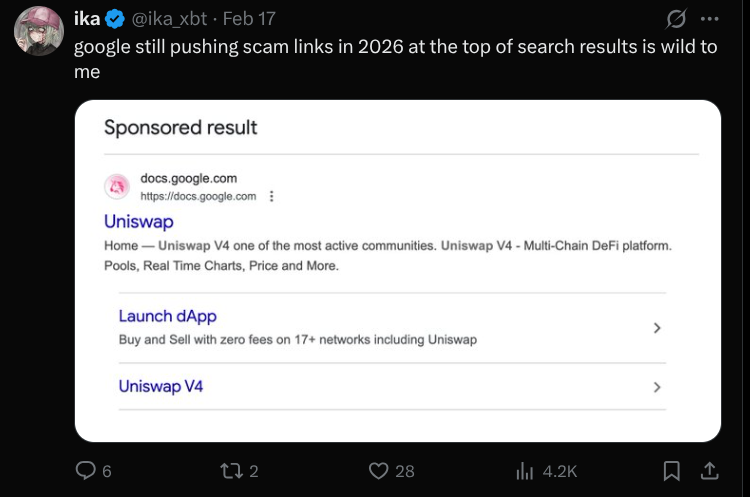

The crypto industry has once again found itself at the center of a scandal — this time not because of market volatility, but because of an old problem that has been poisoning the ecosystem for years: advertising of fraudulent websites in search engines.

The founder of Uniswap, Hayden Adams, publicly criticized search platforms for continuing to allow the placement of advertisements leading to fake versions of the popular decentralized exchange. The trigger was a case involving a trader who lost his entire crypto portfolio — according to him, it amounted to “hundreds of thousands of dollars” — after visiting a counterfeit website that appeared at the top of search results.

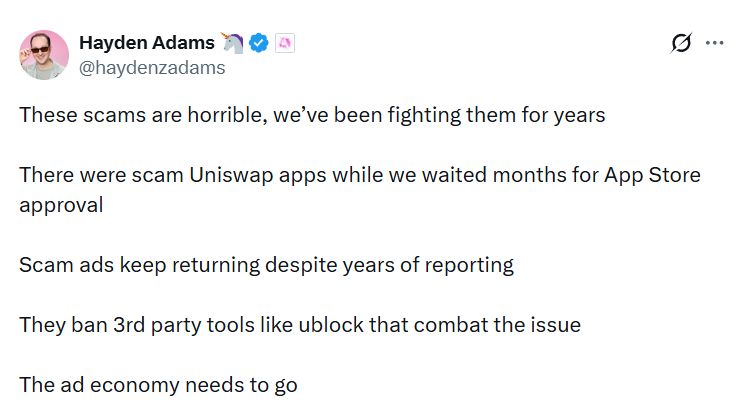

Adams wrote on X: “These scam schemes are horrible, we’ve been fighting them for many years. While we were waiting months for approval in the App Store, scam Uniswap apps were appearing. Despite years of complaints, scam ads keep returning. They block third-party tools such as uBlock that help fight this issue. The ad economy needs to go.”

An X user under the nickname “Ika” published a post titled “I lost everything, what’s next?”, in which he admitted that his crypto wallet, valued in the six-figure range, had been emptied despite his extreme caution. “Two years of discipline. Half the time looking for a job in web3, half hoping to get rich fast enough not to need one,” he noted.

“I believe that losing all funds is not bad luck. It is the final sequence of a long chain of bad decisions,” Ika said.

How the scheme works

The mechanics of the fraud are surprisingly simple and therefore especially dangerous. Scammers buy advertisements for keywords such as “Uniswap.” When a user enters the platform’s name into a search engine, the first result is not the official website but a sponsored link — visually almost indistinguishable from the real one.

Then the scenario develops according to classic crypto phishing:

- The user goes to a fake website.

- The interface looks almost identical to the original.

- The person is asked to connect a crypto wallet.

- After connecting, they are prompted to “confirm a transaction.”

- In reality, the user signs an authorization that gives attackers full access to the assets.

The result is an instant zeroing of the account. In decentralized finance, there is no “undo” button. If you sign a malicious transaction, the funds are gone irreversibly.

Adams emphasized that the problem is far from new. According to him, the Uniswap team has been sending complaints about scam advertisements for years, yet they continue to appear. He also recalled the situation when, during the waiting period for approval of the official app in the app store, fake versions of Uniswap appeared. While developers were going through multi-stage verification, attackers were launching counterfeit apps, misleading users.

The systemic imbalance looks alarming: legitimate projects go through bureaucratic procedures for months, while scam clones appear literally within days.

The situation escalated after the largest amount stolen through crypto fraud in the past 11 months was recorded in January. This intensified the discussion about who bears responsibility for the spread of such schemes — exclusively criminals, or also the platforms that allow them to advertise.

The problem goes beyond a single project. Not only Uniswap users are at risk, but also clients of other major DeFi protocols, NFT marketplaces, and crypto wallets. Search advertising has become a convenient tool for attacks because it exploits trust in the search engines themselves.

Why this is especially dangerous in crypto

In the traditional banking system, stolen funds can sometimes be returned through a transaction dispute procedure. On the blockchain, everything is different:

- transactions are irreversible;

- user personal responsibility is максимized;

- the anonymity of attackers complicates investigations.

In addition, in DeFi there is no centralized support service capable of “freezing” an operation. Essentially, one wrong click can cost a person years of savings.

Adams’ criticism raises a broader question: should search engines tighten moderation of advertisements related to financial services and cryptocurrencies?

On the one hand, platforms claim they are actively fighting fraud. On the other — scam ads continue to appear at the top of search results for branded queries. A conflict of interest arises: advertising generates revenue, and reviewing each application requires resources. However, when it comes to the loss of “hundreds of thousands of dollars” by ordinary users, the argument about the technical complexity of moderation sounds increasingly unconvincing.

What this means for the market and how to protect yourself

Such incidents undermine trust in the crypto industry as a whole. Even if a protocol is technically secure, a user can lose funds due to external infrastructure — advertising systems, phishing websites, malicious browser extensions.

This reinforces several trends:

- Growing demand for hardware wallets and additional security measures.

- Increased attention to digital hygiene.

- Pressure on regulators to strengthen oversight of advertising platforms.

- Rising reputational risks for major technology companies.

Cybersecurity experts recommend:

- not clicking on sponsored links when searching for crypto services;

- saving the official website in bookmarks and using only it;

- checking the domain name down to every letter;

- carefully reading which permissions you confirm when connecting a wallet;

- using a separate wallet for experiments with new protocols.

In cryptocurrencies, there is a rule older than any blockchain: trust, but verify. And sometimes — better verify twice. The story that triggered Hayden Adams’ reaction is not just an isolated case. It is a reminder that in the world of digital assets, threats evolve faster than protection mechanisms. And as long as scam ads continue to occupy the top lines of search results, the main barrier between a user and the loss of capital remains their own caution.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.