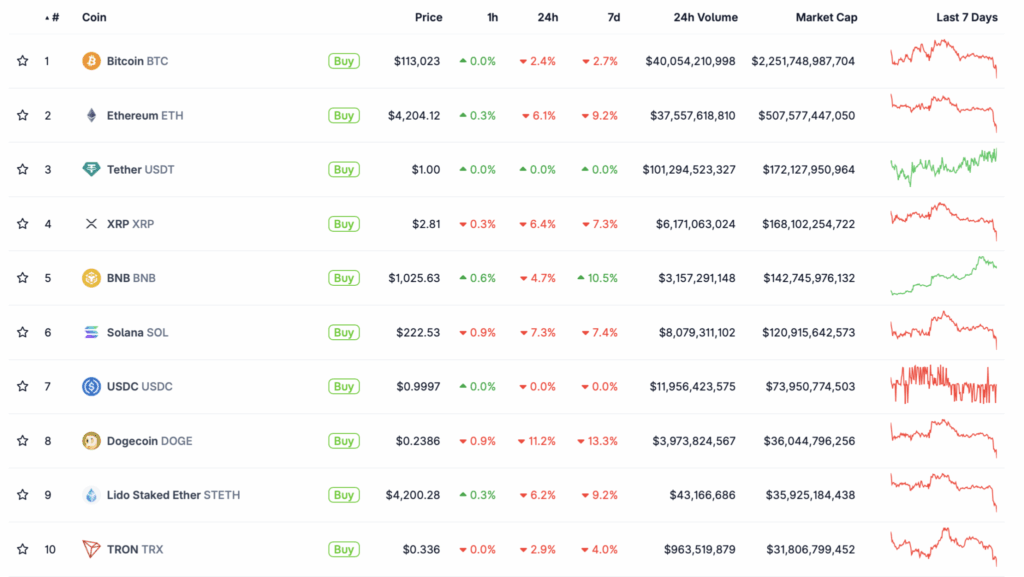

? The cryptocurrency market is experiencing another period of turbulence. Overnight on Tuesday, Bitcoin fell below $112,000, and Ethereum dropped below $4,000. This is the first significant decline in the past month, catching many investors by surprise.

Key figures:

- Bitcoin reached a monthly low, temporarily staying below $112,000.

- Ethereum lost support at the $4,000 level and pulled back.

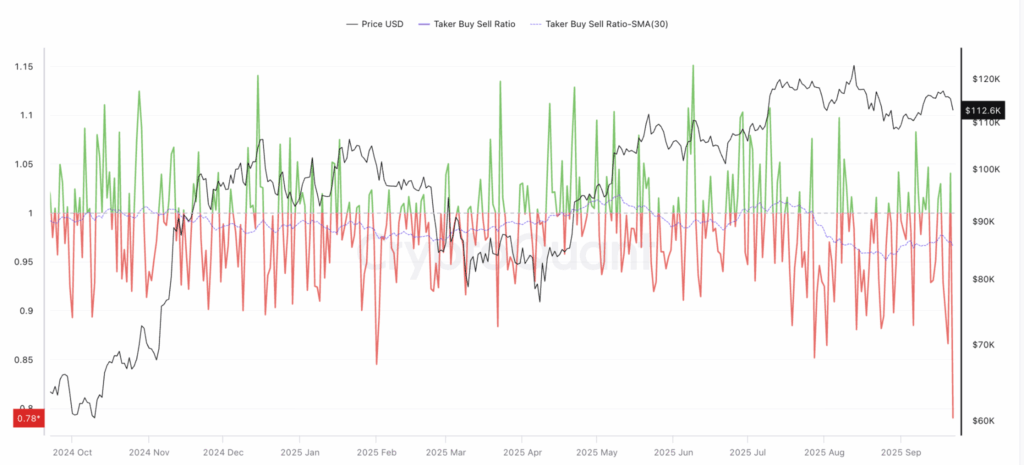

- According to analytics platform Coinglass, over the past 24 hours, more than $400 million worth of positions were liquidated on the market.

- The last few hours were particularly dramatic: nearly $250 million in long positions were liquidated in just four hours, indicating panic selling and active liquidators.

What’s happening:

The sharp drop was accompanied by increased volatility and a surge in trading volumes. Cascade liquidations occurred — automatic closing of margin positions by traders who could not withstand the price decline. This intensified market pressure and accelerated the drop in prices.

Bitcoin buy-to-sell ratio: Source: CryptoQuant.

Expert opinions:

Analysts note that the cryptocurrency decline is linked to several factors:

- Profit-taking by large players after recent growth;

- Investor caution amid global economic uncertainty;

- Rising U.S. bond yields and expectations of Federal Reserve decisions, which traditionally reduce the attractiveness of risky assets.

Many emphasize that this situation fits within a “healthy correction” after the rapid growth of recent weeks. However, for leveraged traders, the correction resulted in significant losses.

Current prices of the largest cryptocurrencies by market capitalization (BTC)

Comment from BTSE COO Jeff May (via The Block):

“The market dipped slightly over the weekend as traders remained cautious amid uncertain macroeconomic conditions. The Fed has indicated that it will make decisions on future rate cuts from meeting to meeting, making a quick policy easing unlikely.”

? What’s next:

- If Bitcoin stays below $112,000, further pullbacks to support zones of $108,000 and even $105,000 are possible.

- Ethereum risks testing levels around $3,800–$3,900.

- At the same time, long-term investors remind that such corrections are normal for the crypto market and present opportunities for “buying the dip.”

The market once again reminds: in the world of cryptocurrencies, high returns go hand in hand with risk.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.