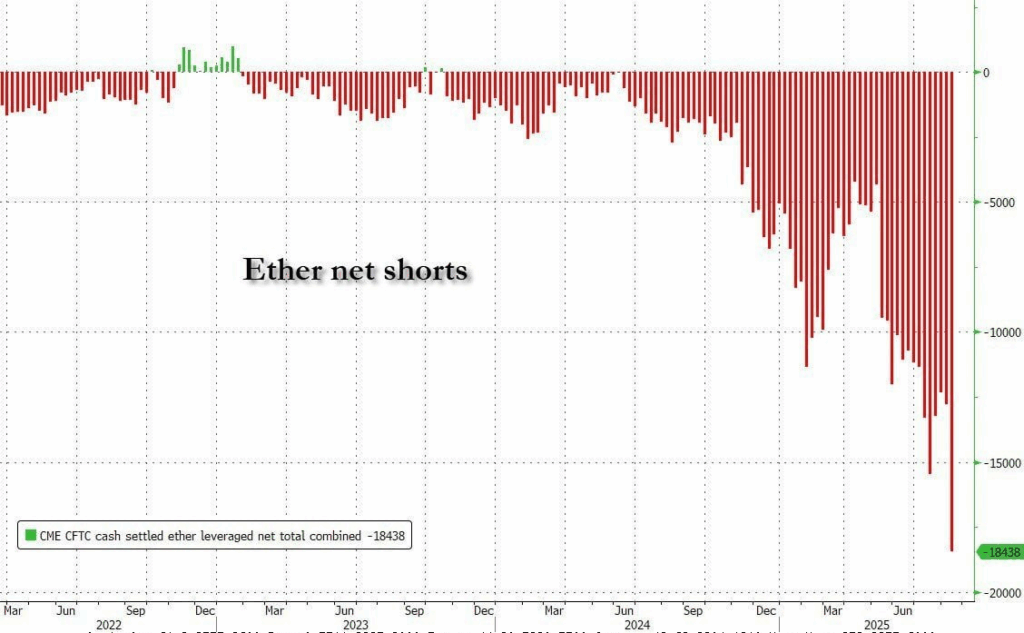

? Short positions on ETH have reached a new peak. This signals tension in the market, as many are betting against Ethereum. However, such extremes often fuel a short squeeze if Bitcoin holds the key level of $115,000.

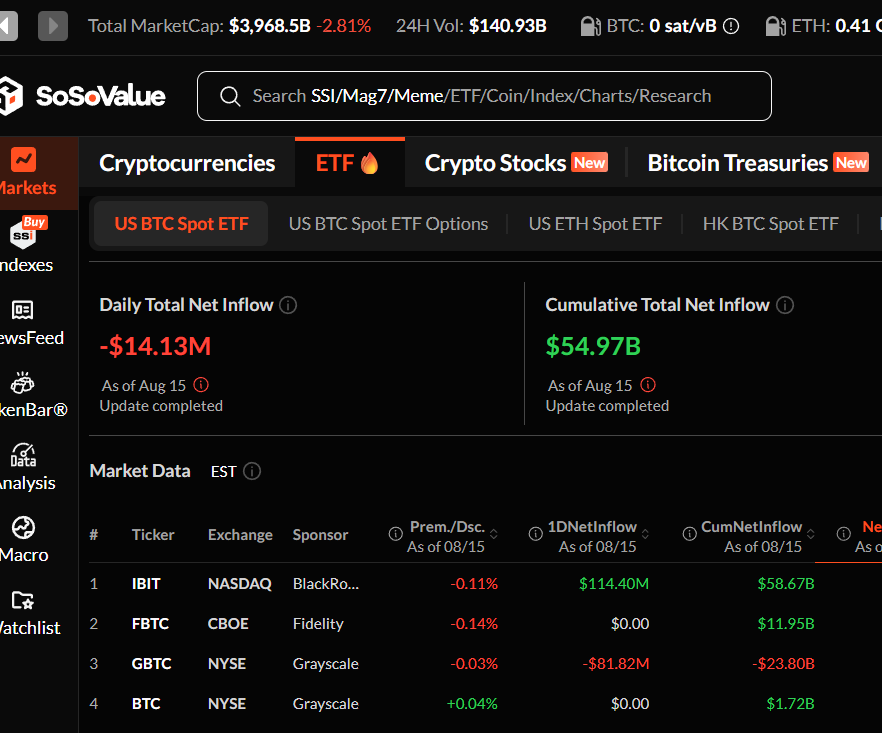

Main driver of the week — ETFs

A record inflow into ETH spot ETFs reached $2.85 billion in one week. By comparison, Bitcoin ETFs only saw $548 million. This shows that institutional investors are beginning to diversify portfolios and see growth potential in Ethereum — a strong argument for an altseason.

Big players step onto the stage

- The Norwegian Sovereign Fund increased BTC holdings by 83%, reaching 11,400 BTC. This confirms a long-term strategy: major state funds are entering crypto.

- Metaplanet acquired 775 BTC ($93 million), following MicroStrategy’s example. A signal for the market: corporate demand remains strong. Michael Saylor hinted at new purchases.

- Trump family’s DeFi project WLFI (World Liberty Financial) bought 84.5 WBTC and 1,911 ETH. This move is more political than institutional, but it reinforces the narrative: crypto is becoming part of the American establishment.

Financial markets and tokenization

S&P Dow Jones is considering launching tokenized versions of its indexes. If implemented, this would create a strong bridge between TradFi and crypto markets, potentially attracting conservative investors for whom crypto ETFs remain too risky.

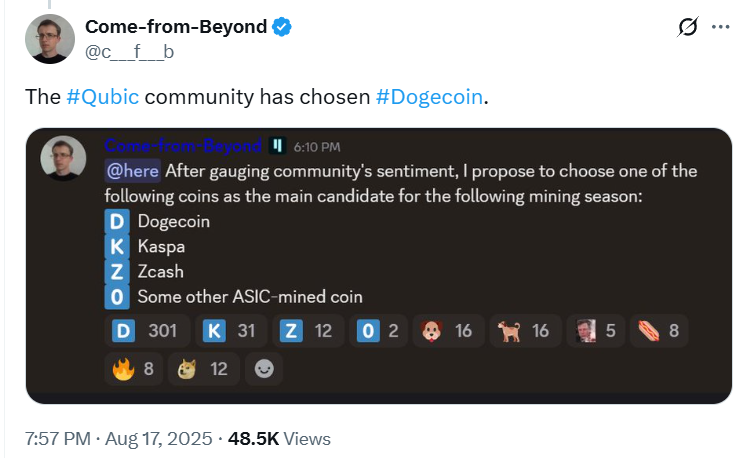

Less significant but notable news

- Qubic mining pool’s attack on Dogecoin is mostly a local story, highlighting the risks of centralization and decentralization in mining.

- The ability to purchase airline tickets with cryptocurrency in the UAE is an important signal of digital assets being adopted in the real economy, but for global markets it remains more of a cosmetic effect for now.

? Conclusion:

- Strong growth factors: ETH ETF inflows, rising institutional demand (funds and corporations), trend toward index tokenization.

- Weak signals: Dogecoin attack and crypto payment for airline tickets.

- In the short term, much depends on BTC holding $115,000. In the long term, the trend is clearly bullish, as institutions and states are increasingly entering crypto.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.